im not very good with excel, can someone assist me with this

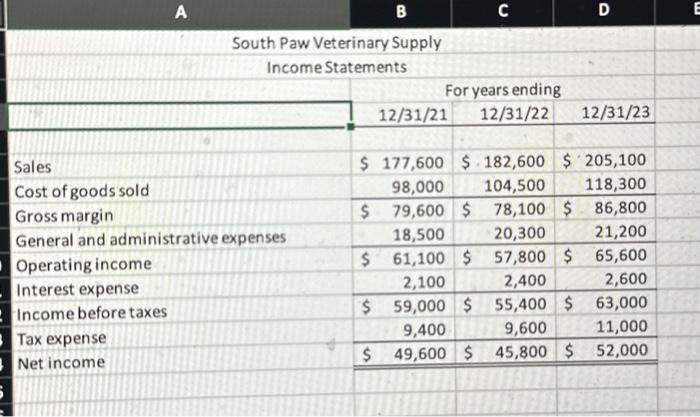

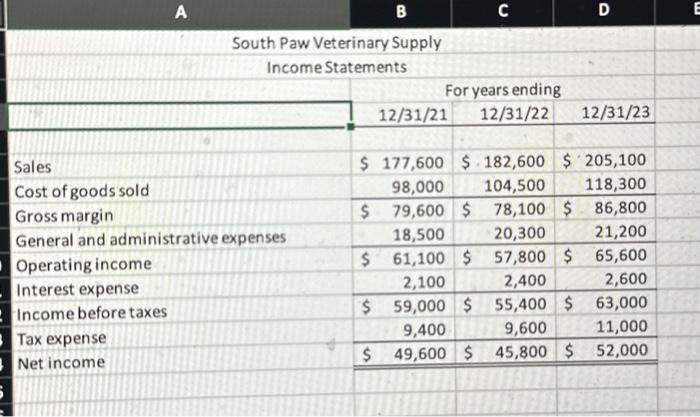

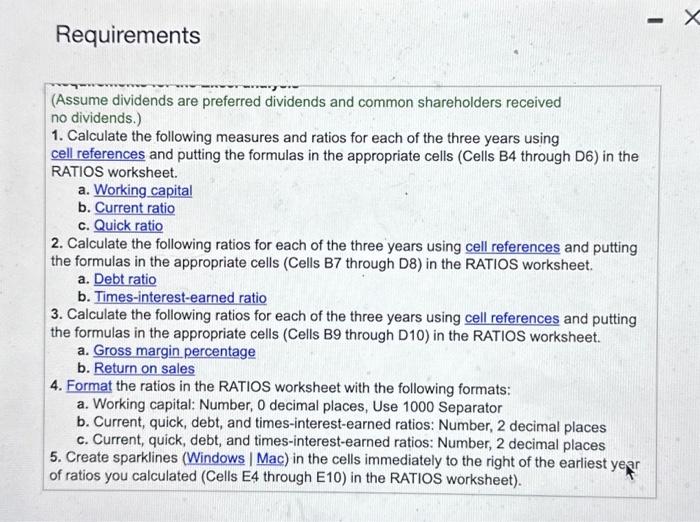

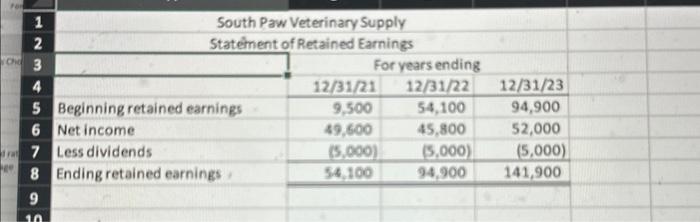

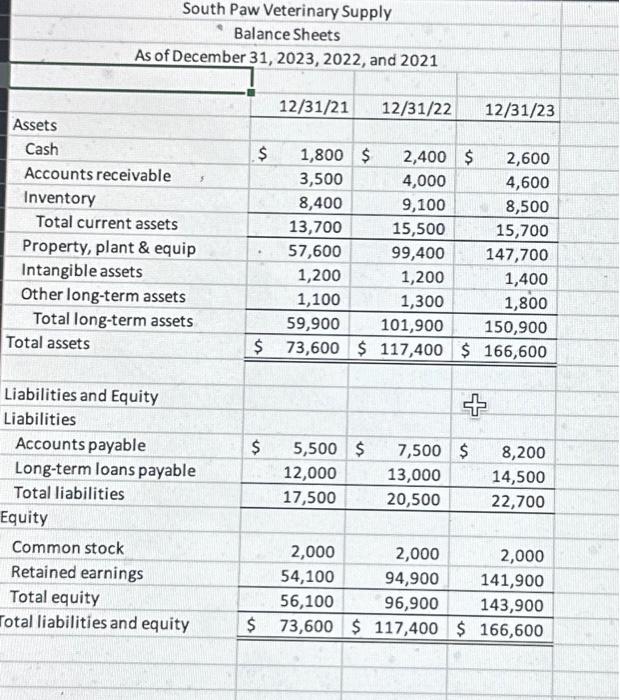

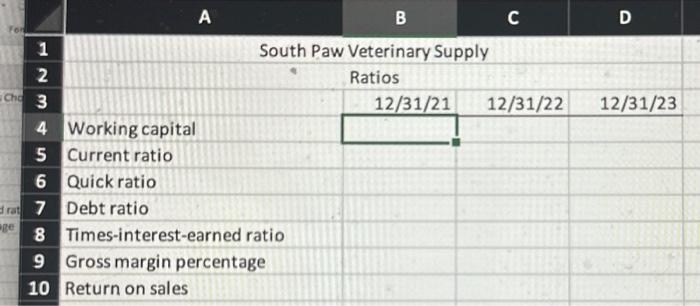

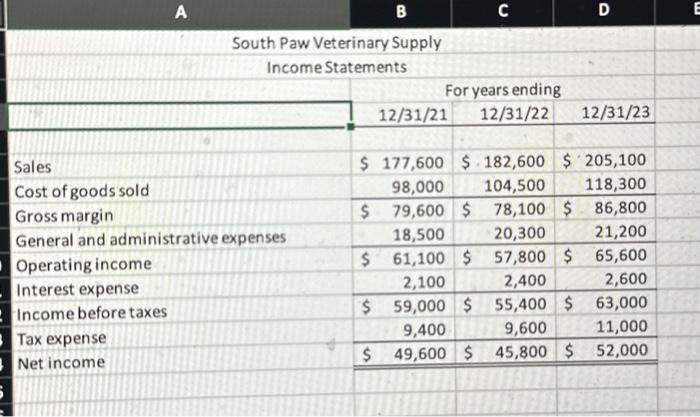

Requirements (Assume dividends are preferred dividends and common shareholders received no dividends.) 1. Calculate the following measures and ratios for each of the three years using cell references and putting the formulas in the appropriate cells (Cells B4 through D6) in the RATIOS worksheet. a. Working capital b. Current ratio c. Quick ratio 2. Calculate the following ratios for each of the three years using cell references and putting the formulas in the appropriate cells (Cells B7 through D8) in the RATIOS worksheet. a. Debt ratio b. Times-interest-earned ratio 3. Calculate the following ratios for each of the three years using cell references and putting the formulas in the appropriate cells (Cells B9 through D10) in the RATIOS worksheet. a. Gross margin percentage b. Return on sales 4. Format the ratios in the RATIOS worksheet with the following formats: a. Working capital: Number, 0 decimal places, Use 1000 Separator b. Current, quick, debt, and times-interest-earned ratios: Number, 2 decimal places c. Current, quick, debt, and times-interest-earned ratios: Number, 2 decimal places 5. Create sparklines (Windows | Mac) in the cells immediately to