Im not sure how to do these problems, if you could label and show the work for each problem, I would greatly appreciate it.

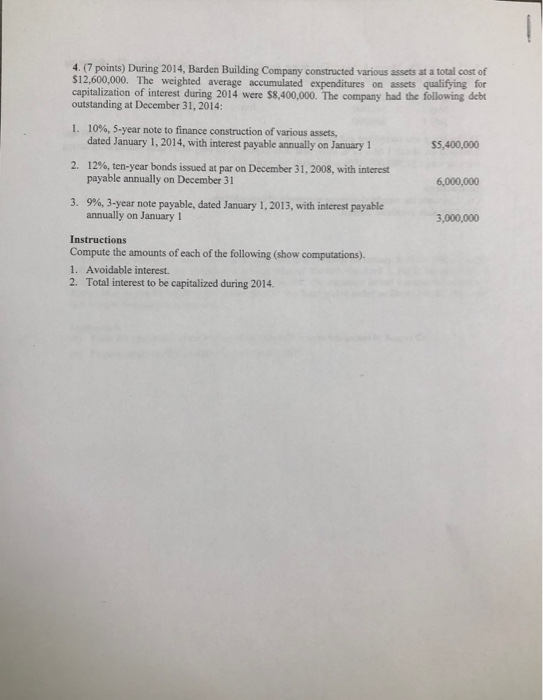

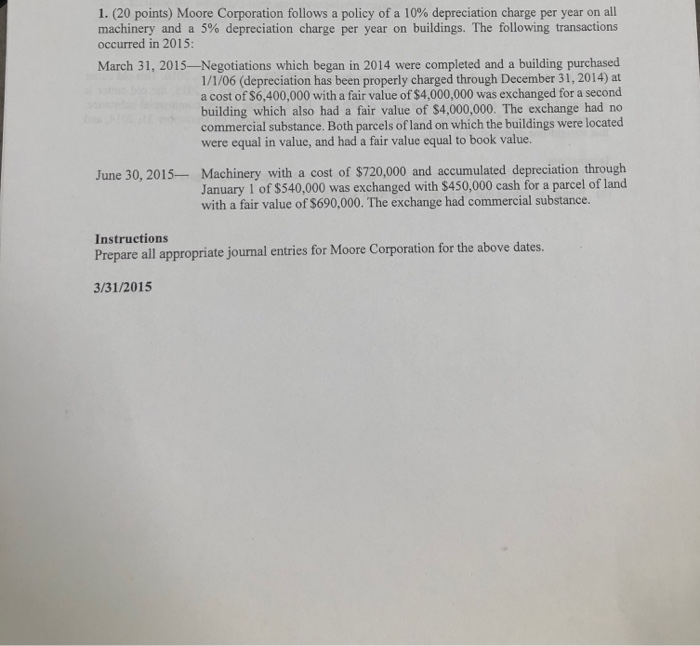

1. (20 points) Moore Corporation follows a policy of a 10% depreciation charge per year on all machinery and a 5% depreciation charge per year on buildings. The following transactions occurred in 2015: March 31, 2015-Negotiations which began in 2014 were completed and a building purchased 1/1/06 (depreciation has been properly charged through December 31, 2014) at a cost of $6,400,000 with a fair value of $4,000,000 was exchanged for a second building which also had a fair value of $4,000,000. The exchange had no commercial substance. Both parcels of land on which the buildings were located were equal in value, and had a fair value equal to book value. June 30, 2015 Machinery with a cost of $720,000 and accumulated depreciation through January 1 of $540,000 was exchanged with $450,000 cash for a parcel of land with a fair value of $690,000. The exchange had commercial substance. Instructions Prepare all appropriate journal entries for Moore Corporation for the above dates. 3/31/2015 6/30/2015 2. (16 points) Rogers Co. had a sheet metal cutter that cost $120,000 on January 5, 2010. This old cutter had an estimated life of ten years and a salvage value of $20,000. On April 3, 2015, the old cutter is exchanged for a new cutter with a fair value of $60,000. The exchange lacked commercial substance. Rogers also received $15,000 cash. Assume that the last fiscal period ended on December 31, 2014, and that straight-line depreciation is used. Instructions (a) Show the calculation of the amount of the gain or loss to be recognized by Rogers Co. (b) Prepare all entries that are necessary on April 3, 2015 3. (7 points) On March 1, Mocl Co. began construction of a small building. The following expenditures were incurred for construction: March 1 $ 225,000 April 1 $ 222,000 May 1 540,000 June 1 810,000 July 1 300,000 The building was completed and occupied on July 1. To help pay for construction $150,000 was borrowed on March 1 on a 12%, three-year note payable. The only other debt outstanding during the year was a $1,500,000, 10% note issued two years ago. Instructions (a) Calculate the weighted-average accumulated expenditures. (b) Calculate avoidable interest. 4. (7 points) During 2014, Barden Building Company constructed various assets at a total cost of $12,600,000. The weighted average accumulated expenditures on assets qualifying for capitalization of interest during 2014 were $8,400,000. The company had the following debt outstanding at December 31, 2014: 1. 10%, 5-year note to finance construction of various assets, dated January 1, 2014, with interest payable annually on January 1 $5,400,000 2. 12%, ten-year bonds issued at par on December 31, 2008, with interest payable annually on December 31 6,000,000 3. 9%, 3-year note payable, dated January 1, 2013, with interest payable annually on January 1 3,000,000 Instructions Compute the amounts of each of the following (show computations). 