Answered step by step

Verified Expert Solution

Question

1 Approved Answer

im i correct ?? 1. Download and complete the spreadsheet found in the Variable and Absorption Costing Spreadsheet Dropbox by inserting either formulas or cell

im i correct ??

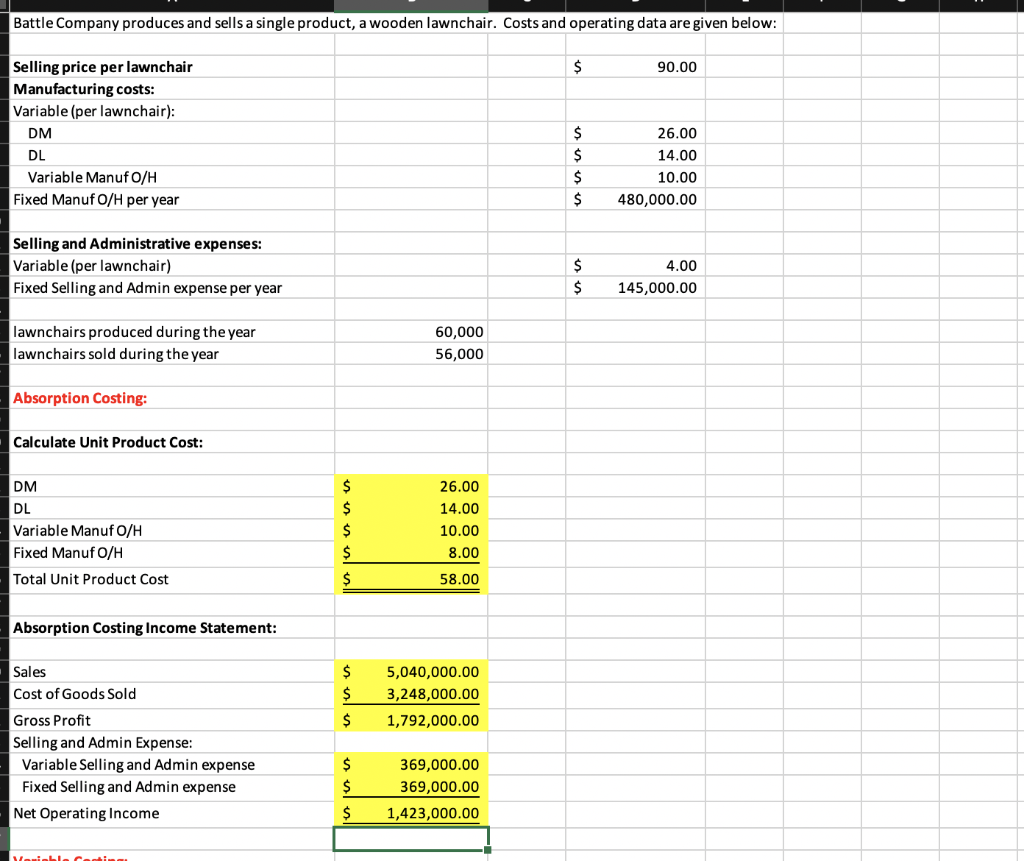

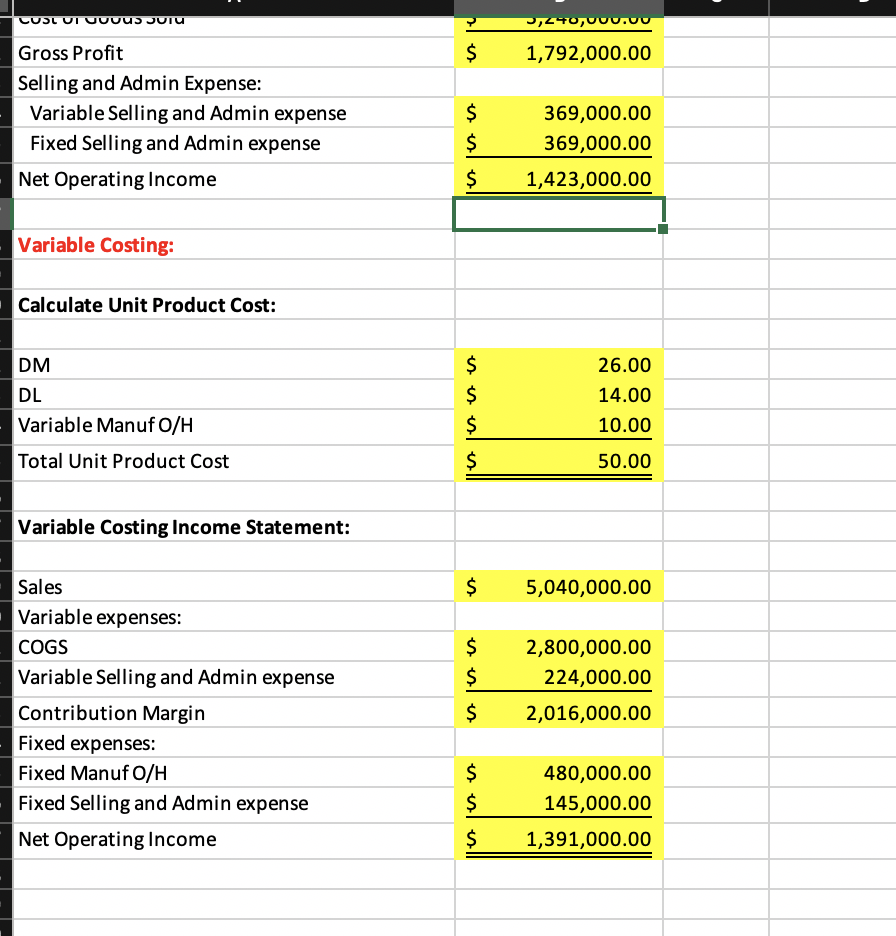

1. Download and complete the spreadsheet found in the Variable and Absorption Costing Spreadsheet Dropbox by inserting either formulas or cell references in all of the cells highlighted yellow. Each cell that requires a formula or cell reference has a question mark in it. Originally the fixed manufacturing overhead in cell D9 is $480,000. The absorption costing net operating income should be $1,423,000 and the variable costing net operating income should be $1,391,000. 2. Check the accuracy of the formulas in your spreadsheet by changing the amount of fixed manufacturing overhead in cell D9 from $480,000 to $540,000. This should cause both of your net operating incomes to change. The absorption costing net operating income should now be $1,367,000 and the variable costing net operating income should now be $1,331,000. If the net operating incomes don't recalculate correctly, fix the errors in your spreadsheet before you submit it. You can submit either version because I will change the amount in cell D9 to check that your net operating incomes recalculate correctly. Battle Company produces and sells a single product, a wooden lawnchair. Costs and operating data are