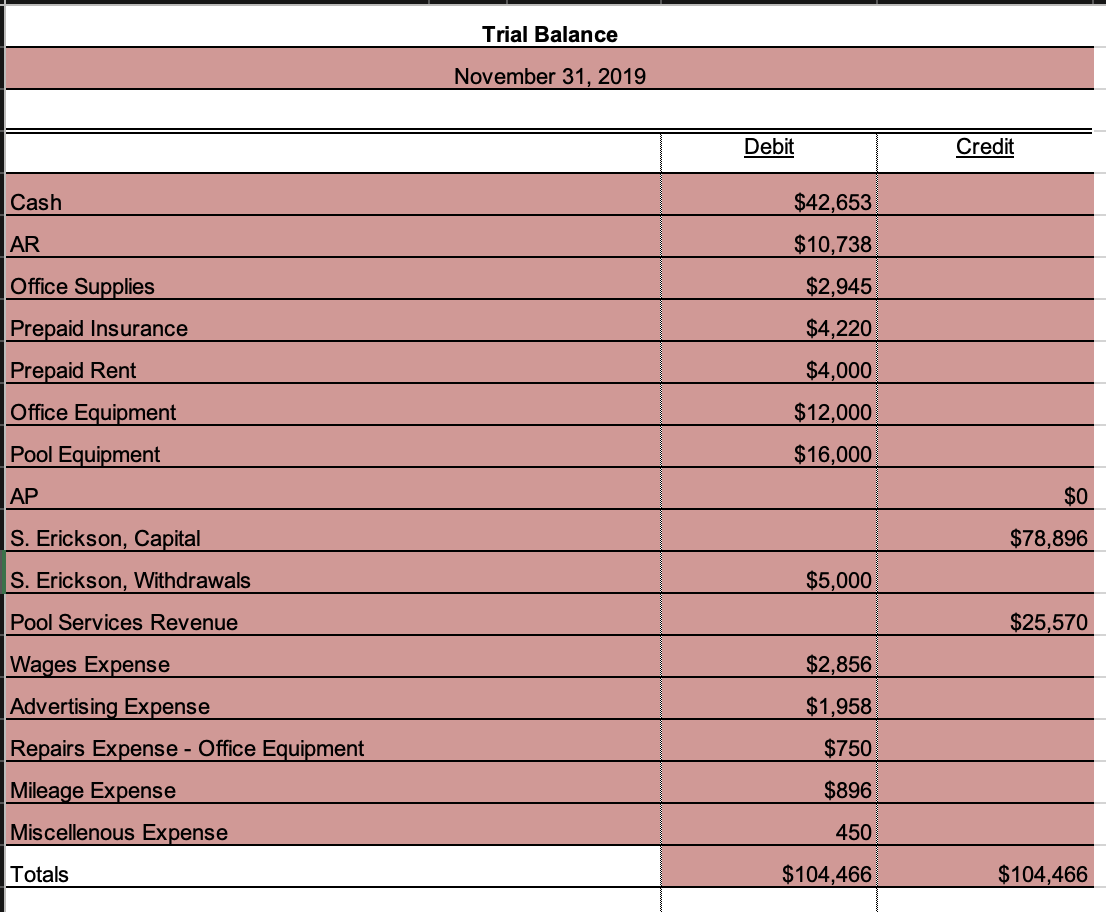

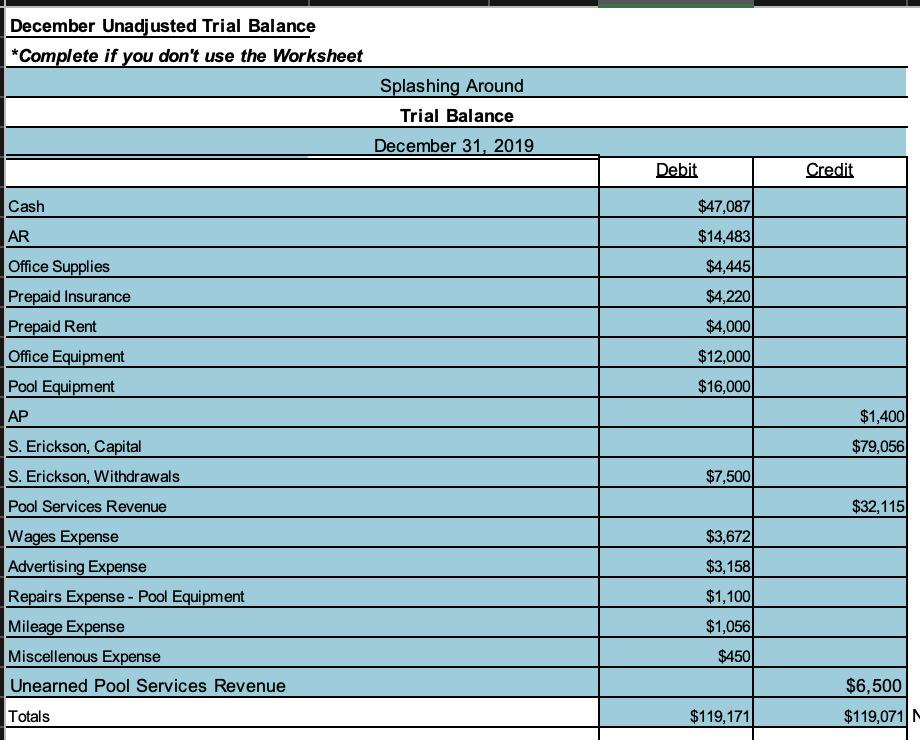

I'm confused on what I did wrong on the December trial balance as the totals do not match.

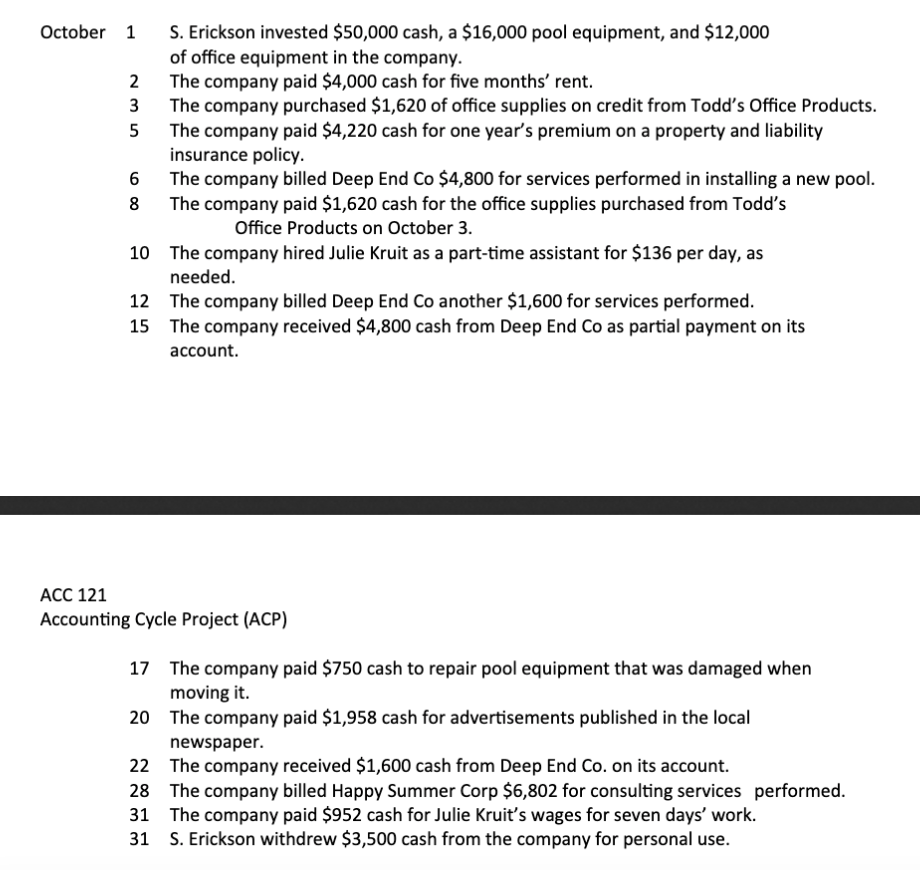

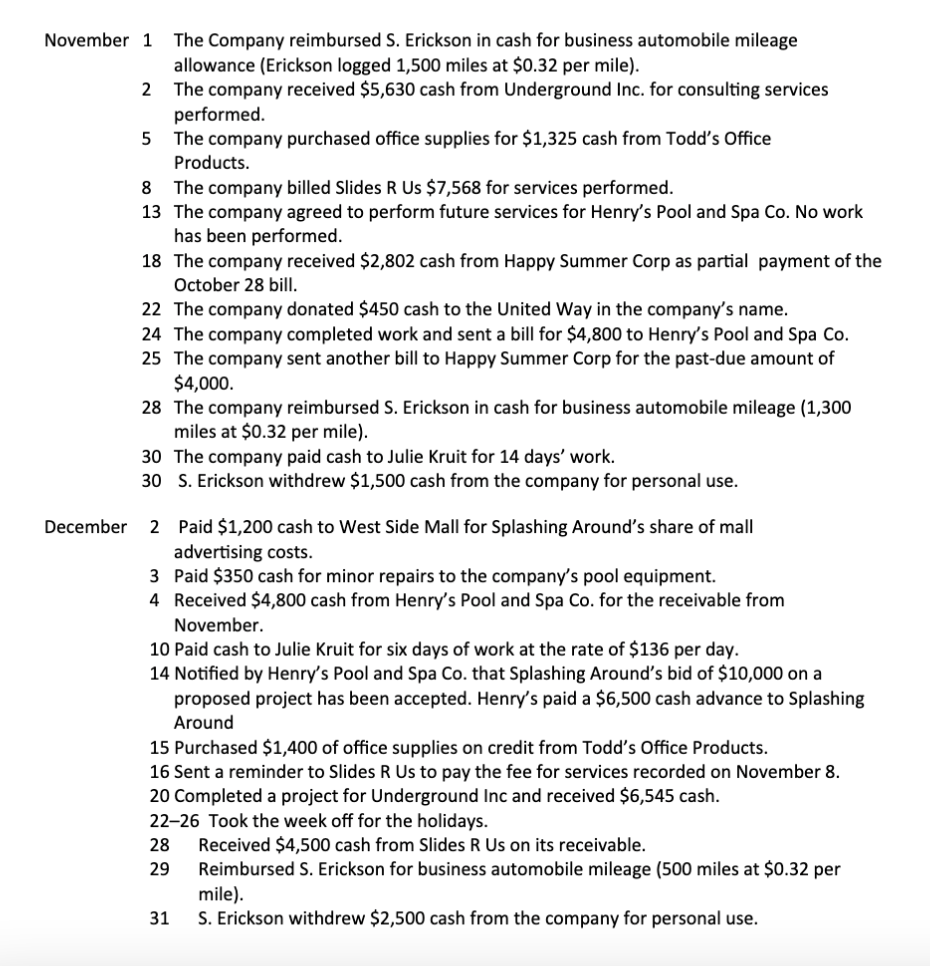

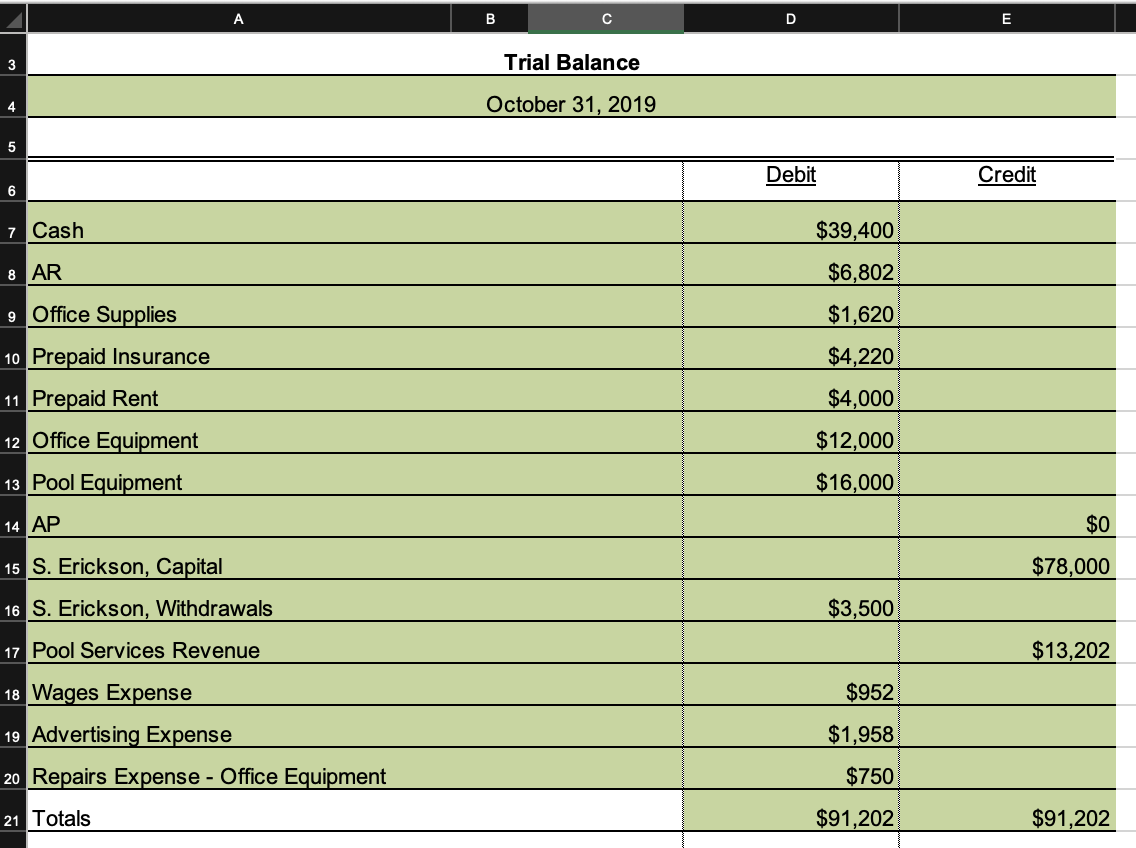

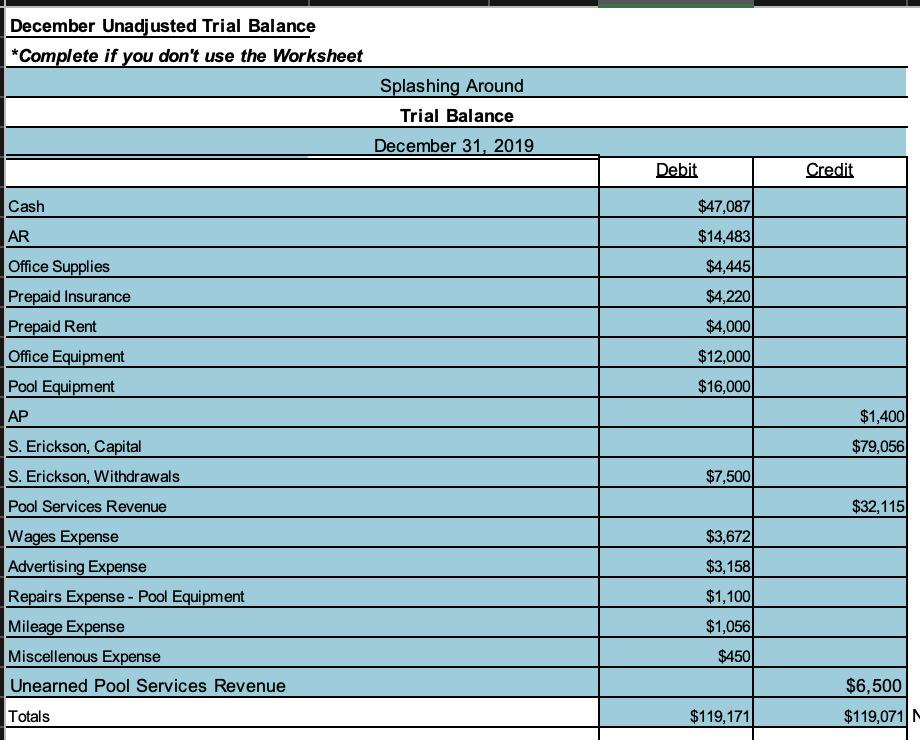

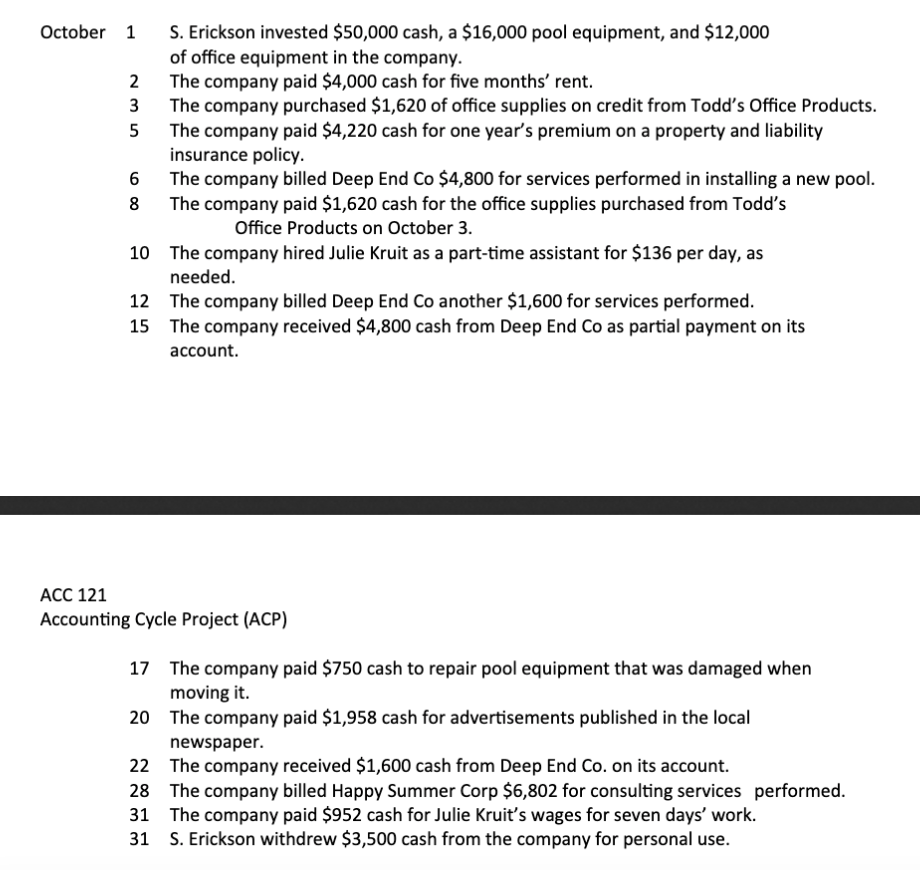

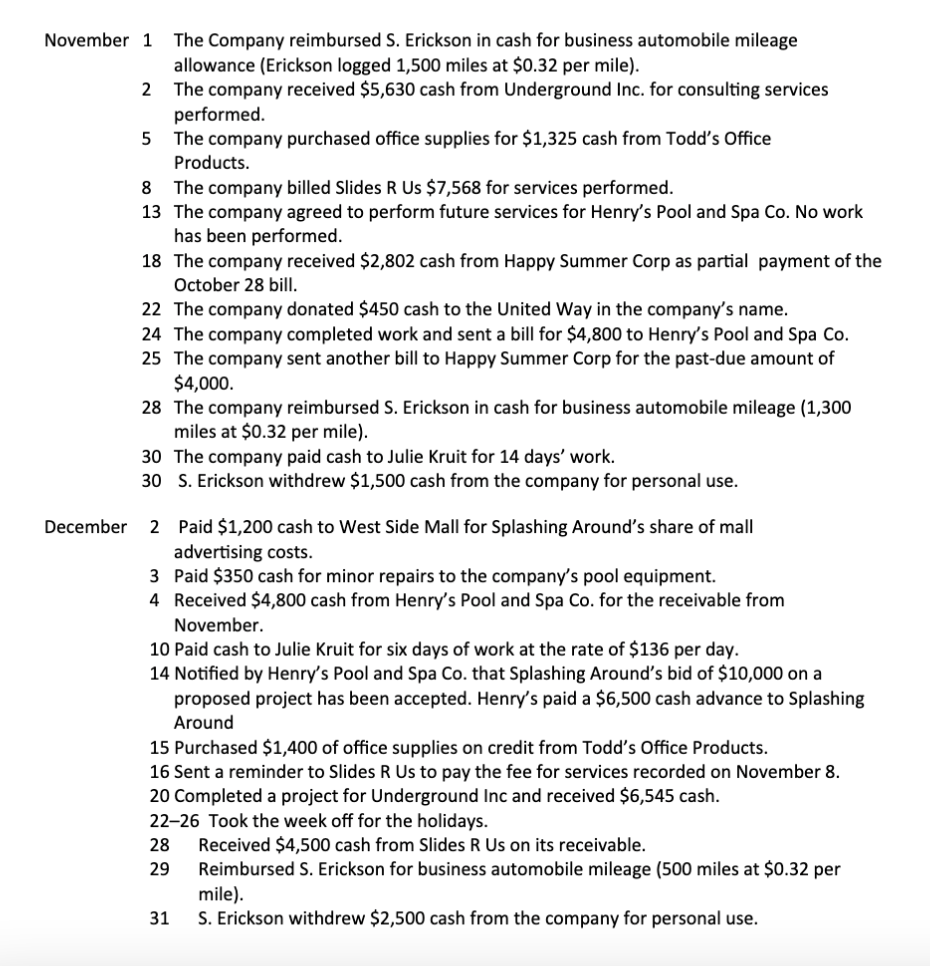

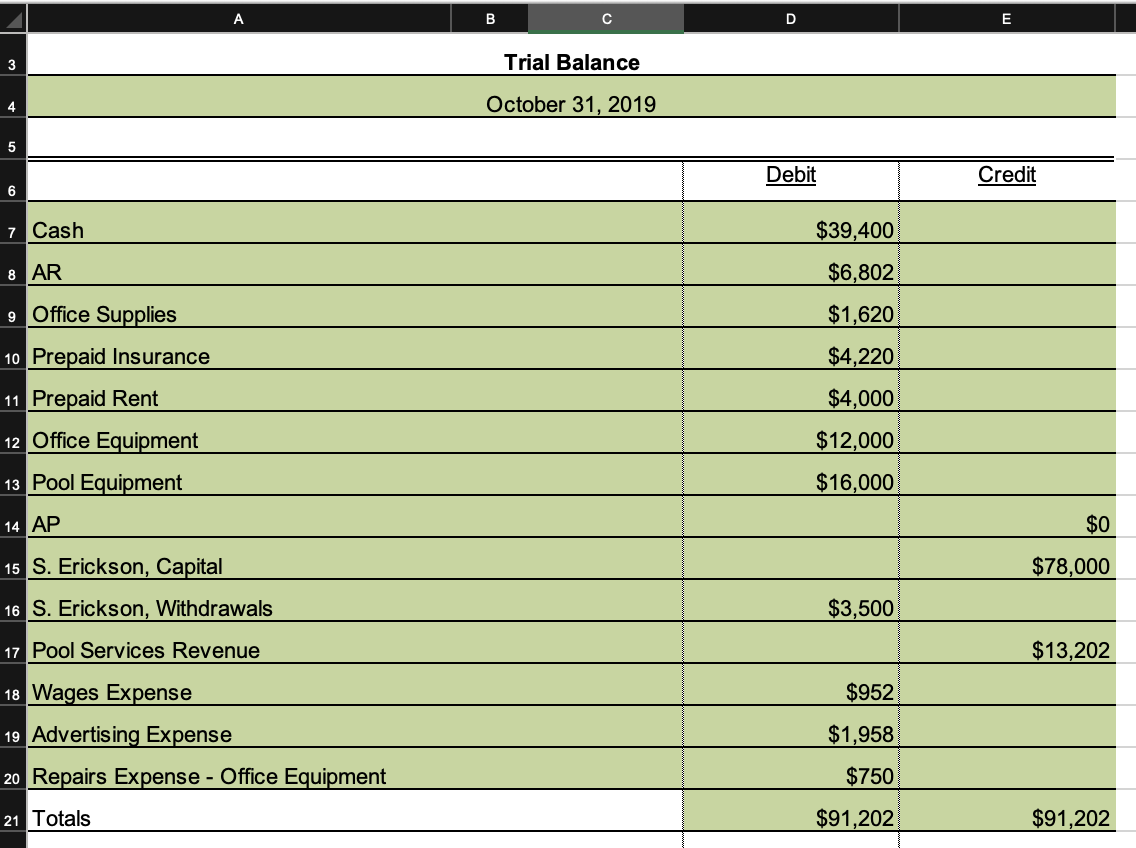

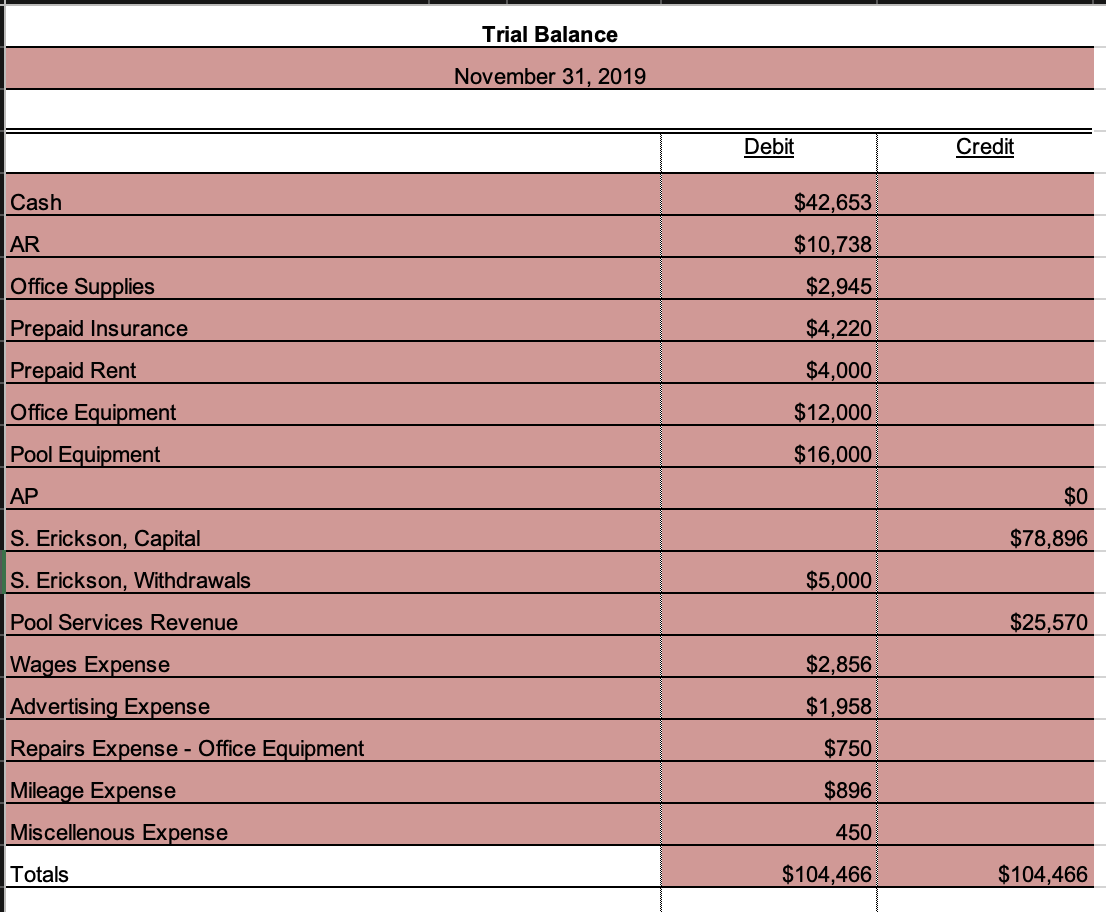

October 1 S. Erickson invested $50,000 cash, a $16,000 pool equipment, and $12,000 of office equipment in the company. 