I'm having a difficult time finding the correct response for the following journal entries. Any help would be greatly appreciated. Thanks in advance.

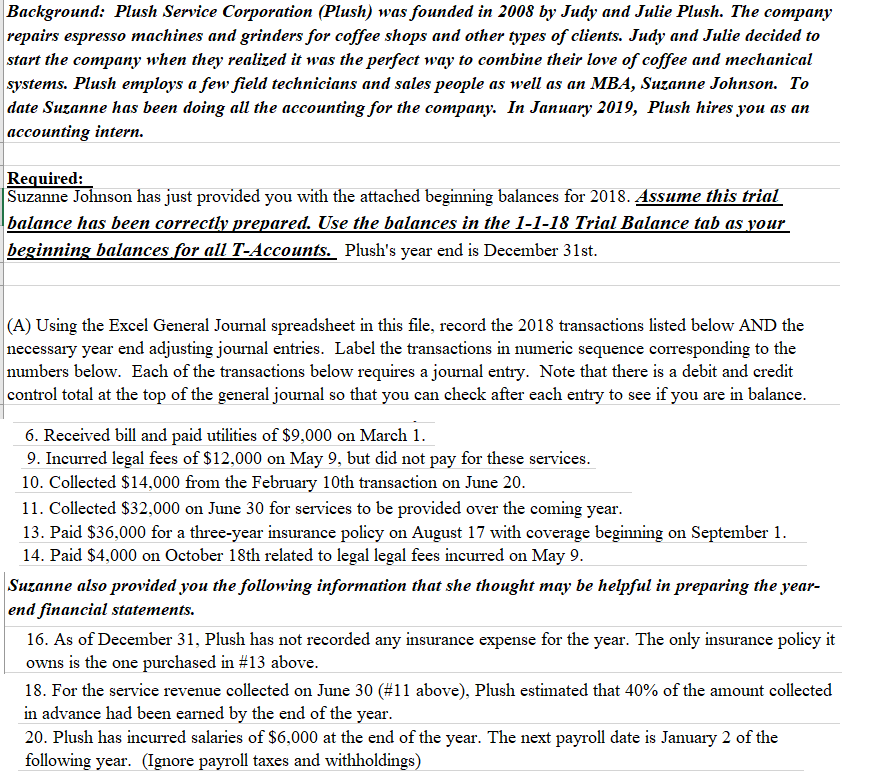

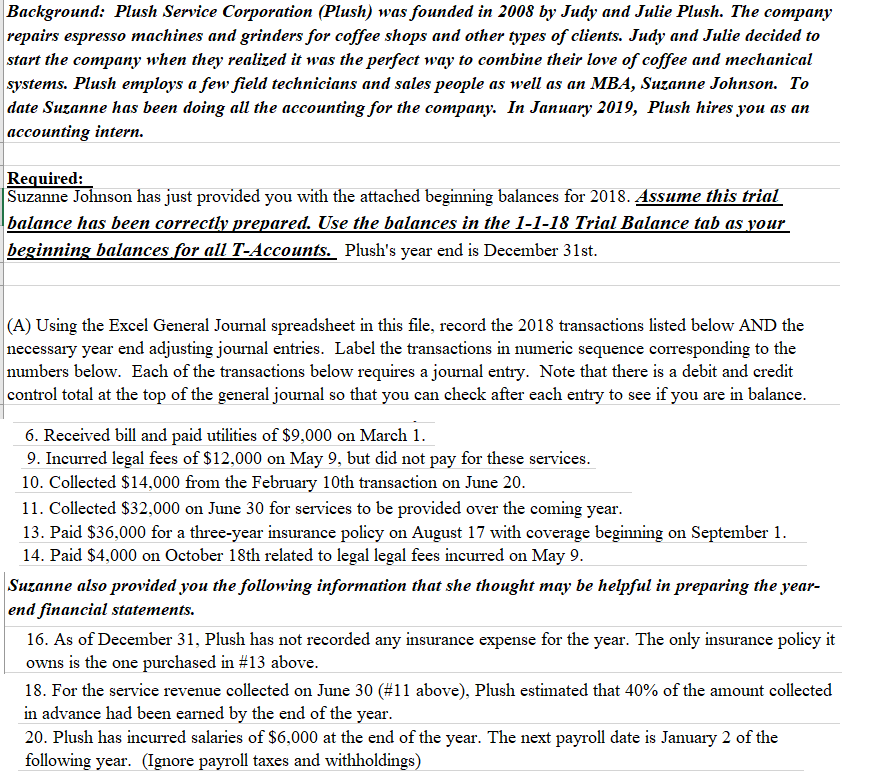

Background: Plush Service Corporation (Plush) was founded in 2008 by Judy and Julie Plush. The company repairs espresso machines and grinders for coffee shops and other types of clients. Judy and Julie decided to start the company when they realized it was the perfect way to combine their love of coffee and mechanical systems. Plush employs a few field technicians and sales people as well as an MBA, Suzanne Johnson. To date Suzanne has been doing all the accounting for the company. In January 2019, Plush hires you as an accounting intern. Required: Suzanne Johnson has just provided you with the attached beginning balances for 2018. Assume this trial balance has been correctly prepared. Use the balances in the 1-1-18 Trial Balance tab as your beginning balances for all T-Accounts. Plush's year end is December 31st. (A) Using the Excel General Journal spreadsheet in this file, record the 2018 transactions listed below AND the necessary year end adjusting journal entries. Label the transactions in numeric sequence corresponding to the numbers below. Each of the transactions below requires a journal entry. Note that there is a debit and credit control total at the top of the general journal so that you can check after each entry to see if you are in balance. 6. Received bill and paid utilities of $9,000 on March 1. 9. Incurred legal fees of $12,000 on May 9, but did not pay for these services. 10. Collected $14,000 from the February 10th transaction on June 20. 11. Collected $32,000 on June 30 for services to be provided over the coming year. 13. Paid $36,000 for a three-year insurance policy on August 17 with coverage beginning on September 1. 14. Paid $4,000 on October 18th related to legal legal fees incurred on May 9. Suzanne also provided you the following information that she thought may be helpful in preparing the year- end financial statements. 16. As of December 31, Plush has not recorded any insurance expense for the year. The only insurance policy it owns is the one purchased in #13 above. 18. For the service revenue collected on June 30 (#11 above), Plush estimated that 40% of the amount collected in advance had been earned by the end of the year. 20. Plush has incurred salaries of $6,000 at the end of the year. The next payroll date is January 2 of the following year. (Ignore payroll taxes and withholdings)