Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'm lost. Any help is appreciated. Thank you! Degree of Operating Leverage, Percent Change in Profit Ringsmith Company is considering two different processes to make

I'm lost. Any help is appreciated. Thank you!

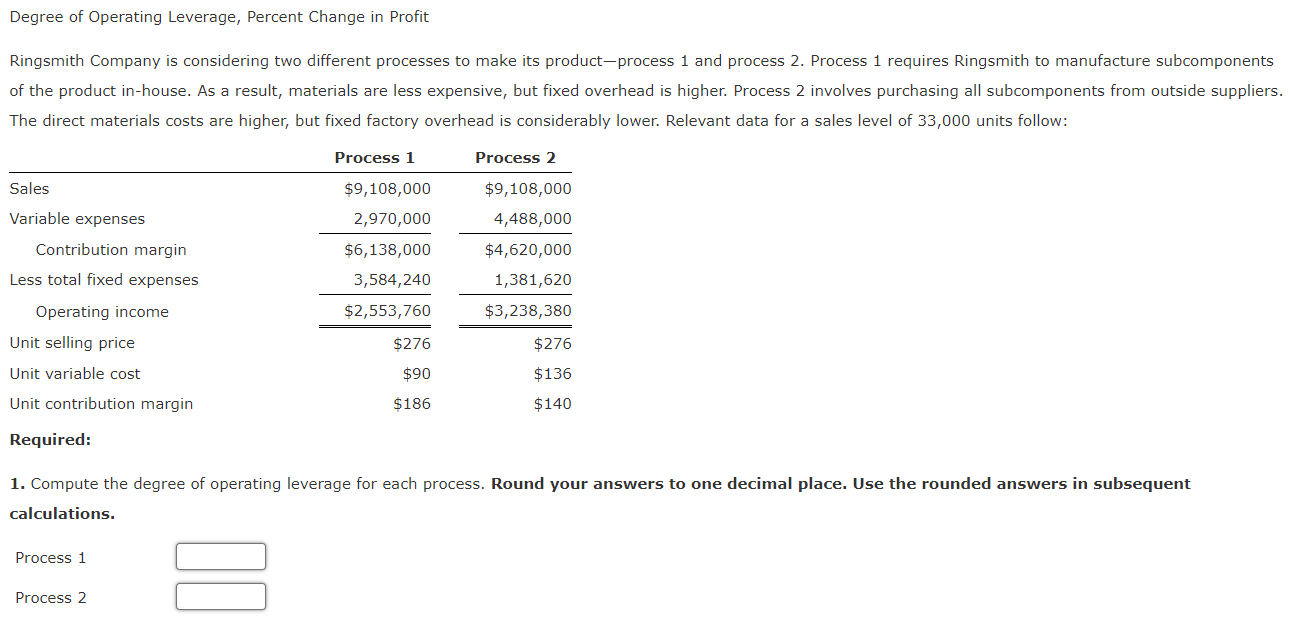

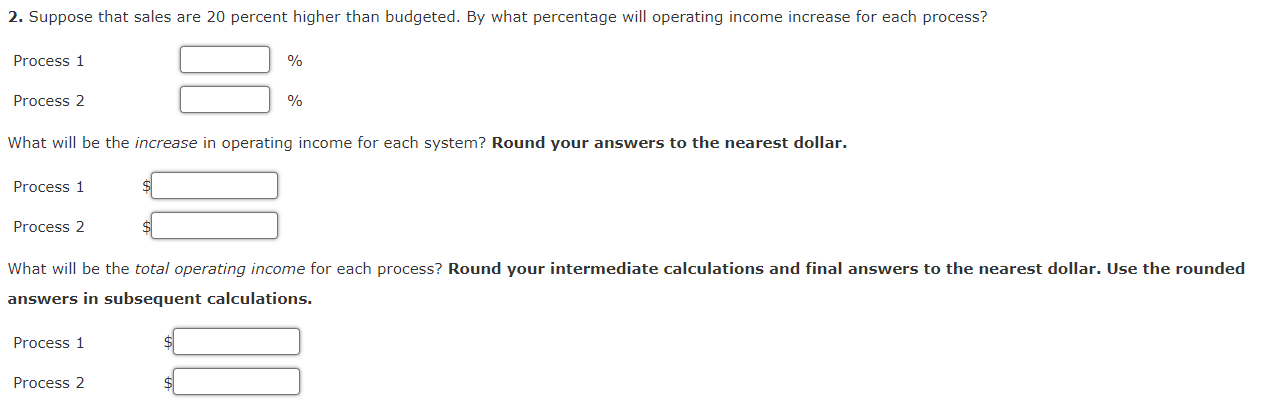

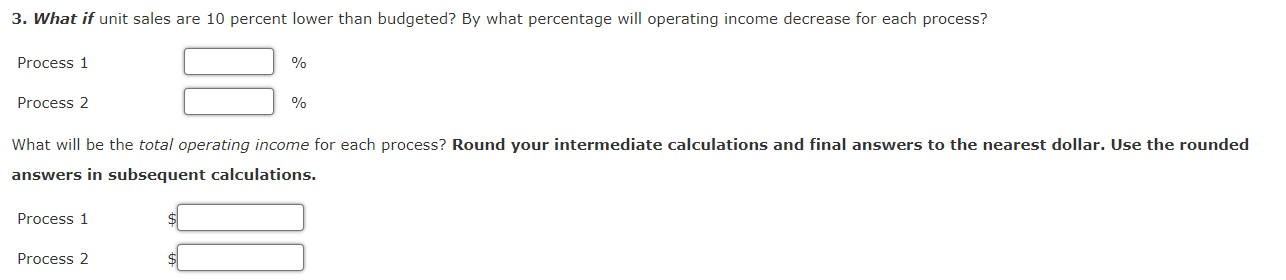

Degree of Operating Leverage, Percent Change in Profit Ringsmith Company is considering two different processes to make its product-process 1 and process 2. Process 1 requires Ringsmith to manufacture subcomponents of the product in-house. As a result, materials are less expensive, but fixed overhead is higher. Process 2 involves purchasing all subcomponents from outside suppliers The direct materials costs are higher, but fixed factory overhead is considerably lower. Relevant data for a sales level of 33,000 units follow: Required: 1. Compute the degree of operating leverage for each process. Round your answers to one decimal place. Use the rounded answers in subsequent calculations. 2. Suppose that sales are 20 percent higher than budgeted. By what percentage will operating income increase for each process? What will be the increase in operating income for each system? Round your answers to the nearest dollar. Process 1 Process 2 What will be the total operating income for each process? Round your intermediate calculations and final answers to the nearest dollar. Use the rounded answers in subsequent calculations. Process 1$ Process2$ 3. What if unit sales are 10 percent lower than budgeted? By what percentage will operating income decrease for each process? What will be the total operating income for each process? Round your intermediate calculations and final answers to the nearest dollar. Use the rounded answers in subsequent calculations. Process 1 Process 2$Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started