im not sure if what i have is correct

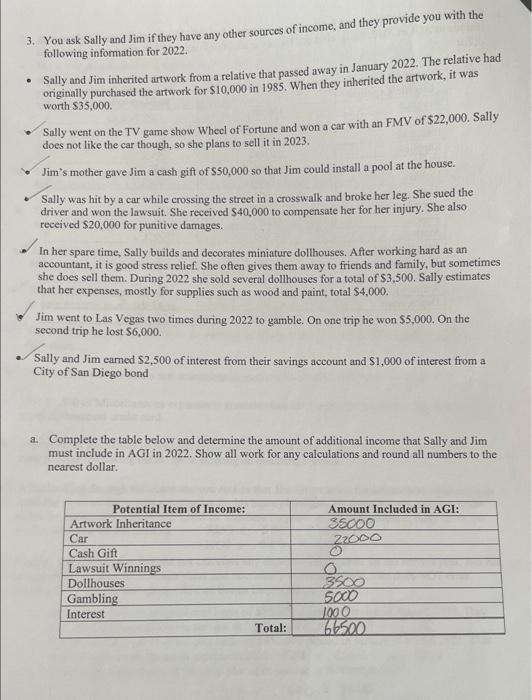

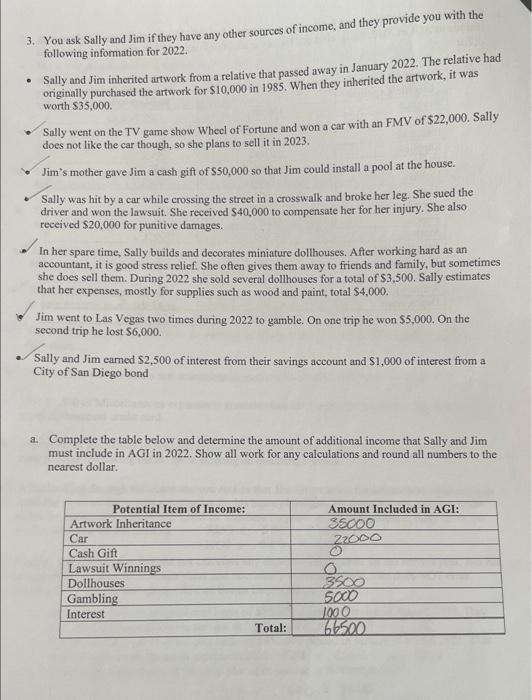

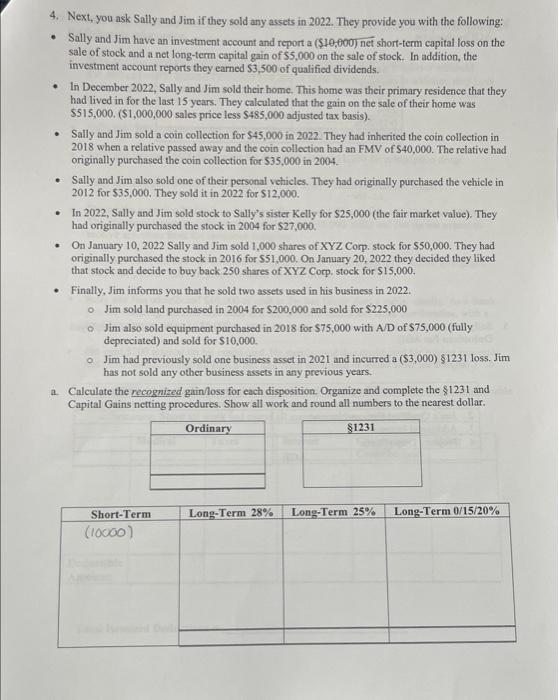

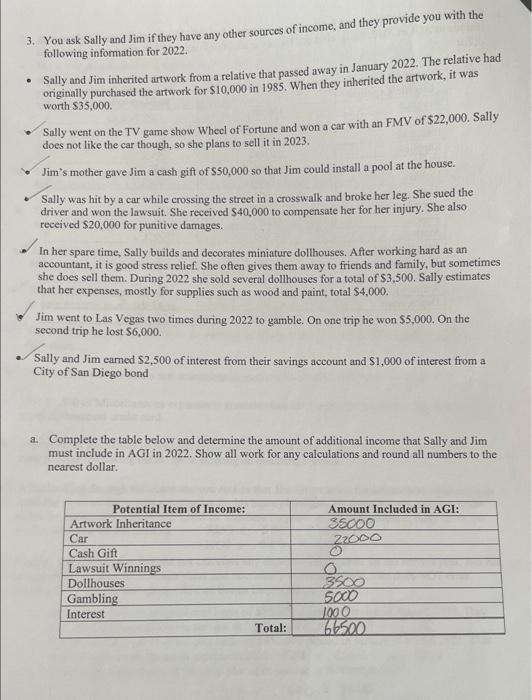

3. You ask Sally and Jim if they have any other sources of income, and they provide you with the following information for 2022 . - Sally and Jim inherited artwork from a relative that passed away in January 2022. The relative had originally purchased the artwork for $10,000 in 1985 . When they inherited the artwork, it was worth 535,000 . - Sally went on the TV game show Wheel of Fortune and won a car with an FMV of $22,000. Sally does not like the car though, so she plans to sell it in 2023. - Jim's mother gave Jim a cash gift of $50,000 so that Jim could install a pool at the house. - Sally was hit by a car while crossing the street in a crosswalk and broke her leg. She sued the driver and won the lawsuit. She received $40,000 to compensate her for her injury. She also received $20,000 for punitive damages. In her spare time, Sally builds and decorates miniature dollhouses. After working hard as an accountant, it is good stress relief. She often gives them away to friends and family, but sometimes she does sell them. During 2022 she sold several dollhouses for a total of $3,500. Sally estimates that her expenses, mostly for supplies such as wood and paint, total $4,000. Jim went to Las Vegas two times during 2022 to gamble. On one trip he won $5,000. On the second trip he lost $6,000. Sally and Jim eamed $2,500 of interest from their savings account and $1,000 of interest from a City of San Diego bond a. Complete the table below and determine the amount of additional income that Sally and Jim must include in AGI in 2022. Show all work for any calculations and round all numbers to the nearest dollar. 