Answered step by step

Verified Expert Solution

Question

1 Approved Answer

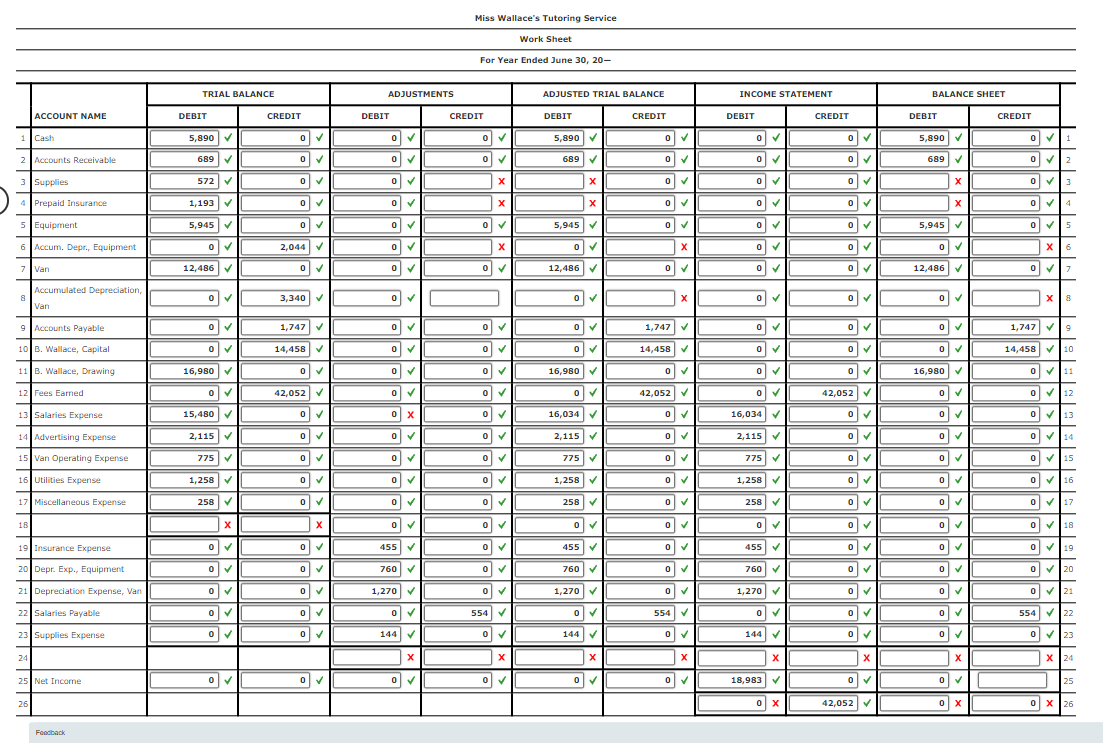

I'm not sure where I'm going wrong here (see red x's) The account balances of Miss Wallace's Tutoring Service as of June 30, the end

I'm not sure where I'm going wrong here (see red x's)

