Question

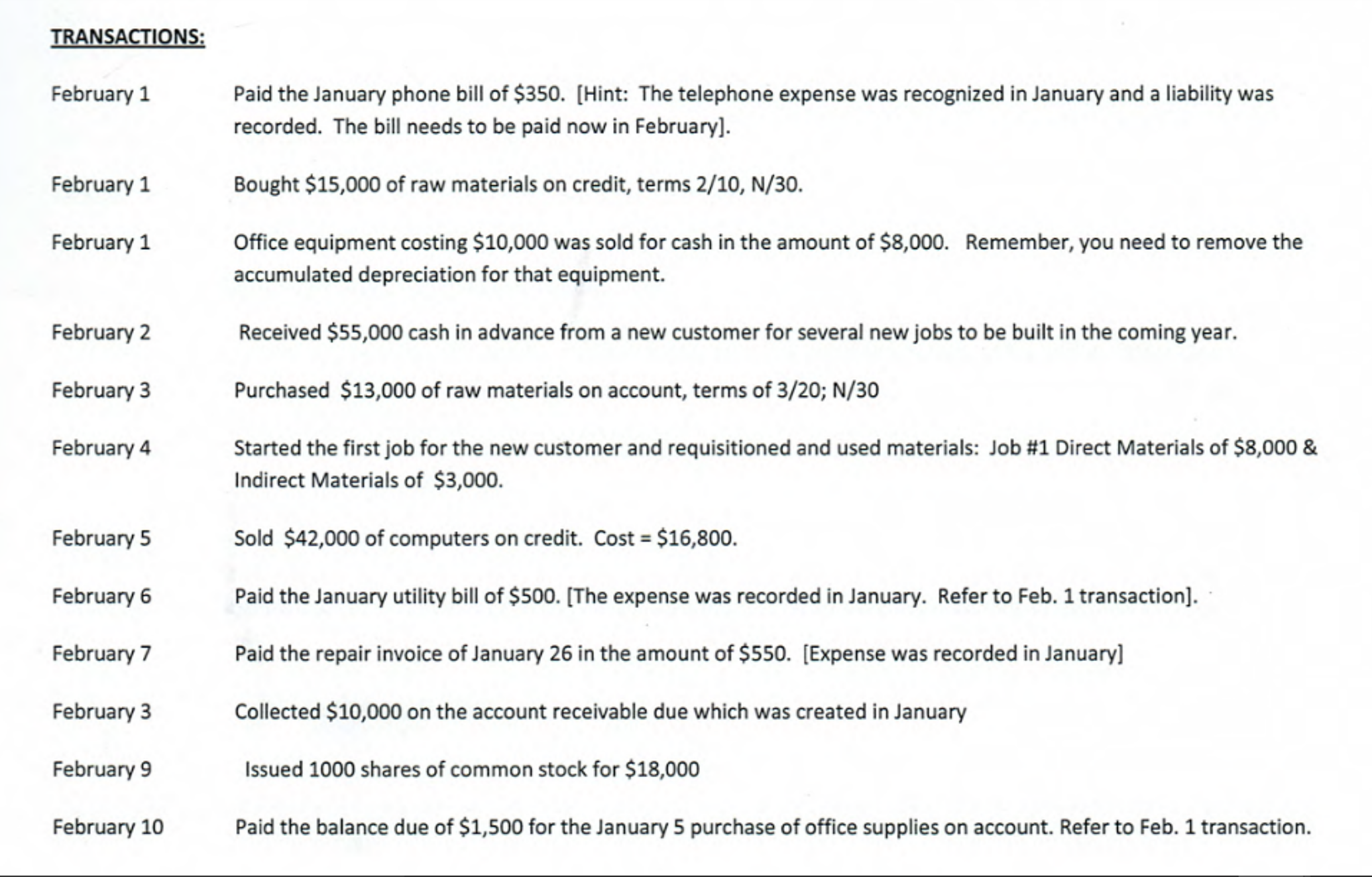

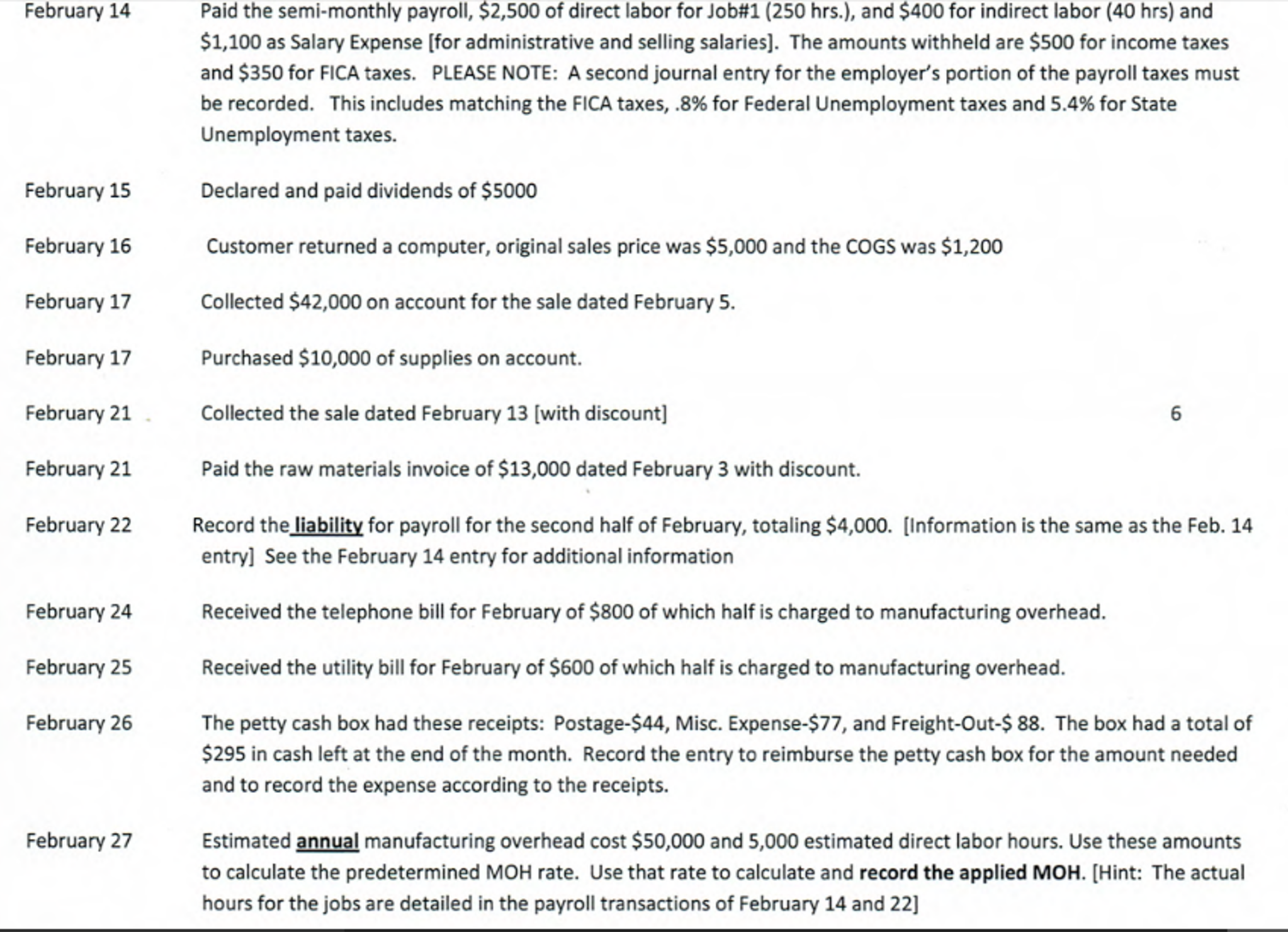

I'm not sure how to record some of the transactions into a general journal. I need help with the february 21st dates, february 22, february

I'm not sure how to record some of the transactions into a general journal. I need help with the february 21st dates, february 22, february 24, february 25, february 26, february 27th dates, and february 28. I have everything else for the general transactions.

