im having trouble with a hmwk question

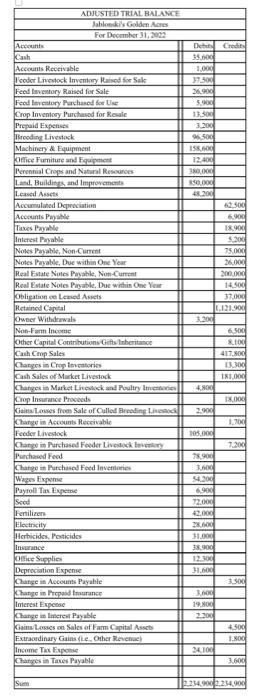

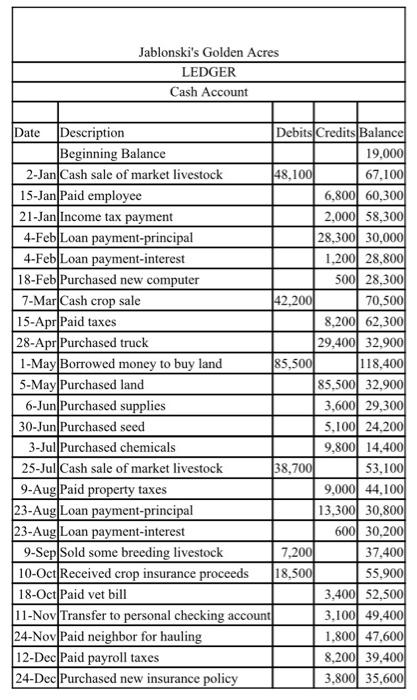

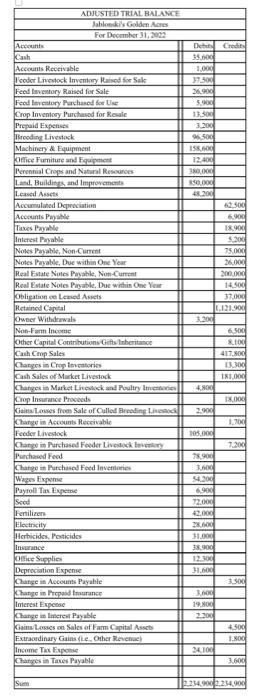

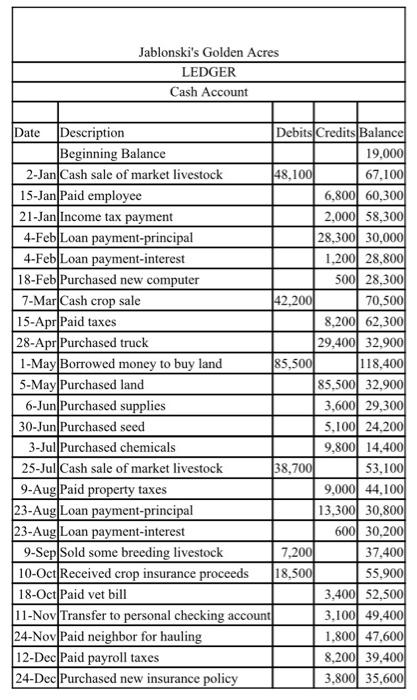

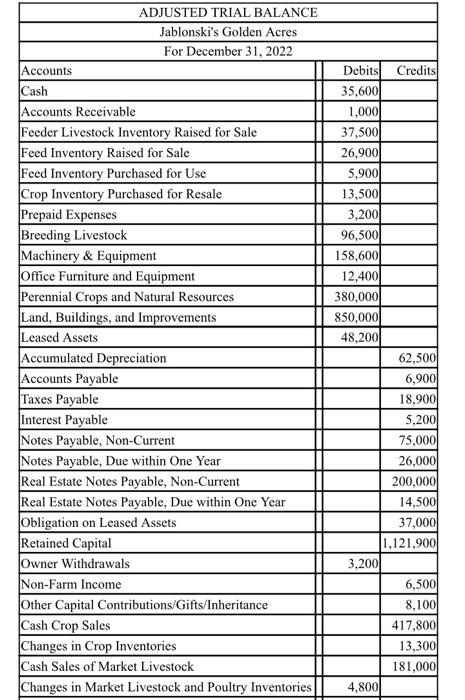

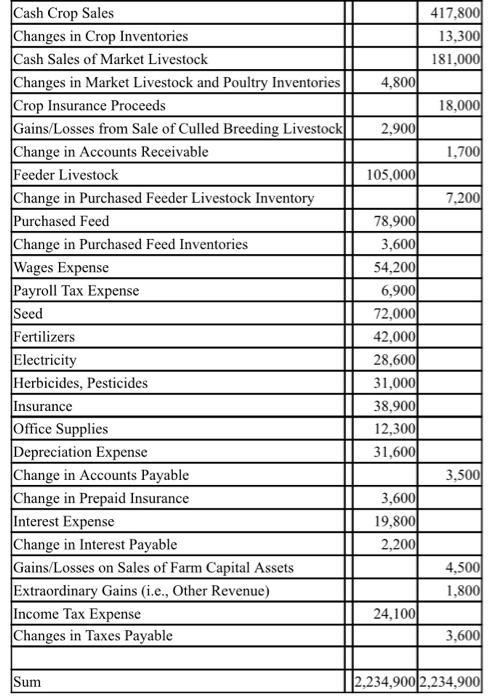

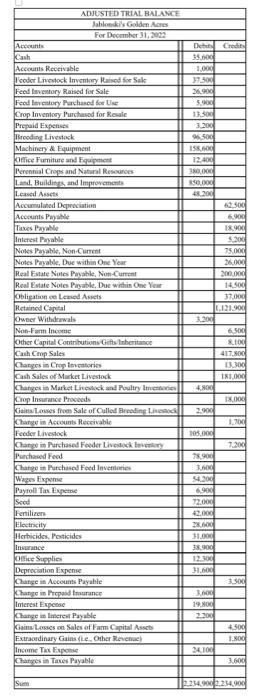

Using the attached Adjusted Trial Balance and Cash ledger page, prepare Jablonskis Golden Acres financial statements for the end of the year. Complete each statement on its own page in the following order:

A) Income Statement for 2022

B) Statement of Owner Equity for 2022

C) Balance Sheet for December 31, 2022

D)Statement of Cash Flow for 2022

It is expected that proper formatting will be used in regard to the document title, headings, sub-totals, etc. Improper formatting will lose points. You are to put together financial statements, not just determine net income or owner equity.