2 The company paid $4,000 cash for five months' rent. 3 The company purchased $1,620 of office supplies on credit from Todd's Office Products. 5 The company paid $4,220 cash for one year's premium on a property and liability insurance policy. 6 The company billed Deep End Co $4,800 for services performed in installing a new pool. 8 The company paid $1,620 cash for the office supplies purchased from Todd's Office Products on October 3. 10 The company hired Julie Kruit as a part-time assistant for $136 per day, as needed. 12 The company billed Deep End Co another $1,600 for services performed. 15 The company received $4,800 cash from Deep End Co as partial payment on its account. ACC 121 Accounting Cycle Project (ACP) The company paid $750 cash to repair pool equipment that was damaged when moving it. 20 The company paid $1,958 cash for advertisements published in the local newspaper. 22 The company received $1,600 cash from Deep End Co. on its account. 28 The company billed Happy Summer Corp $6,802 for consulting services performed. 31 The company paid $952 cash for Julie Kruit's wages for seven days' work. 31 S. Erickson withdrew $3,500 cash from the company for personal use. November 1 The Company reimbursed S. Erickson in cash for business automobile mileage allowance (Erickson logged 1,500 miles at $0.32 per mile). 2 The company received $5,630 cash from Underground Inc. for consulting services performed. 5 The company purchased office supplies for $1,325 cash from Todd's Office Products. 8 The company billed Slides R Us $7,568 for services performed. 13 The company agreed to perform future services for Henry's Pool and Spa Co. No work has been performed. 18 The company received $2,802 cash from Happy Summer Corp as partial payment of the October 28 bill. 22 The company donated $450 cash to the United Way in the company's name. 24 The company completed work and sent a bill for $4,800 to Henry's Pool and Spa Co. 25 The company sent another bill to Happy Summer Corp for the past-due amount of $4,000. 