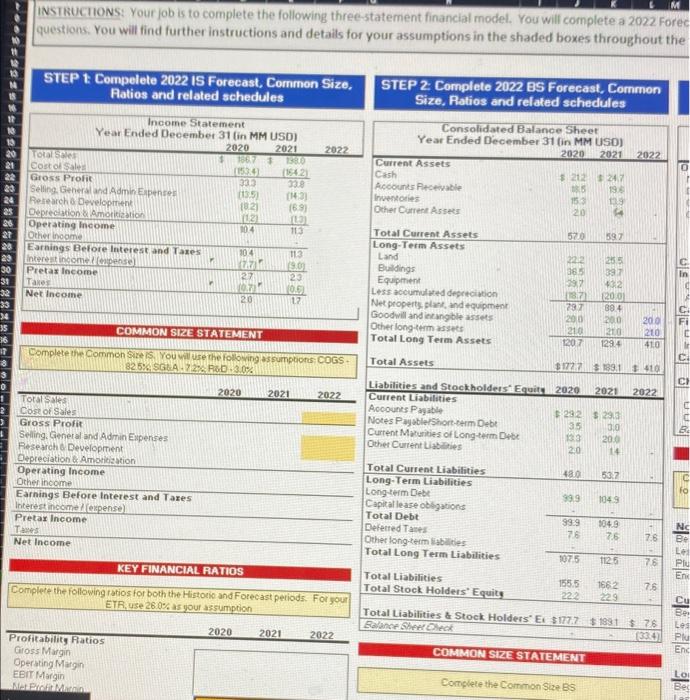

IM INSTRUCTIONS: Your job is to complete the following three-statement financial model. You will complete a 2022 Forec questions. You will find further instructions and details for your assumptions in the shaded boxes throughout the STEP 1 Compelete 2022 IS Forecast, Common Size, Ratios and related schedules STEP 2: Complete 2022 BS Forecast, Common Size, Ratios and related schedules 2022 2022 21 Consolidated Balance Sheet Year Ended December 31 in MM USO) 2020 2021 Current Assets Cash $212242 Accounts Receivable 185 196 Inventories 153 119 Other Current Assets 20 la Income Statement Year Ended December 31 in MM USD) 2020 2021 Total 1561 + Costol Sa 0534 11542 Gross Profit 333 330 Selling General and Admin Expenses 13.5 (143) Research & Development 182) 1691 Depreciation Amortization 112) Operating income 1024 113 Other income Earnings Before Interest and Taxes 304 113 Interest income pense TA 90 Pretax income 27 23 Taxe 0.70 10.5 Net Income 20 L2 23 24 23 26 520 597 des se 30 31 In Total Current Assets Long-Term Assets Land Buildings Equipment Les accused depresion Net property, plant and equipment Goodvillandigible assets Other long-term assets Total Long Term Assets - 33 34 35 36 22:2 365 97 18.7 287 200 210 1207 255 397 32 120.01 89.4 200 210 129.4 COMMON SIZE STATEMENT 200 210 410 Complete the Common Size S. You will use the following assumptions COGS 8256 SGLA7294 R6D3.0% Total Assets ZZZS 183.11 510 CI 0 1 2020 2021 2022 2022 B Toraises Cost of Sales Gross Profit Seling, General and Admin Expenses Research & Development Depreciation & Amortion Operating Income Other income Earnings Before Interest and Tares Interest income expense Pretax Income Ta Net Income Liabilities and Stockholders' Equity 2020 2021 Current Liabilities Accounts Payable $ 292 293 Notes PayableShort-term Debt 35 00 Current Marities of Long-term Debt 133 200 Other Current Labes 20 14 Total Current Liabilities 48.0 53.2 Long-Term Liabilities Long-term Debt 999 1049 Capital lease obligations Total Debt 99.9 104.9 Deretted Tames 76 7.6 Other long term liabilities Total Long Term Liabilities 9075 1125 C fo 7.6 76 KEY FINANCIAL RATIOS Total Liabilities Total Stock Holders' Equity Complete the following ratios for both the Historic and Forecast periods. For your ETR, use 26.0% as your assumption 155.5 222 1662 229 76 sa & Total Liabilities & Stock Holders' E $1777 $1991 $76 Balinessperates 2020 2021 2022 Be Les Plu Enc Profitability Ratios Gloss Margin Operating Margin EBIT Morgan COMMON SIZE STATEMENT Complete the Common Size BS LOI Bes IM INSTRUCTIONS: Your job is to complete the following three-statement financial model. You will complete a 2022 Forec questions. You will find further instructions and details for your assumptions in the shaded boxes throughout the STEP 1 Compelete 2022 IS Forecast, Common Size, Ratios and related schedules STEP 2: Complete 2022 BS Forecast, Common Size, Ratios and related schedules 2022 2022 21 Consolidated Balance Sheet Year Ended December 31 in MM USO) 2020 2021 Current Assets Cash $212242 Accounts Receivable 185 196 Inventories 153 119 Other Current Assets 20 la Income Statement Year Ended December 31 in MM USD) 2020 2021 Total 1561 + Costol Sa 0534 11542 Gross Profit 333 330 Selling General and Admin Expenses 13.5 (143) Research & Development 182) 1691 Depreciation Amortization 112) Operating income 1024 113 Other income Earnings Before Interest and Taxes 304 113 Interest income pense TA 90 Pretax income 27 23 Taxe 0.70 10.5 Net Income 20 L2 23 24 23 26 520 597 des se 30 31 In Total Current Assets Long-Term Assets Land Buildings Equipment Les accused depresion Net property, plant and equipment Goodvillandigible assets Other long-term assets Total Long Term Assets - 33 34 35 36 22:2 365 97 18.7 287 200 210 1207 255 397 32 120.01 89.4 200 210 129.4 COMMON SIZE STATEMENT 200 210 410 Complete the Common Size S. You will use the following assumptions COGS 8256 SGLA7294 R6D3.0% Total Assets ZZZS 183.11 510 CI 0 1 2020 2021 2022 2022 B Toraises Cost of Sales Gross Profit Seling, General and Admin Expenses Research & Development Depreciation & Amortion Operating Income Other income Earnings Before Interest and Tares Interest income expense Pretax Income Ta Net Income Liabilities and Stockholders' Equity 2020 2021 Current Liabilities Accounts Payable $ 292 293 Notes PayableShort-term Debt 35 00 Current Marities of Long-term Debt 133 200 Other Current Labes 20 14 Total Current Liabilities 48.0 53.2 Long-Term Liabilities Long-term Debt 999 1049 Capital lease obligations Total Debt 99.9 104.9 Deretted Tames 76 7.6 Other long term liabilities Total Long Term Liabilities 9075 1125 C fo 7.6 76 KEY FINANCIAL RATIOS Total Liabilities Total Stock Holders' Equity Complete the following ratios for both the Historic and Forecast periods. For your ETR, use 26.0% as your assumption 155.5 222 1662 229 76 sa & Total Liabilities & Stock Holders' E $1777 $1991 $76 Balinessperates 2020 2021 2022 Be Les Plu Enc Profitability Ratios Gloss Margin Operating Margin EBIT Morgan COMMON SIZE STATEMENT Complete the Common Size BS LOI Bes