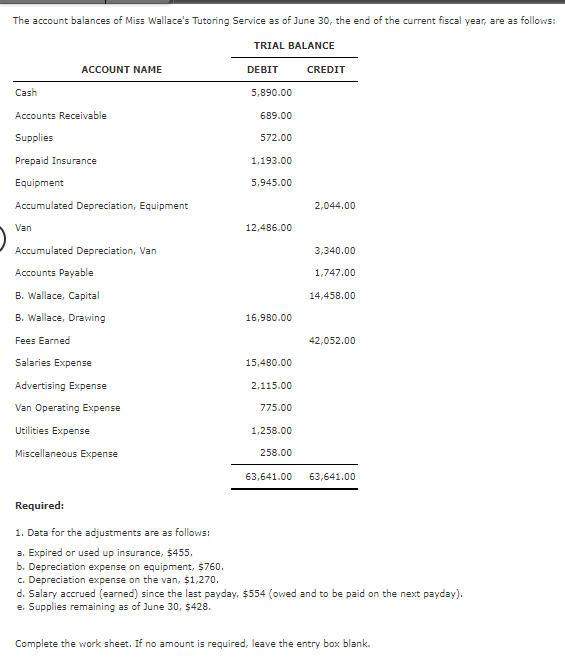

The account balances of Miss Wallace's Tutoring Service as of June 30, the end of the current fiscal year, are as follows: TRTAI RAI ANC.F Required: 1. Data for the adjustments are as follows: a. Expired or used up insurance, $455. b. Depreciation expense on equipment, $760. c. Depreciation expense on the van, $1,270. d. Salary accrued (earned) since the last payday, $554 (owed and to be paid on the next payday). e. Supplies remaining as of June 30,$428. Complete the work sheet. If no amount is required, leave the entry box blank. Miss Wallace's Tutoring Service Work Sheet For Year Ended June 30, 20- \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline & \multirow[b]{2}{*}{ ACCOUNT NAME } & \multicolumn{4}{|c|}{ TRIAL BALANCE } & \multicolumn{4}{|c|}{ ADJUSTMENTS } & \multicolumn{4}{|c|}{ ADJUSTED TRIAL BALANCE } & \multicolumn{4}{|c|}{ INCOME STATEMENT } & \multicolumn{4}{|c|}{ BALANCE SHEET } & \\ \hline & & DEBIT & & CREDIT & & DEBIT & & CREDIT & & DEBIT & & CREDIT & & DEBIT & & CREDIT & & DEBIT & & CREDIT & & \\ \hline 1 & Cash & 5,890 & & 0 & & 0 & & 0 & & 5,890 & & 0 & & 0 & & 0 & & 5,890 & & 0 & & 1 \\ \hline 2 & Accounts Receivable & 689 & & 0 & & 0 & & 0 & & 689 & & 0 & & 0 & & 0 & ] & 689 & & 0 & & 2 \\ \hline 3 & Supplies & 572 & & 0 & & 0 & & & x & & x & 0 & & 0 & & 0 & V & & x & 0 & & 3 \\ \hline 4 & Prepaid Insurance & 1,193 & & 0 & & 0 & & & x & & x & 0 & & 0 & & 0 & V & & x & 0 & & 4 \\ \hline 5 & Equipment & 5,945 & & 0 & & 0 & & 0 & & 5,945 & & 0 & & 0 & & 0 & ] & 5,945 & & 0 & & 5 \\ \hline 6 & Accum. Depr., Equipment & 0 & & 2,044 & & 0 & & & x & 0 & & & x & 0 & & 0 & & 0 & & & x & 6 \\ \hline 7 & Van & 12,486 & & 0 & & 0 & & 0 & & 12,486 & & 0 & & 0 & & 0 & & 12,486 & & 0 & & 7 \\ \hline 8 & \begin{tabular}{l} Accumulated Depreciation, \\ Van \end{tabular} & 0 & & 3,340 & & 0 & & & & 0 & & & x & 0 & & 0 & & 0 & & & x & 8 \\ \hline 9 & Accounts Payable & 0 & & 1,747 & & 0 & & 0 & & 0 & & 1,747 & & 0 & & 0 & ] & 0 & & 1,747 & & 9 \\ \hline 10 & B. Wallace, Capital & 0 & & 14,458 & & 0 & & 0 & & 0 & & 14,458 & & 0 & & 0 & ] & 0 & & 14,458 & & 10 \\ \hline 11 & B. Wallace, Drawing & 16,980 & & 0 & & 0 & & 0 & & 16,980 & & 0 & & 0 & & 0 & & 16,980 & & 0 & & 11 \\ \hline 12 & Fees Eamed & 0 & & 42,052 & & 0 & & 0 & & 0 & & 42,052 & & 0 & & 42,052 & & 0 & & 0 & & 12 \\ \hline 13 & Salaries Expense & 15,480 & & 0 & & 0 & x & 0 & & 16,034 & & 0 & & 16,034 & & 0 & ] & 0 & & 0 & & 13 \\ \hline 14 & Advertising Expense & 2,115 & & 0 & & 0 & & 0 & & 2,115 & & 0 & & 2,115 & & 0 & ] & 0 & & 0 & & 14 \\ \hline 15 & Van Operating Expense & 775 & & 0 & & 0 & & 0 & & 775 & & 0 & & 775 & & 0 & & 0 & & 0 & & 15 \\ \hline 16 & Utilities Expense & 1,258 & & 0 & & 0 & & 0 & & 1,258 & & 0 & & 1,258 & & 0 & v & 0 & & 0 & & 16 \\ \hline 17 & Miscellaneous Expense & 258 & & 0 & & 0 & & 0 & & 258 & & 0 & & 258 & & 0 & & 0 & & 0 & & 17 \\ \hline 18 & & & x & & x & 0 & & 0 & & 0 & & 0 & & 0 & & 0 & & 0 & & 0 & & 18 \\ \hline 19 & Insurance Expense & 0 & & 0 & & 455 & & 0 & & 455 & & 0 & & 455 & & 0 & & 0 & & 0 & & 19 \\ \hline 20 & Depr. Exp., Equipment & 0 & & 0 & & 760 & & 0 & & 760 & & 0 & & 760 & & 0 & & 0 & & 0 & & 20 \\ \hline 21 & Depreciation Expense, Van & 0 & & 0 & & 1,270 & & 0 & & 1,270 & & 0 & & 1,270 & & 0 & ] & 0 & & 0 & & 21 \\ \hline 22 & Salaries Payable & 0 & & 0 & & 0 & & 554 & & 0 & & 554 & & 0 & & 0 & & 0 & & 554 & & 22 \\ \hline 23 & Supplies Expense & 0 & & 0 & & 144 & & 0 & & 144 & & 0 & & 144 & & 0 & ] & 0 & & 0 & & 23 \\ \hline 24 & & & & & & & x & & x & & x & & x & & x & & x & & x & & x & 24 \\ \hline 25 & Net Income & 0 & & 0 & & 0 & & 0 & & 0 & & 0 & & 18,983 & & 0 & & 0 & & & & 25 \\ \hline 26 & & & & & & & & & & & & & & 0 & x & 42,052 & v & 0 & x & 0 & x & 26 \\ \hline \end{tabular}

