Answered step by step

Verified Expert Solution

Question

1 Approved Answer

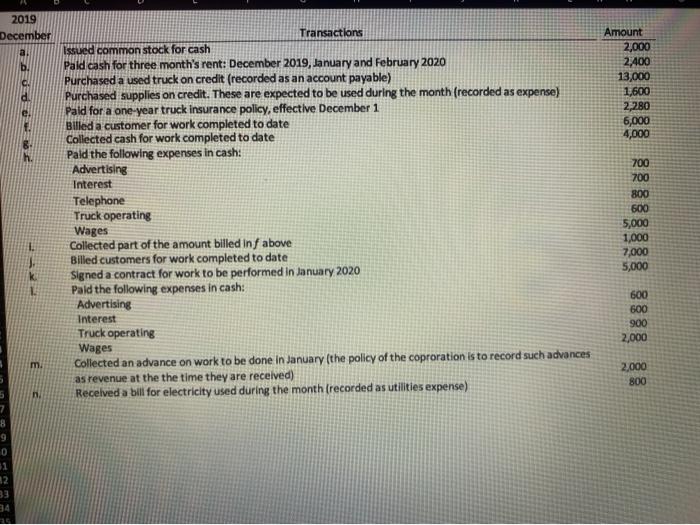

I'm having issues with my T-accounts adding up correctly. 2019 December Amount 2,000 2,400 13,000 1,600 2,280 6,000 4,000 Transactions Issued common stock for cash

I'm having issues with my T-accounts adding up correctly.

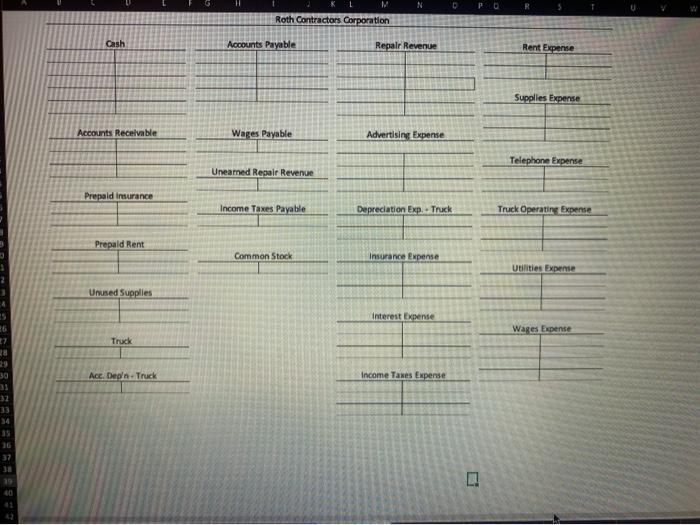

2019 December Amount 2,000 2,400 13,000 1,600 2,280 6,000 4,000 Transactions Issued common stock for cash Paid cash for three month's rent: December 2019, January and February 2020 Purchased a used truck on credit (recorded as an account payable) Purchased supplies on credit. These are expected to be used during the month (recorded as expense) Pald for a one-year truck insurance policy, effective December 1 Billed a customer for work completed to date Collected cash for work completed to date Pald the following expenses in cash: Advertising Interest Telephone Truck operating Wages Collected part of the amount billed inf above Billed customers for work completed to date Signed a contract for work to be performed in January 2020 Pald the following expenses in cash: Advertising Interest Truck operating Wages Collected an advance on work to be done in January (the policy of the coproration is to record such advances as revenue at the the time they are received) Received a bill for electricity used during the month (recorded as utilities expense) 700 700 800 600 5,000 1,000 7.000 5,000 600 600 900 2,000 m. 2,000 800 5 7 8 0 1 12 33 U N D R Roth Contractors Corporation Cash Accounts Payable Repair Revenue Rent Experte Supplies Expense Accounts Receivable Wares Payable Advertising Expense Telephone Expense Uneamed Repair Revenue Prepaid Insurance Income Taxes Payable Depreciation Exp.. Truck Truck Operating Expense Prepaid Rent Common Stock Insurance Expense Utilities Experte Unused Supplies Interest Expense Wages Expense Truck 27 28 Ace Deon-Truck Income Taxes Expense 30 31 32 16 7 19 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started