ADJUSTED TRIAL BALANCE Jablonskis Golden Acres For December 31, 2022 Accounts Kash Accounts Receivable Icedor Livestock Inventowy Rased for Saks Feed laventory Raised for Sale Feed Inventory Purchased for Use Crop Inventory Purchased for sale Prepaid Expenses Breeding Livestock Machinery & Equipment office Furniture and Equipment Perennial Crops and Natural Resources Land Buildings and improvements Lead Assets Accumulated Depreciation Accounts Payable Taxes Payable interest Payable Noles Payable, Non-Current Notes Payable, Due within One Year Real Estate Notes Povable. Non-Current Real Estate Notes Payable. Due within One Year Obligation Lead Assets Retained Capital Owner Withdrawals Non-Farm Income Other Capital Contributions Gifts. Inheritance Cash Crop Sales Khanges in Chap intories Cash Sales of Marker Livestock Changes in Market Livestock and Poultry Images Crop Insurance Proceeds Kies Losses from Sale of Called Breading Lic Change in Accounts Receivable Feeder Livestock Change in Purchased Feeder Livestock very Purchased Feed Chain Purchased Feed Inventos Wages Expense Payroll Tax Expete Sood Fertilizers Electricity Herbicides, Pesticides Ince Office Supplies Depreciation Expense Change in Accounts Payable Khange in Propandwunce Interest Expense Change in Imerest Payable KainLassen Sales of a Capital Asset Extraordinary Gainsbe. Other Revenue Income Tax Expo Chates in Tunes Payable Det Credits 35.00 1.000 37.500 20.00 50 13.30 3200 96.500 IS. 12.400 300 DO 300 62.500 6.90 18.900 $200 75.000 26.000 200.000 14.500 37 L. 121-90 3200 600 XLIC 417.00 13.300 11.000 4 18.00 2.900 105.00 7.200 78.900 3. 5300 6.900 72.000 42.00 31.00 3890 12.300 31. 3500 3.600 19.00 2300 500 1.800 24.100 3.600 S 2.254.002.254.900 Jablonski's Golden Acres LEDGER Cash Account Date Description Debits Credits Balance Beginning Balance 19.000 2-Jan Cash sale of market livestock 48, 1001 67,1001 15-Jan Paid employee 6,800 60,300 21-Jan Income tax payment 2,000 58,300 4-Feb Loan payment-principal |28,300 30,000 4-Feb Loan payment-interest 1,200 28,800 18-Feb Purchased new computer 500 28,300 7-Mar Cash crop sale 42,200 70,500 15-Apr Paid taxes 8,200 62,300 28-Apr Purchased truck 29,400 32.900 1-May Borrowed money to buy land 85,5001 118,400 5-May Purchased land 85,500 32,9001 6-Jun Purchased supplies 3.600 29,300 30-Jun Purchased seed 5.100 24,200 3-Jul Purchased chemicals 9,800 14.400 25-Jul Cash sale of market livestock 38,700 53.100 9-Aug|Paid property taxes 9,000 44,100 23-Aug Loan payment principal 13,300 30.800 23-Aug Loan payment-interest 600 30,200 9-Sep Sold some breeding livestock 7,200 37,400 10-Oct Received crop insurance proceeds 18,500 55.900 18-Oct|Paid vet bill 3,400 52,500 11-Nov Transfer to personal checking account 3.100 49,400 24-Nov Paid neighbor for hauling 1.800 47,600 12-Dec Paid payroll taxes 8,200 39,400 24-Dec Purchased new insurance policy 3.800 35,600 ADJUSTED TRIAL BALANCE Jablonski's Golden Acres For December 31, 2022 Accounts Cash Accounts Receivable Feeder Livestock Inventory Raised for Sale Feed Inventory Raised for Sale Feed Inventory Purchased for Use Crop Inventory Purchased for Resale Prepaid Expenses Breeding Livestock Machinery & Equipment Office Furniture and Equipment Perennial Crops and Natural Resources Land, Buildings, and