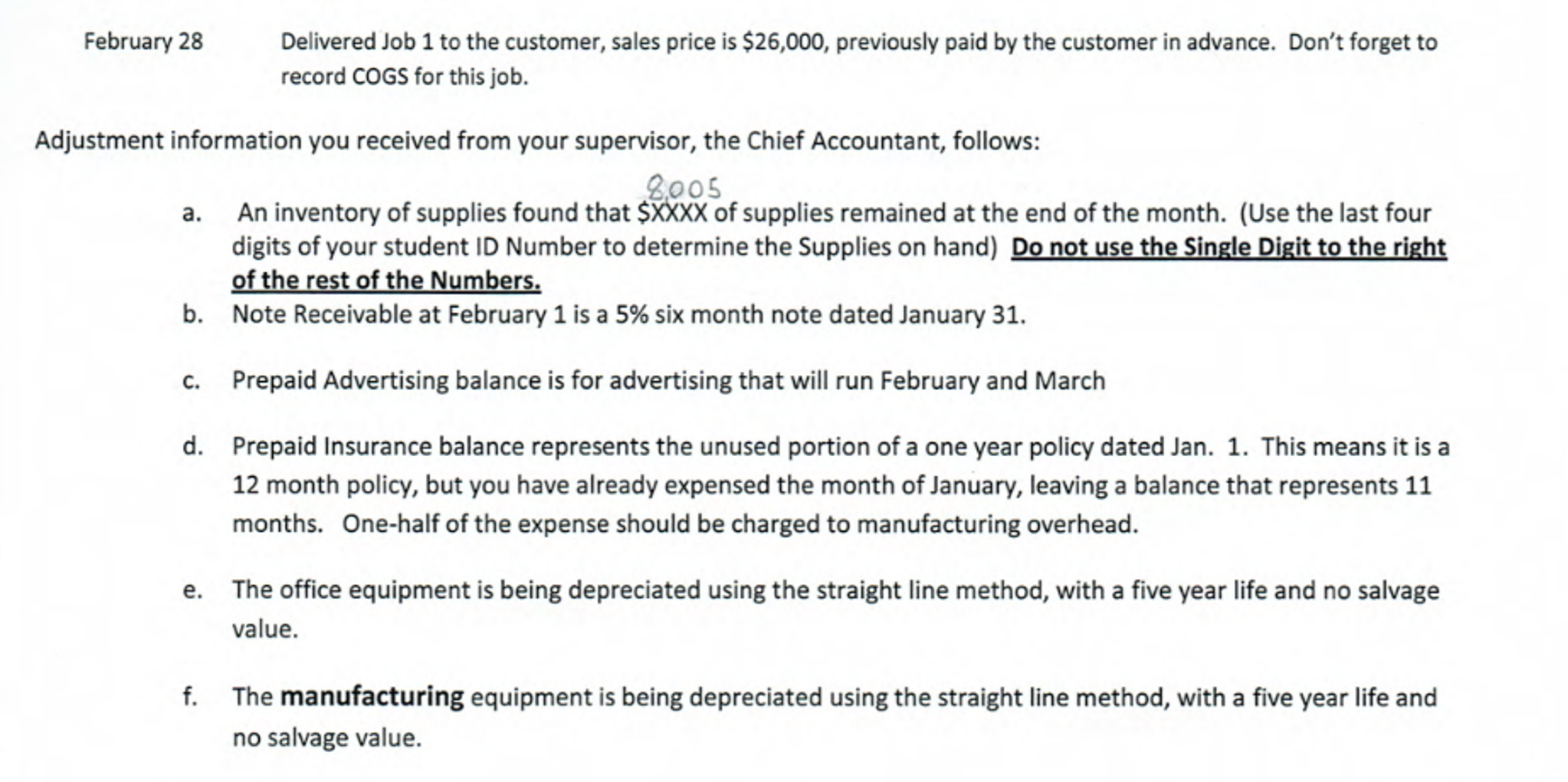

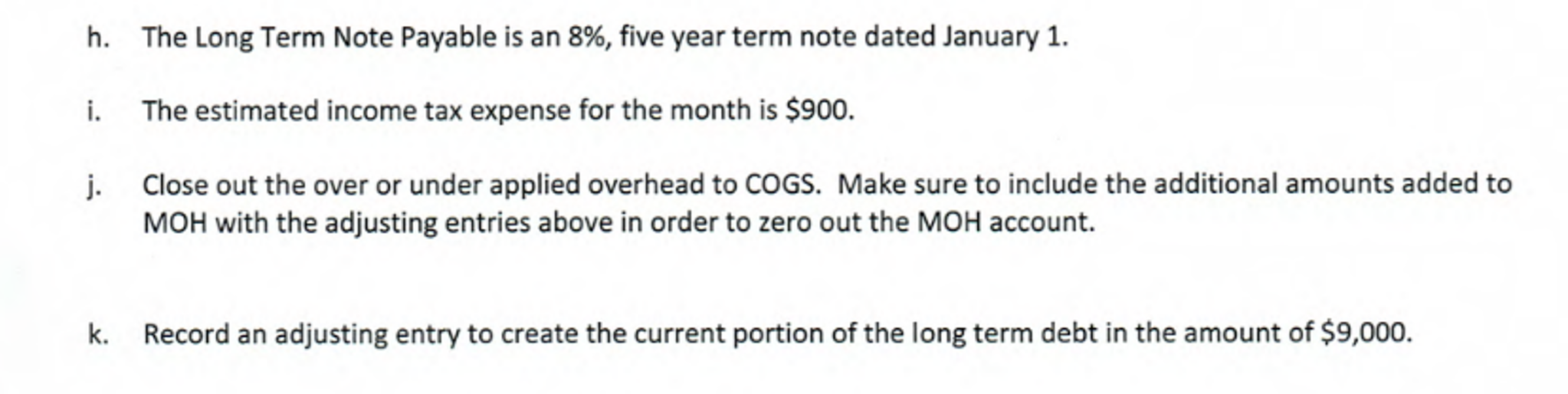

I also do not understand how the adjustment transactions (a through k) should be recorded in a general journal. Your help will be greatly appreciated.

Regarding the second february 1 transaction (I'm not sure of its relevance):

The term 2/10, n/30 is a typical credit term and means the following:

"2" shows the discount percentage offered by the seller.

"10" indicates the number of days (from the invoice date) within which the buyer should pay the invoice in order to receive the discount.

"n/30" states that if the buyer does not pay the (full) invoice amount within the 10 days to qualify for the discount, then the net amount is due within 30 days after the sales invoice date.

The terms offered by the seller usually depend on the trade custom. Some variations of the cash discount terms, among others, may be "2/15, n/30" (2% discount for the payment within 15 days and the full amount to be paid within 30 days) or "n/10 EOM" (the invoice is due and payable 10 days after the end of the month in which the sale occurred

