Answered step by step

Verified Expert Solution

Question

1 Approved Answer

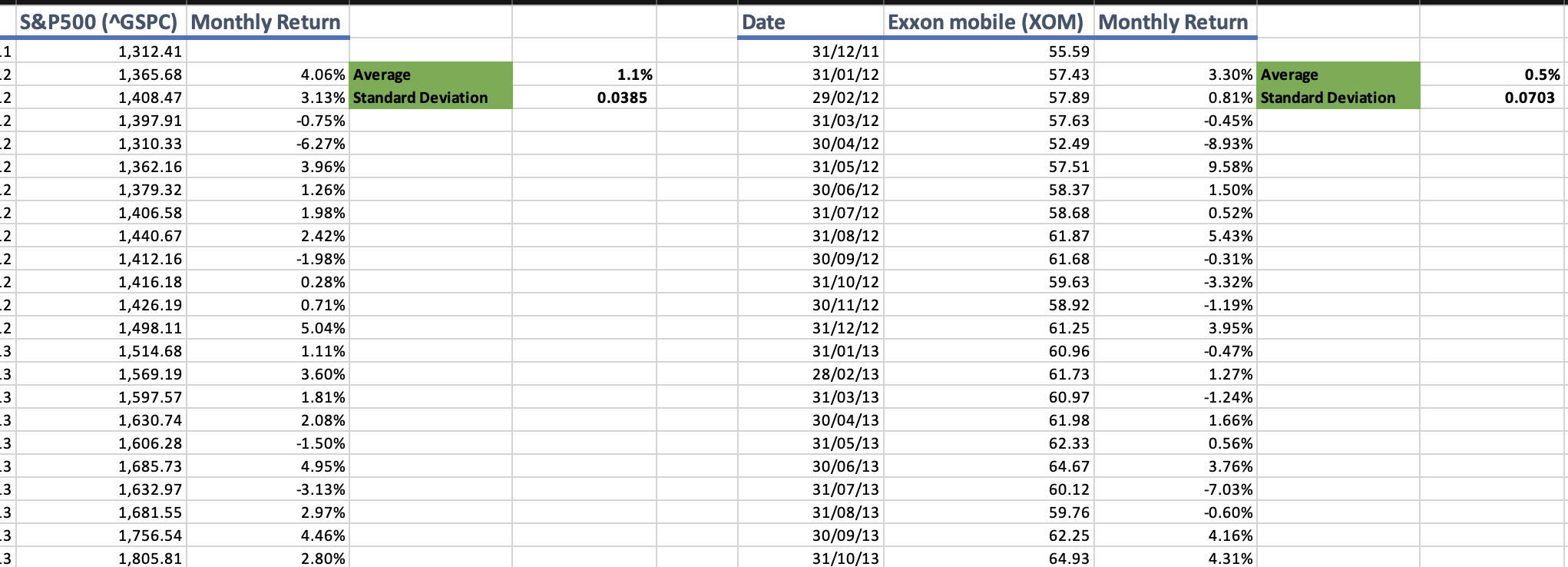

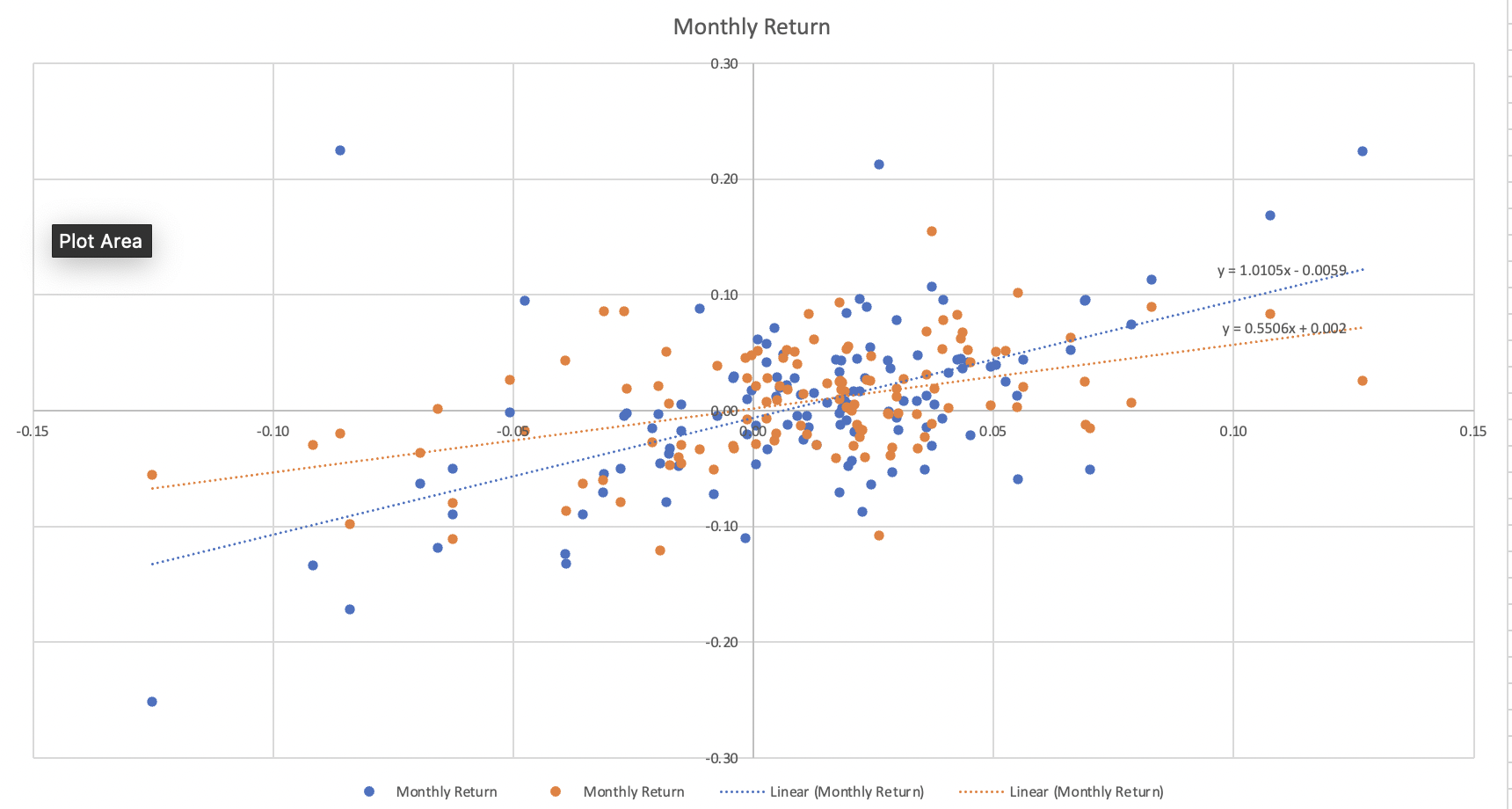

I'm having trouble understanding how to answer this question. When S&P 500 changes by +1%, would EXXON MOBIL (XOM) return be expected to change by:

I'm having trouble understanding how to answer this question.

When S&P 500 changes by +1%, would EXXON MOBIL (XOM) return be expected to change by:

a) 1.01%

b) 2.3%

c) -1.10%

d) 0.95%

The blue line is for company XOM.

I just don't know the steps for calculating the answer and what to substitute where.

Date 1.1% 0.0385 0.5% 0.0703 S&P500 (^GSPC) Monthly Return 1 1,312.41 -2 1,365.68 4.06% Average 2 1,408.47 3.13% Standard Deviation -2 1,397.91 -0.75% -2 1,310.33 -6.27% -2 1,362.16 3.96% 2 1,379.32 1.26% 1,406.58 1.98% 1,440.67 2.42% 1,412.16 -1.98% 1,416.18 0.28% 1,426.19 0.71% 1,498.11 5.04% 1,514.68 1.11% 1,569.19 3.60% 1,597.57 1.81% 1,630.74 