The account balances of Miss Wallace's Tutoring Service as of June 30, the end of the current fiscal year, are as follows: TRTAI RAI ANC.F Required: 1. Data for the adjustments are as follows: a. Expired or used up insurance, $455. b. Depreciation expense on equipment, $760. c. Depreciation expense on the van, $1,270. d. Salary accrued (earned) since the last payday, $554 (owed and to be paid on the next payday). e. Supplies remaining as of June 30,$428. Complete the work sheet. If no amount is required, leave the entry box blank. Miss Wallace's Tutoring Service Work Sheet For Year Ended June 30, 20- \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline & \multirow[b]{2}{*}{ ACCOUNT NAME } & \multicolumn{4}{|c|}{ TRIAL BALANCE } & \multicolumn{4}{|c|}{ ADJUSTMENTS } & \multicolumn{4}{|c|}{ ADJUSTED TRIAL BALANCE } & \multicolumn{4}{|c|}{ INCOME STATEMENT } & \multicolumn{4}{|c|}{ BALANCE SHEET } & \\ \hline & & DEBIT & & CREDIT & & DEBIT & & CREDIT & & DEBIT & & CREDIT & & DEBIT & & CREDIT & & DEBIT & & CREDIT & & \\ \hline 1 & Cash & 5,890 & & 0 & & 0 & & 0 & & 5,890 & & 0 & & 0 & & 0 & & 5,890 & & 0 & & 1 \\ \hline 2 & Accounts Receivable & 689 & & 0 & & 0 & & 0 & & 689 & & 0 & & 0 & & 0 & ] & 689 & & 0 & & 2 \\ \hline 3 & Supplies & 572 & & 0 & & 0 & & & x & & x & 0 & & 0 & & 0 & V & & x & 0 & & 3 \\ \hline 4 & Prepaid Insurance & 1,193 & & 0 & & 0 & & & x & & x & 0 & & 0 & & 0 & V & & x & 0 & & 4 \\ \hline 5 & Equipment & 5,945 & & 0 & & 0 & & 0 & & 5,945 & & 0 & & 0 & & 0 & ] & 5,945 & & 0 & & 5 \\ \hline 6 & Accum. Depr., Equipment & 0 & & 2,044 & & 0 & & & x & 0 & & & x & 0 & & 0 & & 0 & & & x & 6 \\ \hline 7 & Van & 12,486 & & 0 & & 0 & & 0 & & 12,486 & & 0 & & 0 & & 0 & & 12,486 & & 0 & & 7 \\ \hline 8 & \begin{tabular}{l} Accumulated Depreciation, \\ Van \end{tabular} & 0 & & 3,340 & & 0 & & & & 0 & & & x & 0 & & 0 & & 0 & & & x & 8 \\ \hline 9 & Accounts Payable & 0 & & 1,747 & & 0 & & 0 & & 0 & & 1,747 & & 0 & & 0 & ] & 0 & & 1,747 & & 9 \\ \hline 10 & B. Wallace, Capital & 0 & & 14,458 & & 0 & & 0 & & 0 & & 14,458 & & 0 & & 0 & ] & 0 & & 14,458 & & 10 \\ \hline 11 & B. Wallace, Drawing & 16,980 & & 0 & & 0 & & 0 & & 16,980 & & 0 & & 0 & & 0 & & 16,980 & & 0 & & 11 \\ \hline 12 & Fees Eamed & 0 & & 42,052 & & 0 & & 0 & & 0 & & 42,052 & & 0 & & 42,052 & & 0 & & 0 & & 12 \\ \hline 13 & Salaries Expense & 15,480 & & 0 & & 0 & x & 0 & & 16,034 & & 0 & & 16,034 & & 0 & ] & 0 & & 0 & & 13 \\ \hline 14 & Advertising Expense & 2,115 & & 0 & & 0 & & 0 & & 2,115 & & 0 & & 2,115 & & 0 & ] & 0 & & 0 & & 14 \\ \hline 15 & Van Operating Expense & 775 & & 0 & & 0 & & 0 & & 775 & & 0 & & 775 & & 0 & & 0 & & 0 & & 15 \\ \hline 16 & Utilities Expense & 1,258 & & 0 & & 0 & & 0 & & 1,258 & & 0 & & 1,258 & & 0 & v & 0 & & 0 & & 16 \\ \hline 17 & Miscellaneous Expense & 258 & & 0 & & 0 & & 0 & & 258 & & 0 & & 258 & & 0 & & 0 & & 0 & & 17 \\ \hline 18 & & & x & & x & 0 & & 0 & & 0 & & 0 & & 0 & & 0 & & 0 & & 0 & & 18 \\ \hline 19 & Insurance Expense & 0 & & 0 & & 455 & & 0 & & 455 & & 0 & & 455 & & 0 & & 0 & & 0 & & 19 \\ \hline 20 & Depr. Exp., Equipment & 0 & & 0 & & 760 & & 0 & & 760 & & 0 & & 760 & & 0 & & 0 & & 0 & & 20 \\ \hline 21 & Depreciation Expense, Van & 0 & & 0 & & 1,270 & & 0 & & 1,270 & & 0 & & 1,270 & & 0 & ] & 0 & & 0 & & 21 \\ \hline 22 & Salaries Payable & 0 & & 0 & & 0 & & 554 & & 0 & & 554 & & 0 & & 0 & & 0 & & 554 & & 22 \\ \hline 23 & Supplies Expense & 0 & & 0 & & 144 & & 0 & & 144 & & 0 & & 144 & & 0 & ] & 0 & & 0 & & 23 \\ \hline 24 & & & & & & & x & & x & & x & & x & & x & & x & & x & & x & 24 \\ \hline 25 & Net Income & 0 & & 0 & & 0 & & 0 & & 0 & & 0 & & 18,983 & & 0 & & 0 & & & & 25 \\ \hline 26 & & & & & & & & & & & & & & 0 & x & 42,052 & v & 0 & x & 0 & x & 26 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started