Im currently working on practice accounting homework ( not graded). this ist the question

I got all the answers correct except for 3 and 4. my professor said

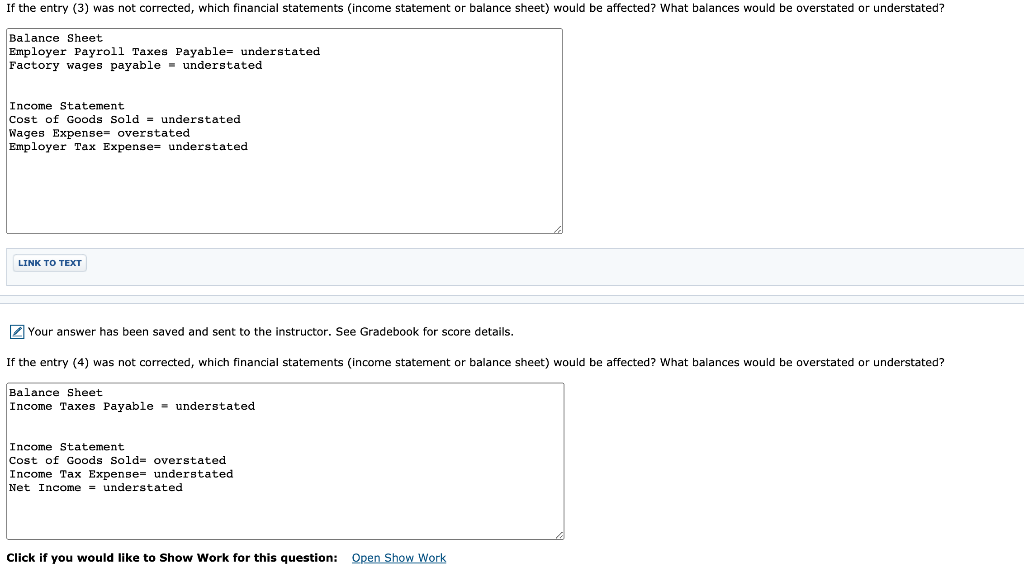

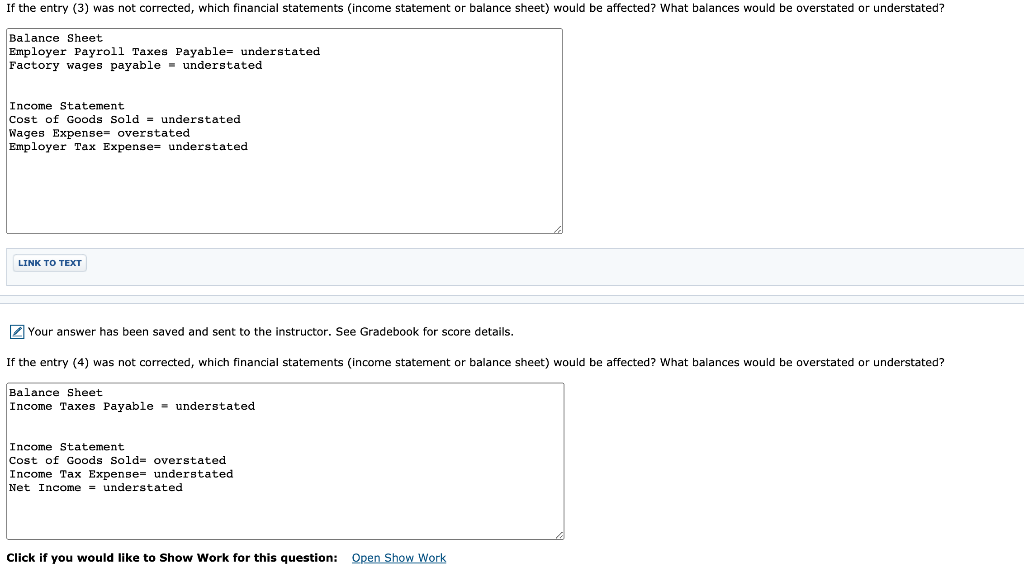

3. If COGS is incorrect as you correctly stated, then Net Income is not correct on the I/S. What impact does this have on the B/S (hint: closing process of temporary accounts on the I/S to the B/S)? Same as situation #2.

4. If COGS is incorrect as you correctly stated, then Net Income is not correct on the I/S. What impact does this have on the B/S (hint: closing process of temporary accounts on the I/S to the B/S)? Same as situation #2 and 3.