28 The company reimbursed S. Erickson in cash for business automobile mileage (1,300 miles at $0.32 per mile). 30 The company paid cash to Julie Kruit for 14 days' work. 30 S. Erickson withdrew $1,500 cash from the company for personal use. December 2 Paid $1,200 cash to West Side Mall for Splashing Around's share of mall advertising costs. 3 Paid $350 cash for minor repairs to the company's pool equipment. 4 Received $4,800 cash from Henry's Pool and Spa Co. for the receivable from November 10 Paid cash to Julie Kruit for six days work at the rate of $136 per day. 14 Notified by Henry's Pool and Spa Co. that Splashing Around's bid of $10,000 on a proposed project has been accepted. Henry's paid a $6,500 cash advance to Splashing Around 15 Purchased $1,400 of office supplies on credit from Todd's Office Products. 16 Sent a reminder to Slides R Us to pay the fee for services recorded on November 8. 20 Completed a project for Underground Inc and received $6,545 cash. 2226 Took the week off for the holidays. 28 Received $4,500 cash from Slides R Us on its receivable. 29 Reimbursed S. Erickson for business automobile mileage (500 miles at $0.32 per mile). 31 S. Erickson withdrew $2,500 cash from the company for personal use. A B C D E 3 Trial Balance 4 October 31, 2019 5 Debit Credit 6 7 Cash $39,400 8 AR $6,802 9 Office Supplies $1,620 10 Prepaid