Answered step by step

Verified Expert Solution

Question

1 Approved Answer

im not sure what number to use for the equal payment amount or how it is supposed to be set up if you could do

im not sure what number to use for the equal payment amount or how it is supposed to be set up if you could do one so i have an example to go off that would be great

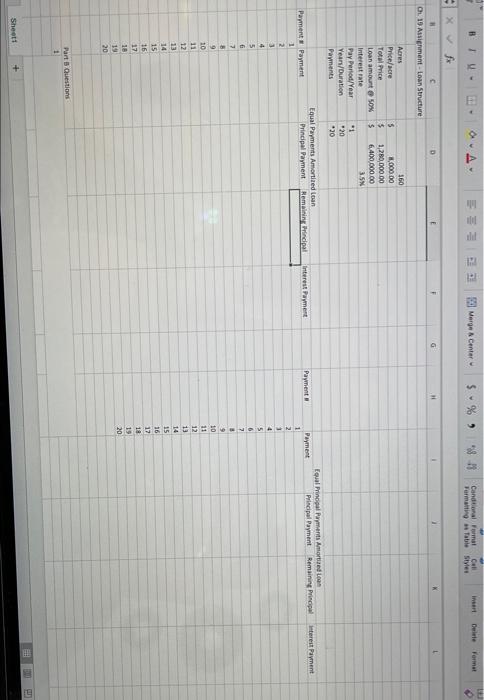

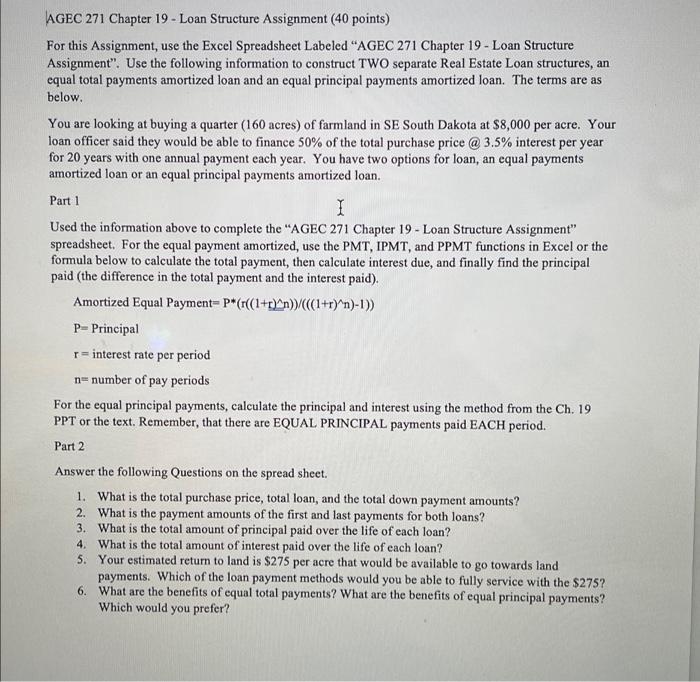

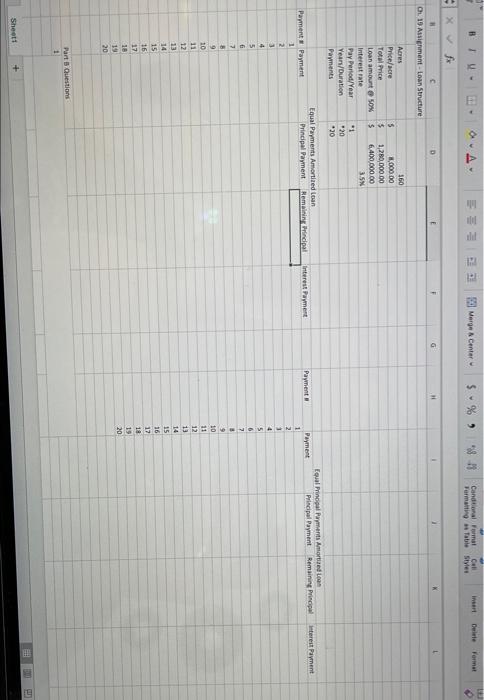

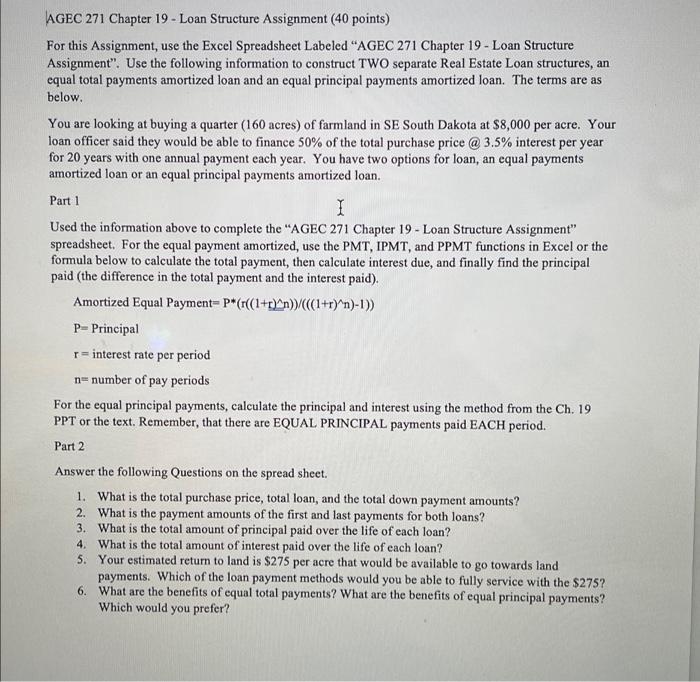

1 2 BTW- A ES a 3 Merge Center Delete Format Cantonal Formal Call Formatting Table Styles Xf D CL. 19 Assignment - Loan Structure 5 $ $ Acres Price/ure Total Price Loan amount 50% Interest rate Pay Period/Year Years/Duration Payments 160 3,000.00 1,200,000.00 6,400,000.00 3.5N * 20 *20 Equal Payment Amortized loan Principal Payment Reminicipal Interest Payment Equal Principal Payments Amore Le Principal Payment Remaining Principal Interest Payment Payment Payment 2 1 4 5 6 7 Payment Payment 1 2 3 4 5 6 7 5 9 10 11 12 13 14 15 16 17 18 19 20 BERSAR 3 9 10 11 12 13 14 15 16 17 18 19 20 Part Questions 1 BU Sheet1 - AGEC 271 Chapter 19 - Loan Structure Assignment (40 points) For this Assignment, use the Excel Spreadsheet Labeled "AGEC 271 Chapter 19 - Loan Structure Assignment". Use the following information to construct TWO separate Real Estate Loan structures, an equal total payments amortized loan and an equal principal payments amortized loan. The terms are as below. You are looking at buying a quarter (160 acres) of farmland in SE South Dakota at $8,000 per acre. Your loan officer said they would be