Improvements Leased Assets Accumulated Depreciation Accounts Payable Taxes Payable Interest Payable Notes Payable, Non-Current Notes Payable, Due within One Year Real Estate Notes Payable, Non-Current Real Estate Notes Payable, Due within One Year Obligation on Leased Assets Retained Capital Owner Withdrawals Non-Farm Income Other Capital Contributions/Gifts/Inheritance Cash Crop Sales Changes in Crop Inventories Cash Sales of Market Livestock Changes in Market Livestock and Poultry Inventories Debits Credits 35,600 1,000 37,500 26,900 5,900 13,500 3,200 96,500 158,600 12,400 380,000 850,000 48,200 62,500 6,900 18,9001 5,200 75,000 26,000 200,000 14,500 37,000 1,121,900 3,200 6,500 8,100 417,800 13,300 181,0001 4,800 417,8001 13,300 181,000 4.800 18,000 2,9001 1,700 105,000 7.2001 Cash Crop Sales Changes in Crop Inventories Cash Sales of Market Livestock Changes in Market Livestock and Poultry Inventories Crop Insurance Proceeds Gains/Losses from Sale of Culled Breeding Livestock Change in Accounts Receivable Feeder Livestock Change in Purchased Feeder Livestock Inventory Purchased Feed Change in Purchased Feed Inventories Wages Expense Payroll Tax Expense Seed Fertilizers Electricity Herbicides, Pesticides Insurance Office Supplies Depreciation Expense Change in Accounts Payable Change in Prepaid Insurance Interest Expense Change in Interest Payable Gains/Losses on Sales of Farm Capital Assets Extraordinary Gains (i.e., Other Revenue) Income Tax Expense Changes in Taxes Payable 78,900 3,600 54,200 6,900 72,000 42,000 28,600 31,000 38,900 12,3001 31,600 3,5001 3,6001 19,8001 2,200 4,500 1,8001 24,100 3,600 Sum 2.234,900 2,234,900 ADJUSTED TRIAL BALANCE Jablonskis Golden Acres For December 31, 2022 Accounts Kash Accounts Receivable Icedor Livestock Inventowy Rased for Saks Feed laventory Raised for Sale Feed Inventory Purchased for Use Crop Inventory Purchased for sale Prepaid Expenses Breeding Livestock Machinery & Equipment office Furniture and Equipment Perennial Crops and Natural Resources Land Buildings and improvements Lead Assets Accumulated Depreciation Accounts Payable Taxes Payable interest Payable Noles Payable, Non-Current Notes Payable, Due within One Year Real Estate Notes Povable. Non-Current Real Estate Notes Payable. Due within One Year Obligation Lead Assets Retained Capital Owner Withdrawals Non-Farm Income Other Capital Contributions Gifts. Inheritance Cash Crop Sales Khanges in Chap intories Cash Sales of Marker Livestock Changes in Market Livestock and Poultry Images Crop Insurance Proceeds Kies Losses from Sale of Called Breading Lic Change in Accounts Receivable Feeder Livestock Change in Purchased Feeder Livestock very Purchased Feed Chain Purchased Feed Inventos Wages Expense Payroll Tax Expete Sood Fertilizers Electricity Herbicides, Pesticides Ince Office Supplies Depreciation Expense Change in Accounts Payable Khange in Propandwunce Interest Expense Change in Imerest Payable KainLassen Sales of a Capital Asset Extraordinary Gainsbe. Other Revenue Income Tax Expo Chates in Tunes Payable Det Credits 35.00 1.000 37.500 20.00 50 13.30 3200 96.500 IS. 12.400 300 DO 300 62.500 6.90 18.900 $200 75.000 26.000 200.000 14.500 37 L. 121-90 3200 600 XLIC 417.00 13.300 11.000 4 18.00 2.900 105.00 7.200 78.900 3. 5300 6.900 72.000 42.00 31.00 3890 12.300 31. 