Insurance $4,220 11 Prepaid Rent $4,000 12 Office Equipment $12,000 13 Pool Equipment $16,000 14 AP $0 15 S. Erickson, Capital $78,000 16 S. Erickson, Withdrawals $3,500 17 Pool Services Revenue $13,202 18 Wages Expense $952 19 Advertising Expense $1,958 20 Repairs Expense - Office Equipment $750 21 Totals $91,202 $91,202 Trial Balance November 31, 2019 Debit Credit Cash $42,653 AR $10,738 Office Supplies $2,945 Prepaid Insurance $4,220 Prepaid Rent $4,000 $12,000 Office Equipment Pool Equipment $16,000 AP $0 S. Erickson, Capital $78,896 S. Erickson, Withdrawals $5,000 Pool Services Revenue $25,570 Wages Expense $2,856 $1,958 Advertising Expense Repairs Expense - Office Equipment $750 Mileage Expense $896 Miscellenous Expense 450 Totals $104,466 $104,466 December Unadjusted Trial Balance * Complete if you don't use the Worksheet Splashing Around Trial Balance December 31, 2019 Debit Credit Cash $47,087 AR $14,483 $4,445 $4,220 $4,000 Office Supplies Prepaid Insurance Prepaid Rent Office Equipment Pool Equipment AP $12,000 $16,000 $1,400 $79,056 S. Erickson, Capital S. Erickson, Withdrawals Pool Services Revenue $7,500 $32,115 $3,672) $3,158 $1,100 Wages Expense Advertising Expense Repairs Expense - Pool Equipment Mileage Expense Miscellenous Expense Unearned Pool Services Revenue $1,056 $450 $6,500 Totals $119,171 $119,071