able to finance 50% of the total purchase price @3.5% interest per year for 20 years with one annual payment each year. You have two options for loan, an equal payments amortized loan or an equal principal payments amortized loan. Part 1 I Used the information above to complete the "AGEC 271 Chapter 19 - Loan Structure Assignment" spreadsheet. For the equal payment amortized, use the PMT, IPMT, and PPMT functions in Excel or the formula below to calculate the total payment, then calculate interest due, and finally find the principal paid (the difference in the total payment and the interest paid). Amortized Equal Payment-P*(r((1+r)/(1+r)^n)-1)) P-Principal r=interest rate per period n=number of pay periods For the equal principal payments, calculate the principal and interest using the method from the Ch. 19 PPT or the text. Remember, that there are EQUAL PRINCIPAL payments paid EACH period. Part 2 Answer the following Questions on the spread sheet. 1. What is the total purchase price, total loan, and the total down payment amounts? 2. What is the payment amounts of the first and last payments for both loans? 3. What is the total amount of principal paid over the life of each loan? 4. What is the total amount of interest paid over the life of each loan? 5. Your estimated return to land is $275 per acre that would be available to go towards land payments. Which of the loan payment methods would you be able to fully service with the $275? 6. What are the benefits of equal total payments? What are the benefits of equal principal payments? Which would you prefer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started