Answered step by step

Verified Expert Solution

Question

1 Approved Answer

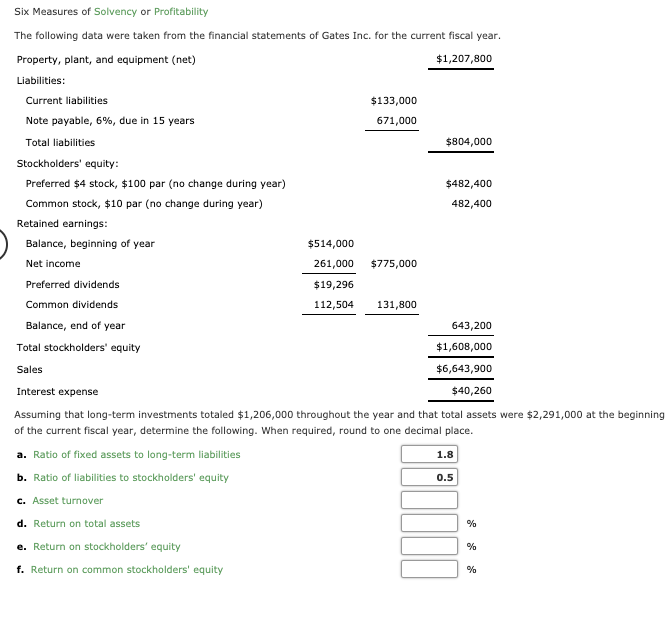

I'm missing parts C - F. Six Measures of Solvency or Profitability The following data were taken from the financial statements of Gates Inc. for

I'm missing parts C - F.

Six Measures of Solvency or Profitability The following data were taken from the financial statements of Gates Inc. for the current fiscal year. $1,207,800 Property, plant, and equipment (net) Liabilities Current liabilities $133,000 671,000 Note payable, 6%, due in 15 years $804,000 Total liabilities Stockholders' equity: Preferred $4 stock, $100 par (no change during year) $482,400 Common stock, $10 par (no change during year) 482,400 Retained earnings: Balance, beginning of year $514,000 261,000 Net income $775,000 Preferred dividends $19,296 Common dividends 112,504 131,800 Balance, end of year 643,200 Total stockholders' equity $1,608,000 $6,643,900 Sales $40,260 Interest expense Assuming that long-term investments totaled $1,206,000 throughout the year and that total assets were $2,291,000 at the beginning of the current fiscal year, determine the following. When required, round to one decimal place. a. Ratio of fixed assets to long-term liabilities 1.8 b. Ratio of liabilities to stockholders' equity 0.5 c. Asset turnover d. Return on total assets e. Return on stockholders' equity f. Return on common stockholders' equity %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started