Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'm pretty sure i know how to solve this, but it can't hurt to be sure (in excel please). EDIT: Given the provided table, which

I'm pretty sure i know how to solve this, but it can't hurt to be sure (in excel please).

EDIT: Given the provided table, which of the provided questions are accurate to this problem?

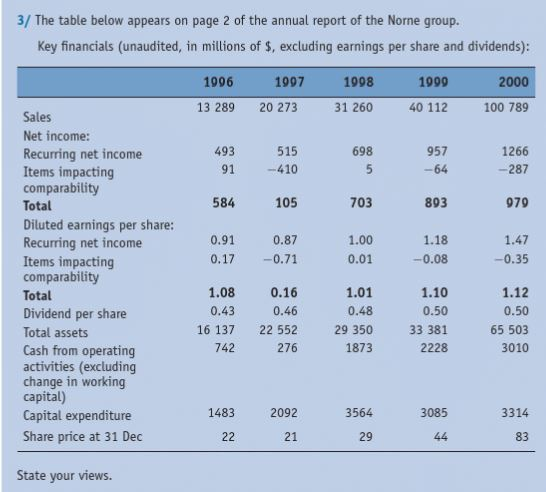

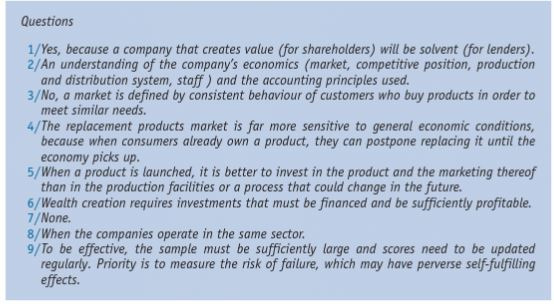

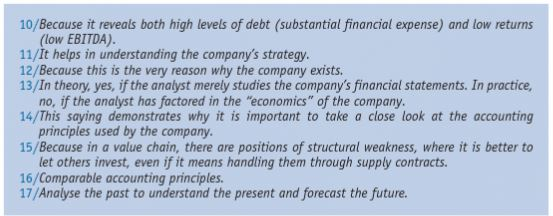

3/The table below appears on page 2 of the annual report of the Norne group. Key financials (unaudited, in millions of $, excluding earnings per share and dividends): 1997 1998 2000 1996 1999 13 289 20 273 31 260 40 112 100 789 Sales Net income: Recurring net income Items impacting comparability 493 515 698 957 1266 -287 91 -410 5 -64 584 105 703 803 979 Total Diluted earnings per share: Recurring net income Items impacting comparability 0.91 0.87 1.00 1.18 1.47 -0.08 -0.35 0.17 -0.71 0.01 1.08 0.16 1.01 1.10 1.12 Total 0.43 0.46 0.48 0.50 0.50 Dividend per share 16 137 22 552 29 350 33 381 65 503 Total assets 742 276 1873 2228 3010 Cash from operating activities (excluding change in working capital) Capital expenditure 1483 2092 3564 3085 3314 Share price at 31 Dec 22 21 29 44 83 State your views. Questions 1/Yes, because a company that creates value (for shareholders) will be solvent (for lenders). 2/An understanding of the company's economics (market, competitive position, production and distribution system, staff) and the accounting principles used. 3/No, a market is defined by consistent behaviour of customers who buy products in order to meet similar needs. 4/The replacement products market is far more sensitive to general economic conditions because when consumers already own a product, they can postpone replacing it until the economy picks up. 5/When a product is launched, it is better to invest in the product and the marketing thereof than in the production facilities 6/Wealth creation requires investments that must be financed and be sufficiently profitable 7/None 8/When the companies operate in the same sector 9/To be effective, the sample must be sufficiently large and scores need to be updated regularly. Priority is to measure the risk of failure, which may have perverse self-fulfilling effects or a process that could change in the future. 10/Because it reveals both high levels of debt (substantial financial expense) and low returns (low EBITDA) 11/It helps in understanding the company's strategy. 12/Because this is the very reason why the company exists. 13/In theory, yes, if the analyst merely studies the company's financial statements. In practice no, if the analyst has factored in the "economics" of the company. 14/This saying demonstrates why it is important to take a close look at the accounting principles used by the company 15/Because in a value chain, there are positions of structural weakness, where it is better to let others invest, even if it means handling them through supply contracts. 16/Comparable accounting principles. 17/Analyse the past to understand the present and forecast the future. 3/The table below appears on page 2 of the annual report of the Norne group. Key financials (unaudited, in millions of $, excluding earnings per share and dividends): 1997 1998 2000 1996 1999 13 289 20 273 31 260 40 112 100 789 Sales Net income: Recurring net income Items impacting comparability 493 515 698 957 1266 -287 91 -410 5 -64 584 105 703 803 979 Total Diluted earnings per share: Recurring net income Items impacting comparability 0.91 0.87 1.00 1.18 1.47 -0.08 -0.35 0.17 -0.71 0.01 1.08 0.16 1.01 1.10 1.12 Total 0.43 0.46 0.48 0.50 0.50 Dividend per share 16 137 22 552 29 350 33 381 65 503 Total assets 742 276 1873 2228 3010 Cash from operating activities (excluding change in working capital) Capital expenditure 1483 2092 3564 3085 3314 Share price at 31 Dec 22 21 29 44 83 State your views. Questions 1/Yes, because a company that creates value (for shareholders) will be solvent (for lenders). 2/An understanding of the company's economics (market, competitive position, production and distribution system, staff) and the accounting principles used. 3/No, a market is defined by consistent behaviour of customers who buy products in order to meet similar needs. 4/The replacement products market is far more sensitive to general economic conditions because when consumers already own a product, they can postpone replacing it until the economy picks up. 5/When a product is launched, it is better to invest in the product and the marketing thereof than in the production facilities 6/Wealth creation requires investments that must be financed and be sufficiently profitable 7/None 8/When the companies operate in the same sector 9/To be effective, the sample must be sufficiently large and scores need to be updated regularly. Priority is to measure the risk of failure, which may have perverse self-fulfilling effects or a process that could change in the future. 10/Because it reveals both high levels of debt (substantial financial expense) and low returns (low EBITDA) 11/It helps in understanding the company's strategy. 12/Because this is the very reason why the company exists. 13/In theory, yes, if the analyst merely studies the company's financial statements. In practice no, if the analyst has factored in the "economics" of the company. 14/This saying demonstrates why it is important to take a close look at the accounting principles used by the company 15/Because in a value chain, there are positions of structural weakness, where it is better to let others invest, even if it means handling them through supply contracts. 16/Comparable accounting principles. 17/Analyse the past to understand the present and forecast the futureStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started