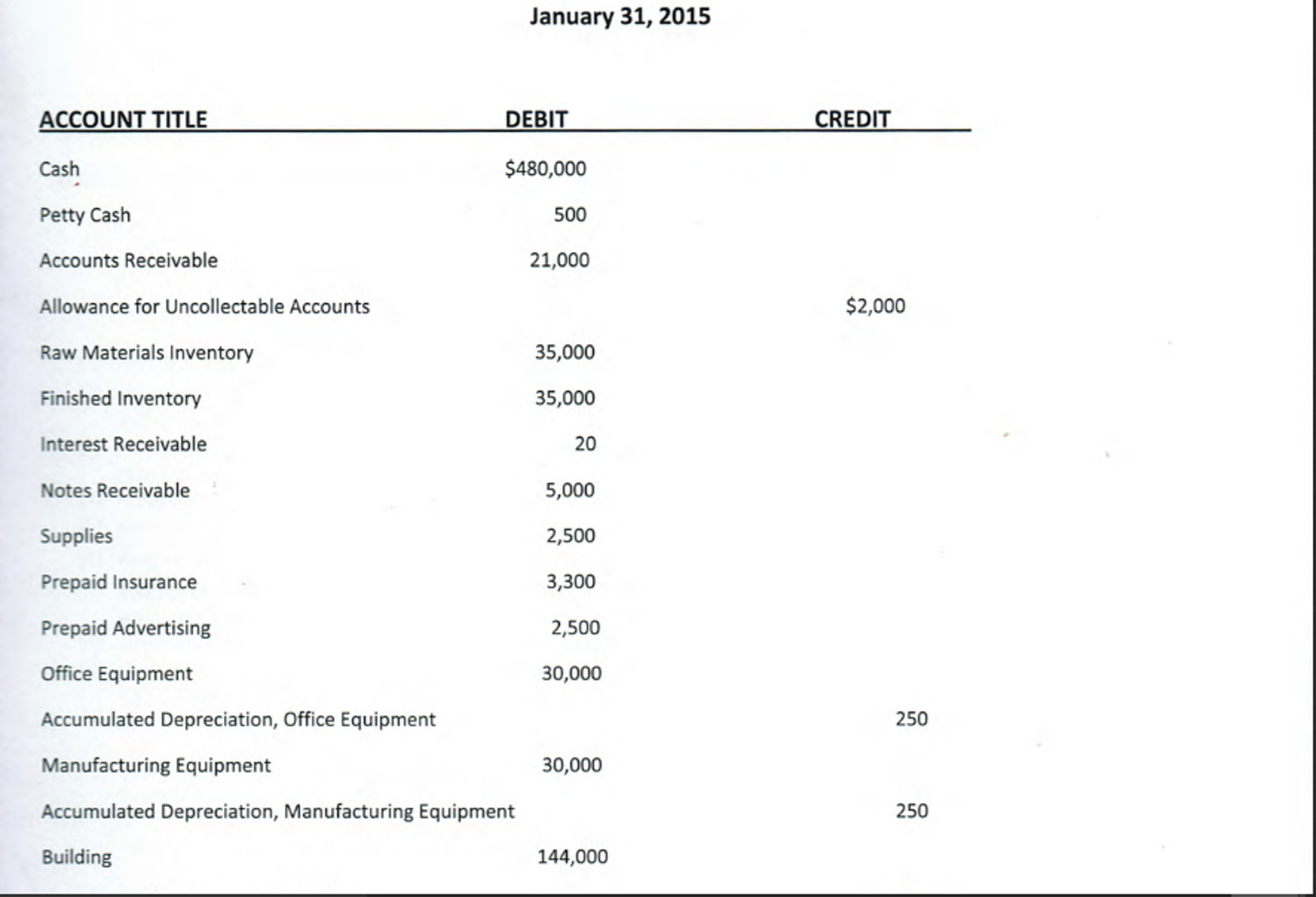

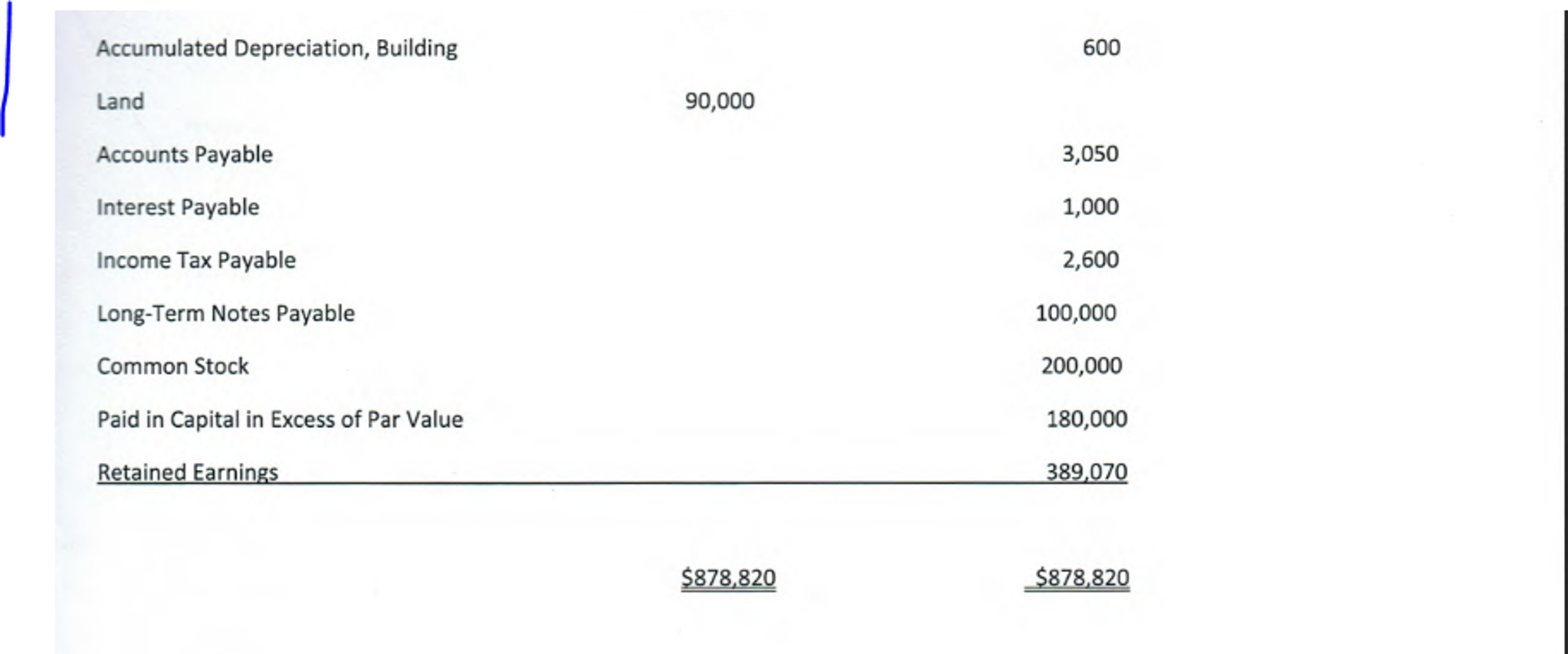

?Here is the trial balance.............................................................................................................

?Here is the trial balance.............................................................................................................

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started