3500 3.600 19.00 2300 500 1.800 24.100 3.600 S 2.254.002.254.900 Jablonski's Golden Acres LEDGER Cash Account Date Description Debits Credits Balance Beginning Balance 19.000 2-Jan Cash sale of market livestock 48, 1001 67,1001 15-Jan Paid employee 6,800 60,300 21-Jan Income tax payment 2,000 58,300 4-Feb Loan payment-principal |28,300 30,000 4-Feb Loan payment-interest 1,200 28,800 18-Feb Purchased new computer 500 28,300 7-Mar Cash crop sale 42,200 70,500 15-Apr Paid taxes 8,200 62,300 28-Apr Purchased truck 29,400 32.900 1-May Borrowed money to buy land 85,5001 118,400 5-May Purchased land 85,500 32,9001 6-Jun Purchased supplies 3.600 29,300 30-Jun Purchased seed 5.100 24,200 3-Jul Purchased chemicals 9,800 14.400 25-Jul Cash sale of market livestock 38,700 53.100 9-Aug|Paid property taxes 9,000 44,100 23-Aug Loan payment principal 13,300 30.800 23-Aug Loan payment-interest 600 30,200 9-Sep Sold some breeding livestock 7,200 37,400 10-Oct Received crop insurance proceeds 18,500 55.900 18-Oct|Paid vet bill 3,400 52,500 11-Nov Transfer to personal checking account 3.100 49,400 24-Nov Paid neighbor for hauling 1.800 47,600 12-Dec Paid payroll taxes 8,200 39,400 24-Dec Purchased new insurance policy 3.800 35,600 ADJUSTED TRIAL BALANCE Jablonski's Golden Acres For December 31, 2022 Accounts Cash Accounts Receivable Feeder Livestock Inventory Raised for Sale Feed Inventory Raised for Sale Feed Inventory Purchased for Use Crop Inventory Purchased for Resale Prepaid Expenses Breeding Livestock Machinery & Equipment Office Furniture and Equipment Perennial Crops and Natural Resources Land, Buildings, and Improvements Leased Assets Accumulated Depreciation Accounts Payable Taxes Payable Interest Payable Notes Payable, Non-Current Notes Payable, Due within One Year Real Estate Notes Payable, Non-Current Real Estate Notes Payable, Due within One Year Obligation on Leased Assets Retained Capital Owner Withdrawals Non-Farm Income Other Capital Contributions/Gifts/Inheritance Cash Crop Sales Changes in Crop Inventories Cash Sales of Market Livestock Changes in Market Livestock and Poultry Inventories Debits Credits 35,600 1,000 37,500 26,900 5,900 13,500 3,200 96,500 158,600 12,400 380,000 850,000 48,200 62,500 6,900 18,9001 5,200 75,000 26,000 200,000 14,500 37,000 1,121,900 3,200 6,500 8,100 417,800 13,300 181,0001 4,800 417,8001 13,300 181,000 4.800 18,000 2,9001 1,700 105,000 7.2001 Cash Crop Sales Changes in Crop Inventories Cash Sales of Market Livestock Changes in Market Livestock and Poultry Inventories Crop Insurance Proceeds Gains/Losses from Sale of Culled Breeding Livestock Change in Accounts Receivable Feeder Livestock Change in Purchased Feeder Livestock Inventory Purchased Feed Change in Purchased Feed Inventories Wages Expense Payroll Tax Expense Seed Fertilizers Electricity Herbicides, Pesticides Insurance Office Supplies Depreciation Expense Change in Accounts Payable Change in Prepaid Insurance Interest Expense Change in Interest Payable Gains/Losses on Sales of Farm Capital Assets Extraordinary Gains (i.e., Other Revenue) Income Tax Expense Changes in Taxes Payable 78,900 3,600 54,200 6,900 72,000 42,000 28,600 31,000 38,900 12,3001 31,600 3,5001 3,6001 19,8001 2,200 4,500 1,8001 24,100 3,600 Sum 2.234,900 2,234,900