1. Avoidable interest. 2. Total interest to be capitalized during 2014 1. (20 points) Moore Corporation follows a policy of a 10% depreciation charge per year on all machinery and a 5% depreciation charge per year on buildings. The following transactions occurred in 2015: March 31, 2015-Negotiations which began in 2014 were completed and a building purchased 1/1/06 (depreciation has been properly charged through December 31, 2014) at a cost of $6,400,000 with a fair value of $4,000,000 was exchanged for a second building which also had a fair value of $4,000,000. The exchange had no commercial substance. Both parcels of land on which the buildings were located were equal in value, and had a fair value equal to book value. June 30, 2015 Machinery with a cost of $720,000 and accumulated depreciation through January 1 of $540,000 was exchanged with $450,000 cash for a parcel of land with a fair value of $690,000. The exchange had commercial substance. Instructions Prepare all appropriate journal entries for Moore Corporation for the above dates. 3/31/2015 6/30/2015 2. (16 points) Rogers Co. had a sheet metal cutter that cost $120,000 on January 5, 2010. This old cutter had an estimated life of ten years and a salvage value of $20,000. On April 3, 2015, the old cutter is exchanged for a new cutter with a fair value of $60,000. The exchange lacked commercial substance. Rogers also received $15,000 cash. Assume that the last fiscal period ended on December 31, 2014, and that straight-line depreciation is used. Instructions (a) Show the calculation of the amount of the gain or loss to be recognized by Rogers Co. (b) Prepare all entries that are necessary on April 3, 2015 3. (7 points) On March 1, Mocl Co. began construction of a small building. The following expenditures were incurred for construction: March 1 $ 225,000 April 1 $ 222,000 May 1 540,000 June 1 810,000 July 1 300,000 The building was completed and occupied on July 1. To help pay for construction $150,000 was borrowed on March 1 on a 12%, three-year note payable. The only other debt outstanding during the year was a $1,500,000, 10% note issued two years ago. Instructions (a) Calculate the weighted-average accumulated expenditures. (b) Calculate avoidable interest. 4. (7 points) During 2014, Barden Building Company constructed various assets at a total cost of $12,600,000. The weighted average accumulated expenditures on assets qualifying for capitalization of interest during 2014 were $8,400,000. The company had the following debt outstanding at December 31, 2014: 1. 10%, 5-year note to finance construction of various assets, dated January 1, 2014, with interest payable annually on January 1 $5,400,000 2. 12%, ten-year bonds issued at par on December 31, 2008, with interest payable annually on December 31 6,000,000 3. 9%, 3-year note payable, dated January 1, 2013, with interest payable annually on January 1 3,000,000 Instructions Compute the amounts of each of the following (show computations). 1. Avoidable interest. 2. Total interest to be capitalized during 2014