the right of the earliest year of ratios you calculated (Cells E4 through E10) in the RATIOS worksheet). A B C D 1 South Paw Veterinary Supply 2 Ratios 3 4 Working capital 5 Current ratio 6 Quick ratio 7 Debt ratio 8 Times-interest-earned ratio 9 Gross margin percentage 10 Return on sales South Paw Veterinary Supply - Balance Sheets As of December 31, 2023, 2022, and 2021 \begin{tabular}{|c|c|c|c|} \hline 7 & & a & \\ \hline & 12/31/21 & 12/31/22 & 12/31/23 \\ \hline \multicolumn{4}{|l|}{ Assets } \\ \hline Cash & 1,800 & 2,400 & 2,600 \\ \hline Accounts receivable & 3,500 & 4,000 & 4,600 \\ \hline Inventory & 8,400 & 9,100 & 8,500 \\ \hline Total current assets & 13,700 & 15,500 & 15,700 \\ \hline Property, plant \& equip & 57,600 & 99,400 & 147,700 \\ \hline Intangible assets & 1,200 & 1,200 & 1,400 \\ \hline Other long-term assets & 1,100 & 1,300 & 1,800 \\ \hline Total long-term assets & 59,900 & 101,900 & 150,900 \\ \hline Total assets & $73,600 & $117,400 & $166,600 \\ \hline Liabilities and Equity & & & \\ \hline \multicolumn{4}{|l|}{ Liabilities } \\ \hline Accounts payable & 5,500 & 7,500 & 8,200 \\ \hline Long-term loans payable & 12,000 & 13,000 & 14,500 \\ \hline Total liabilities & 17,500 & 20,500 & 22,700 \\ \hline \multicolumn{4}{|l|}{ Equity } \\ \hline Common stock & 2,000 & 2,000 & 2,000 \\ \hline Retained earnings & 54,100 & 94,900 & 141,900 \\ \hline Total equity & 56,100 & 96,900 & 143,900 \\ \hline Total liabilities and equity & $73,600 & $117,400 & $166,600 \\ \hline \end{tabular}