given below: $ 90.00 Selling price per lawnchair Manufacturing costs: Variable (per lawnchair): DM DL Variable ManufO/H Fixed Manuf O/H per year $ $ $ $ 26.00 14.00 10.00 480,000.00 Selling and Administrative expenses: Variable (per lawnchair) Fixed Selling and Admin expense per year $ $ 4.00 145,000.00 lawnchairs produced during the year lawnchairs sold during the year 60,000 56,000 Absorption Costing: Calculate Unit Product Cost: DM DL Variable Manuf O/H Fixed Manuf O/H $ $ $ $ 26.00 14.00 10.00 8.00 Total Unit Product Cost $ 58.00 Absorption Costing Income Statement: Sales Cost of Goods Sold $ $ 5,040,000.00 3,248,000.00 1,792,000.00 $ Gross Profit Selling and Admin Expense: Variable Selling and Admin expense Fixed Selling and Admin expense Net Operating Income $ $ $ 369,000.00 369,000.00 1,423,000.00 Yaniable racing LULUI UUUU JUTU . $ 1,792,000.00 Gross Profit Selling and Admin Expense: Variable Selling and Admin expense Fixed Selling and Admin expense Net Operating Income $ $ 369,000.00 369,000.00 1,423,000.00 $ Variable Costing: Calculate Unit Product Cost: DM DL Variable ManufO/H Total Unit Product Cost $ $ $ 26.00 14.00 10.00 $ 50.00 Variable Costing Income Statement: $ 5,040,000.00 $ $ Sales Variable expenses: COGS Variable Selling and Admin expense Contribution Margin Fixed expenses: Fixed Manuf O/H Fixed Selling and Admin expense Net Operating Income 2,800,000.00 224,000.00 2,016,000.00 $ $ $ $ 480,000.00 145,000.00 1,391,000.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started