Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Illustrative Problem An entity received a govemment grant under the following independent assumption : 1. An entity received a grant of P30,000,000 from the British

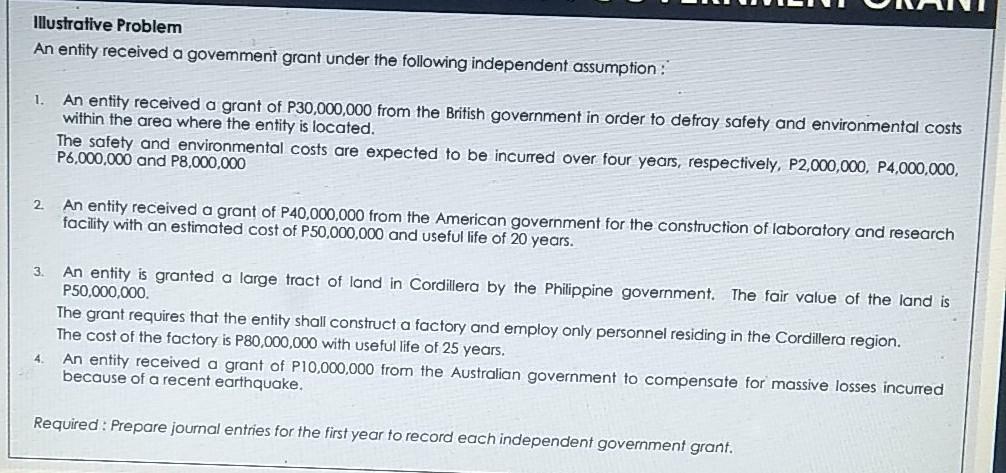

Illustrative Problem An entity received a govemment grant under the following independent assumption : 1. An entity received a grant of P30,000,000 from the British government in order to defray safety and environmental costs within the area where the entity is located. The safety and environmental costs are expected to be incurred over four years, respectively, P2,000,000, P4,000,000, P6,000,000 and P8,000,000 2. An entity received a grant of P40,000,000 from the American government for the construction of laboratory and research facility with an estimated cost of P50,000,000 and useful life of 20 years. 3 An entity is granted a large tract of land in Cordillera by the Philippine government. The fair value of the land is P50,000,000. The grant requires that the entity shall construct a factory and employ only personnel residing in the Cordillera region. The cost of the factory is P80,000,000 with useful life of 25 years. An entity received a grant of P10,000,000 from the Australian government to compensate for massive losses incurred because of a recent earthquake. 4 Required : Prepare journal entries for the first year to record each independent government grant

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started