Answered step by step

Verified Expert Solution

Question

1 Approved Answer

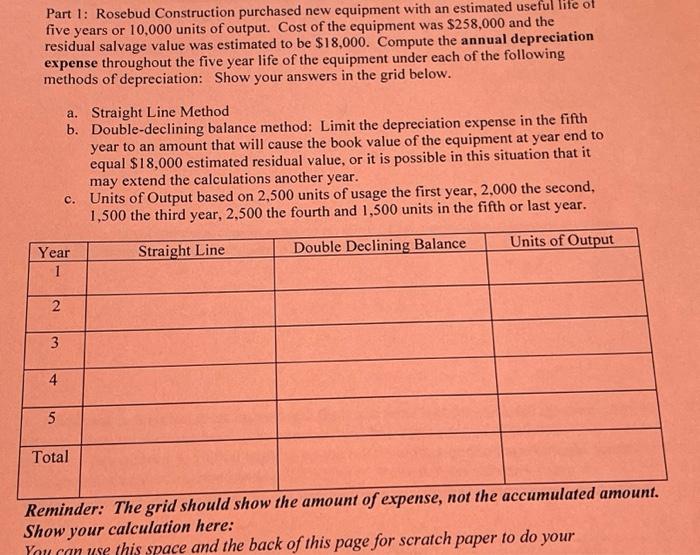

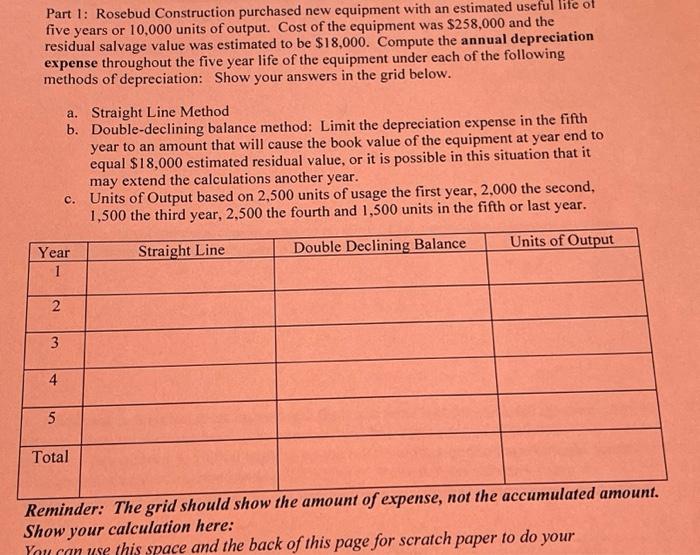

I'm having a hard time on how to work this out... Part 1: Rosebud Construction purchased new equipment with an estimated useful life of five

I'm having a hard time on how to work this out...

Part 1: Rosebud Construction purchased new equipment with an estimated useful life of five years or 10,000 units of output. Cost of the equipment was $258,000 and the residual salvage value was estimated to be $18,000. Compute the annual depreciation expense throughout the five year life of the equipment under each of the following methods of depreciation: Show your answers in the grid below. a. Straight Line Method b. Double-declining balance method: Limit the depreciation expense in the fifth year to an amount that will cause the book value of the equipment at year end to equal $18,000 estimated residual value, or it is possible in this situation that it may extend the calculations another year. c. Units of Output based on 2,500 units of usage the first year, 2,000 the second, 1,500 the third year, 2,500 the fourth and 1,500 units in the fifth or last year. Reminder: The grid should show the amount of expense, not the accumuareu umvuru. Show your calculation here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started