4. Next, you ask Sally and Jim if they sold any assets in 2022 . They provide you with the following: - Sally and Jim have an investment account and report a (\$10,000) net short-term capital loss on the sale of stock and a net long-term capital gain of $5,000 on the sale of stock. In addition, the investment account reports they earned 53,500 of qualified dividends. - In December 2022, Sally and Jim sold their home. This home was their primary residence that they had lived in for the last 15 years. They calculated that the gain on the sale of their home was $515,000. ( $1,000,000 sales price less $485,000 adjusted tax basis). - Sally and Jim sold a coin collection for 545,000 in 2022 . They had inherited the coin collection in 2018 when a relative passed away and the coin collection had an FMV of $40,000. The relative had originally purchased the coin collection for 535,000 in 2004 . - Sally and Jim also sold one of their personal vehicles. They had originally purchased the vehicle in 2012 for $35,000. They sold it in 2022 for $12,000. - In 2022, Sally and Jim sold stock to Sally's sister Kelly for $25,000 (the fair market value). They had originally purchased the stock in 2004 for $27,000, - On January 10, 2022 Sally and Jim sold 1,000 shares of XYZ Corp. stock for $50,000. They had originally purchased the stock in 2016 for 551,000 . On January 20,2022 they decided they liked that stock and decide to buy back 250 shares of XYZ Corp. stock for $15,000, - Finally, Jim informs you that he sold two assets used in his business in 2022. - Jim sold land purchased in 2004 for $200,000 and sold for $225,000 - Jim also sold equipment purchased in 2018 for $75,000 with A/D of $75,000 (fully depreciated) and sold for $10,000. o. Jim had previously sold one business asset in 2021 and ineurred a ($3,000)$1231 loss. Jim has not sold any other business assets in any previous years. a. Calculate the recognized gain/loss for each disposition. Organize and complete the $1231 and Capital Gains netting procedures. Show all work and round all numbers to the nearest dollar