2.08% 1,606.28 -1.50% 1,685.73 4.95% 1,632.97 -3.13% 1,681.55 2.97% 1,756.54 4.46% -3 1,805.81 2.80% w w w w w w w w w w N N N N N N Exxon mobile (XOM) Monthly Return 31/12/11 55.59 31/01/12 57.43 3.30% Average 29/02/12 57.89 0.81% Standard Deviation 31/03/12 57.63 -0.45% 30/04/12 52.49 -8.93% 31/05/12 57.51 9.58% 30/06/12 58.37 1.50% 31/07/12 58.68 0.52% 31/08/12 61.87 5.43% 30/09/12 61.68 -0.31% 31/10/12 59.63 -3.32% 30/11/12 58.92 -1.19% 31/12/12 61.25 3.95% 31/01/13 60.96 -0.47% 28/02/13 61.73 1.27% 31/03/13 60.97 -1.24% 30/04/13 61.98 1.66% 31/05/13 62.33 0.56% 30/06/13 64.67 3.76% 31/07/13 60.12 -7.03% 31/08/13 59.76 -0.60% 30/09/13 62.25 4.16% 31/10/13 64.93 4.31% Monthly Return 0.30 . 0.20 Plot Area y = 1.0105x -0.0059.... 0.10 y = 0.5506x + 0,002... -0.15 -0.10 -0. Os 0.05 0.10 0.15 -0.10 -0.20 -0.30 Monthly Return Monthly Return ... Linear Monthly Return) ... Linear (Monthly Return)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started