please help

please explain your answer in the form of

balance sheet

all the accounts over stated and understated

income statement

all the accounts overstated and understated

these were the answers that I put but they are wrong

cant you just zoom in

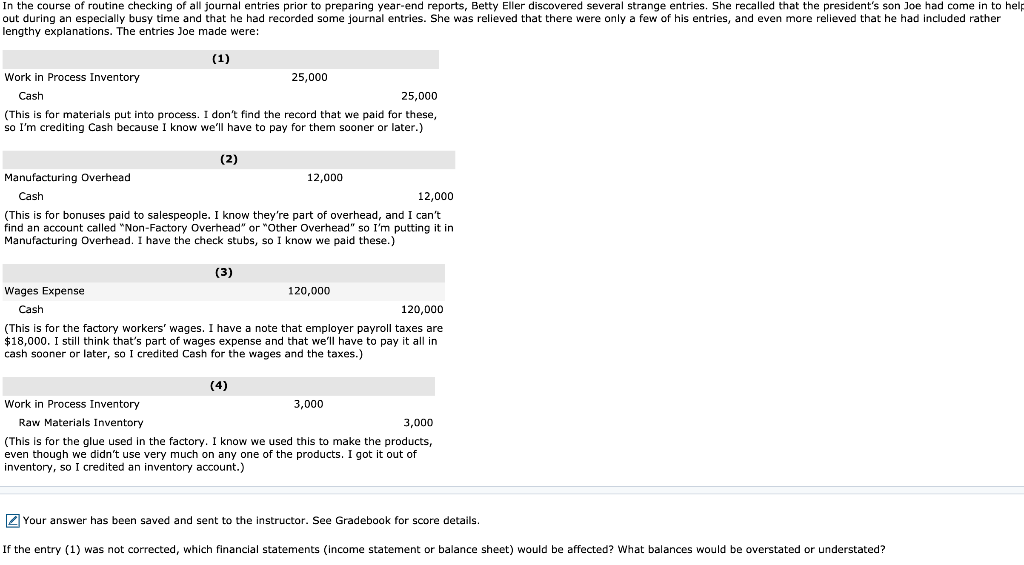

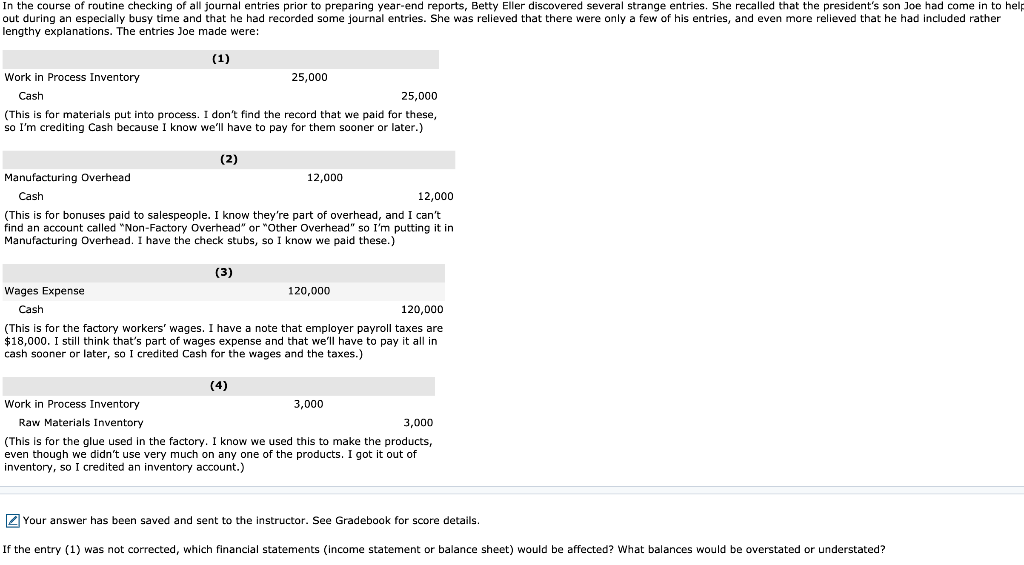

In the course of routine checking of all journal entries prior to preparing year-end reports, Betty Eller discovered several strange entries. She recalled that the president's son Joe had come in to help out during an especially busy time and that he had recorded some journal entries. She was relieved that there were only a few of his entries, and even more relieved that he had included rather lengthy explanations. The entries Joe made were: (1) Work in Process Inventory 25,000 Cash 25,000 (This is for materials put into process. I don't find the record that we paid for these, so I'm crediting Cash because I know we'll have to pay for them sooner or later.) (2) Manufacturing Overhead 12,000 Cash 12,000 (This is for bonuses paid to salespeople. I know they're part of overhead, and I can't find an account called "Non-Factory Overhead" or "Other Overhead" so I'm putting it in Manufacturing Overhead. I have the check stubs, so I know we paid these.) (3) Wages Expense 120,000 Cash 120,000 (This is for the factory workers' wages. I have note that employer payroll taxes are $18,000. I still think that's part of wages expense and that we'll have to pay it all in cash sooner or later, so I credited Cash for the wages and the taxes.) (4) Work in Process Inventory 3,000 Raw Materials Inventory 3,000 (This is for the glue used in the factory. I know we used this to make the products, even though we didn't use very much on any one of the products. I got it out of inventory, so I credited an inventory account.) Your answer has been saved and sent to the instructor. See Gradebook for score details. If the entry (1) was not corrected, which financial statements (income statement or balance sheet) would be affected? What balances would be overstated or understated? If the entry (3) was not corrected, which financial statements (income statement or balance sheet) would be affected? What balances would be overstated or understated? Balance Sheet Employer Payroll Taxes Payable= understated Factory wages payable - understated Income Statement Cost of Goods Sold = understated Wages Expenser overstated Employer Tax Expense= understated LINK TO TEXT Your answer has been saved and sent to the instructor. See Gradebook for score details. If the entry (4) was not corrected, which financial statements (income statement or balance sheet) would be affected? What balances would be overstated or understated? Balance Sheet Income Taxes Payable = understated Income Statement Cost of Goods Sold= overstated Income Tax Expense= understated Net Income = understated Click if you would like to Show Work for this question: Open Show Work