Question: Im having issue finding the change in price amount per share. The rest I have correct Nemesis, Inc., has 195,000 shares of stock outstanding. Each

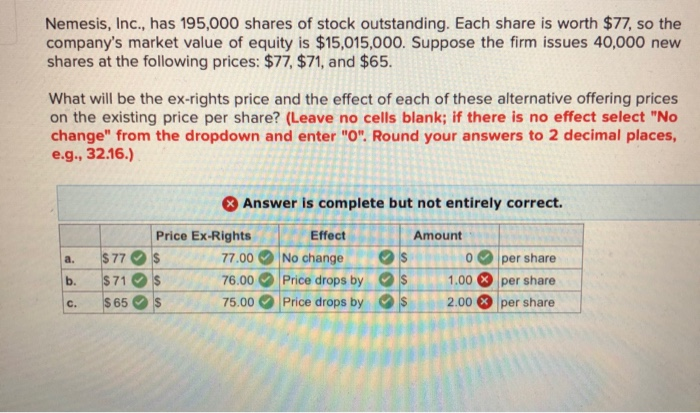

Nemesis, Inc., has 195,000 shares of stock outstanding. Each share is worth $77, so the company's market value of equity is $15,015,000. Suppose the firm issues 40,000 new shares at the following prices: $77, $71, and $65. What will be the ex-rights price and the effect of each of these alternative offering prices on the existing price per share? (Leave no cells blank; if there is no effect select "No change" from the dropdown and enter "O". Round your answers to 2 decimal places, e.g., 32.16.) $ 77 $ 71 $65 Answer is complete but not entirely correct. Price Ex-Rights Effect Amount S 77.00 No change $ 0 per share $ 76.00 Price drops by $ 1.00 per share $ 75.00 Price drops by $ 2.00 per share c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts