Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'm new to finance and trying to analyze my assumptions are correct if not can you please provide reasoning for the wrong answers? Brown company

I'm new to finance and trying to analyze my assumptions are correct if not can you please provide reasoning for the wrong answers?

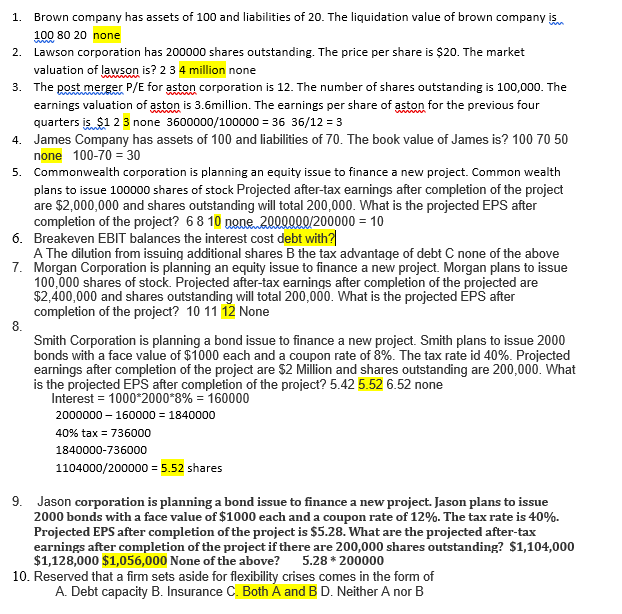

Brown company has assets of 100 and liabilities of 20. The liquidation value of brown company is 1. 100 80 20 none 2. Lawson corporation has 200000 shares outstanding. The price per share is $20. The market valuation of lawson is? 2 3 4 million none The post merger P/E for aston corporation is 12. The number of shares outstanding is 100,000. The 3. earnings valuation of aston is 3.6million. The earnings per share of aston for the previous four quarters is$1 2 3 none 3600000/100000 36 36/12-3 James Company has assets of 100 and liabilities of 70. The book value of James is? 100 70 50 none 100-70 30 Commonwealth corporation is planning an equity issue to finance a new project. Common wealth 4. 5. plans to issue 100000 shares of stock Projected after-tax earnings after completion of the project are $2,000,000 and shares outstanding will total 200,000. What is the projected EPS after completion of the project? 6 8 10 none 2000000/200000 10 6. Breakeven EBIT balances the interest cost debt with? A The dilution from issuing additional shares B the tax advantage of debt C none of the above 7. Morgan Corporation is planning an equity issue to finance a new project. Morgan plans to issue 100,000 shares of stock. Projected after-tax earnings after completion of the projected are $2,400,000 and shares outstanding will total 200,000. What is the projected EPS after completion of the project? 10 11 12 None Smith Corporation is planning a bond issue to finance a new project. Smith plans to issue 2000 bonds with a face value of $1000 each and a coupon rate of 8%. The tax rate id 40%. Projected earnings after completion of the project are $2 Million and shares outstanding are 200,000. What is the projected EPS after completion of the project? 5.42 5.52 6.52 none Interest-1000*2000*8%-160000 2000000 160000 1840000 40% tax = 736000 1840000-736000 1104000/200000 5.52 share:s 9. Jason corporation is planning a bond issue to finance a new project. Jason plans to issue 2000 bonds with a face value of $1000 each and a coupon rate of 12%. The tax rate is 40%. Projected EPS after completion of the project is $5.28. What are the projected after-tax earnings after completion of the project if there are 200,000 shares outstanding? $1,104,000 $1,128,000 $1,056,000 None of the above? 5.28 *200000 10. Reserved that a firm sets aside for flexibility crises comes in the form of A. Debt capacity B. Insurance C. Both A and B D. Neither A nor BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started