Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Im not sure if Ive done this correctly. Can you check and explain if possible how you got each solution Challenge Exercise 3 Expands on:

Im not sure if Ive done this correctly. Can you check and explain if possible how you got each solution

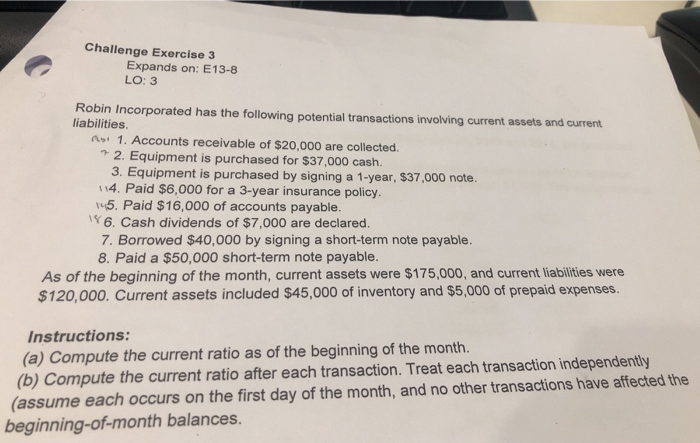

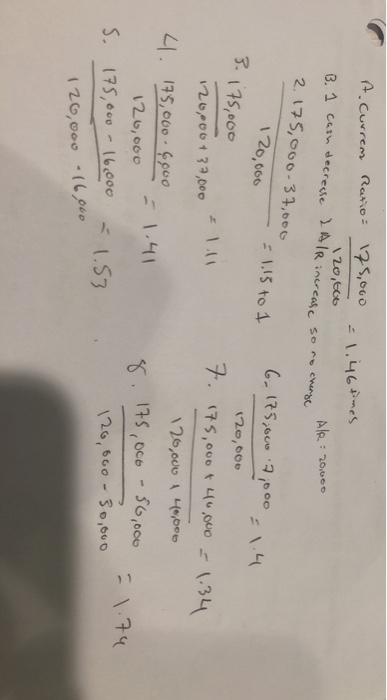

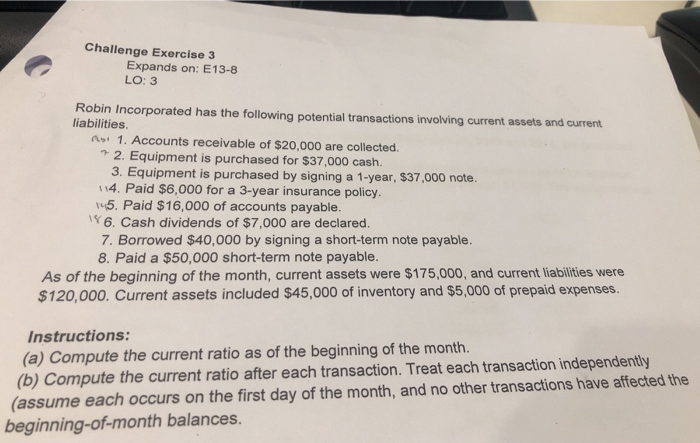

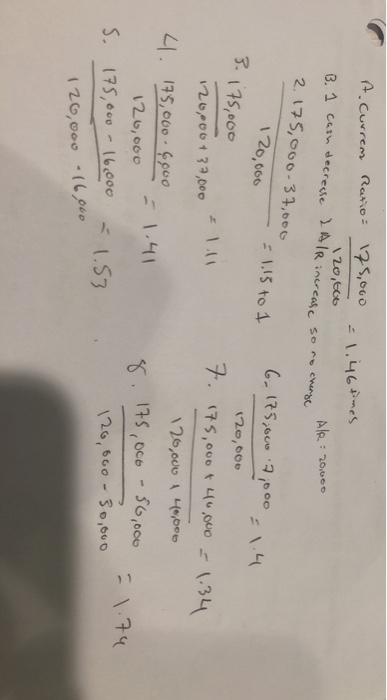

Challenge Exercise 3 Expands on: E13-8 LO: 3 Robin Incorporated has the following potential transactions involving current assets and current liabilitiess 1. Accounts receivable of $20,000 are collected 2. Equipment is purchased for $37,000 cash. 3. Equipment is purchased by signing a 1-year, $37,000 note. 4. Paid $6,000 for a 3-year insurance policy. 5. Paid $16,000 of accounts payable. 6. Cash dividends of $7,000 are declared. 7. Borrowed $40,000 by signing a short-term note payable. 8. Paid a $50,000 short-term note payable. As of the beginning of the month, current assets were $175,000, and current liabilities were $120,000. Current assets included $45,000 of inventory and $5,000 of prepaid expenses. Instructions: (a) Compute the current ratio as of the beginning of the month. (b) Compute the current ratio after each transaction. Treat each transaction independently (assume each occurs on the first day of the month, and no other transactions have affected the beginning-of-month balances. Soco . I r, .kq6mes 20, eco B 1 cun decrease ) A/R increase sess cwac 2. IFS,ooo-31,000 20,000 4. -Sees-poo l-M 175 , oco | fe,ooo , \.at

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started