Answered step by step

Verified Expert Solution

Question

1 Approved Answer

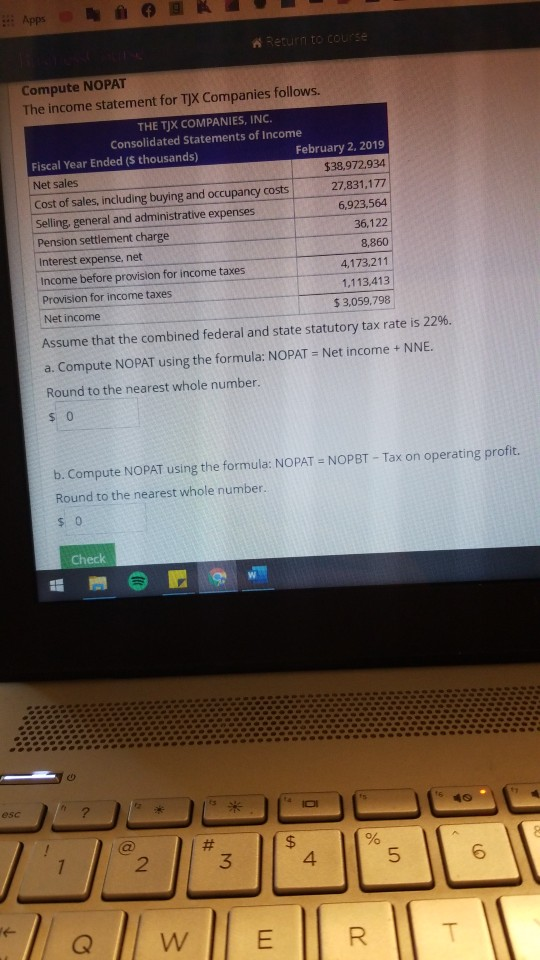

I'm not sure what to include in NNE. Thank you! Apps Return to course Compute NOPAT The income statement for TJX Companies follows. THE TJX

I'm not sure what to include in NNE. Thank you!

Apps Return to course Compute NOPAT The income statement for TJX Companies follows. THE TJX COMPANIES, INC. Consolidated Statements of income Fiscal Year Ended (5 thousands) February 2, 2019 Net sales $38.972.934 Cost of sales, including buying and occupancy costs 27,831,177 Selling general and administrative expenses 6,923,564 Pension settlement charge 36,122 Interest expense, net 8,860 Income before provision for income taxes 4,173.211 Provision for income taxes 1,113,413 Net income $3,059,798 Assume that the combined federal and state statutory tax rate is 22%. a. Compute NOPAT using the formula: NOPAT = Net income + NNE. Round to the nearest whole number. $ 0 b. Compute NOPAT using the formula: NOPAT = NOPBT - Tax on operating profit. Round to the nearest whole number. $ 0 Check S ? # % $ 4 5 3 6 2. 7 I E W R. T TStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started