Question

I'm having trouble I'm having trouble with my homework it seems that the answer is incorrect but I've done the formula as it should be...

I'm having trouble I'm having trouble with my homework it seems that the answer is incorrect but I've done the formula as it should be...

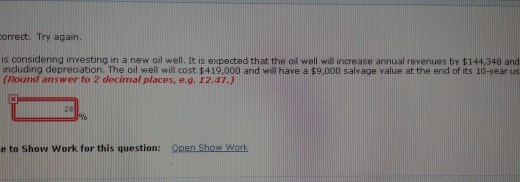

1st Question: Bramble Oil Company is considering investing in a new oil well. It is expected that the oil well will increase annual revenues by $144,348 and will increase annual expenses by $84,000 including depreciation. The oil well will cost $419,000 and will have a $9,000 salvage value at the end of its 10-year useful life. Calculate the annual rate of return.

Annual rate of return= Expected Annual Income/Average Investment

(144,348-84,000)/(419,000+9,000)/2 =60,438/214,000 =0.28

Also Have Trouble With This Question As Well Did A Whole Sheet For This & Still Got It Wrong??

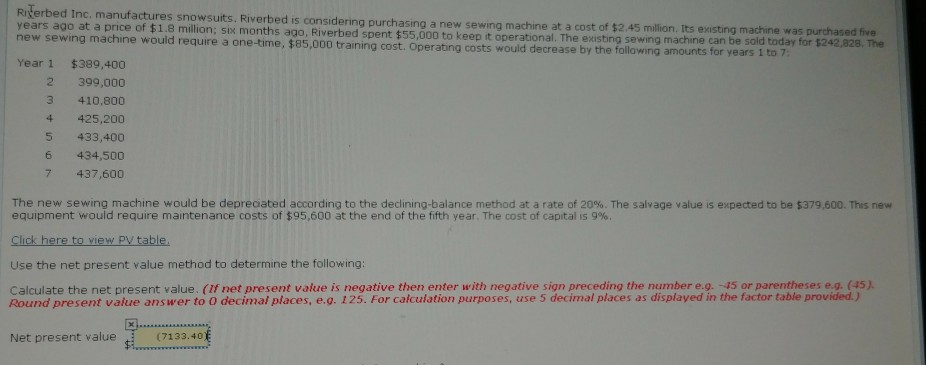

2nd Question: Riverbed Inc. manufactures snowsuits. Riverbed is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing machine was purchased five years ago at a price of $1.8 million; six months ago, Riverbed spent $55,000 to keep it operational. The existing sewing machine can be sold today for $242,828. The new sewing machine would require a one-time, $85,000 training cost. Operating costs would decrease by the following amounts for years 1 to 7:

orrect. Try again. is considenng investing in a new oil well. It is expected that the oil well will increase annual revenues by $144,348 and including deprecation. The oil well will cost 419,000 and will have a $9,000 salvage value at the end of its 10-year us (Round answer to 2 decimal places, e.g. 12.47.) e to Show Work for this question: Qpen Show Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started