Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'm really confused about this question. Create a savings plan to achieve your FIRE number: If you wanted to retire at 40, how much would

I'm really confused about this question. Create a savings plan to achieve your FIRE number: If you wanted to retire at 40, how much would you need to save every year to achieve your nest egg assuming a 4% real interest rate? If you wanted to retire at 70, how much would you need to save every year to achieve your nest egg assuming a 4% real interest rate?

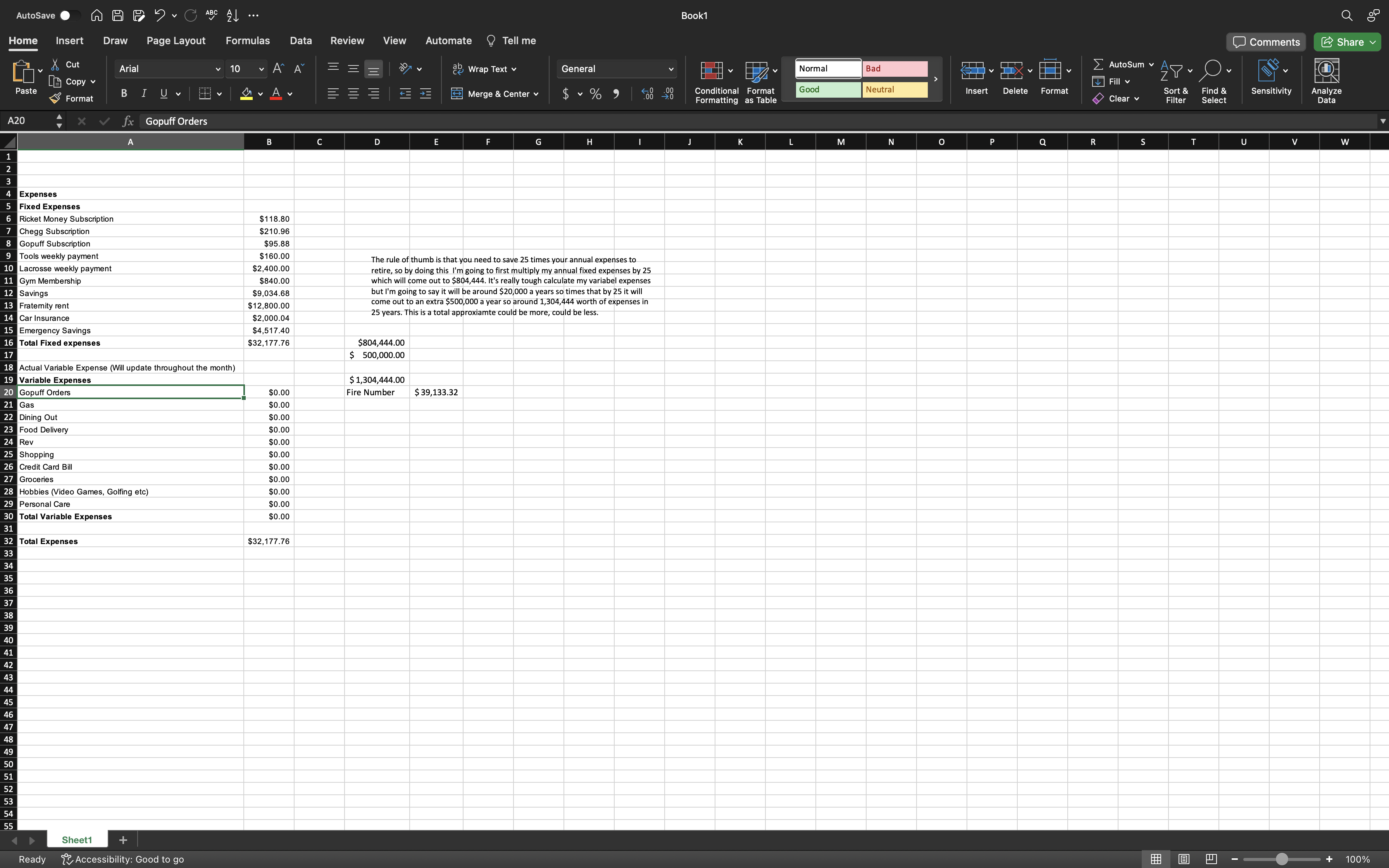

Home Insert Draw Page Layout Formulas Data Review View Automate @ Tell me Expenses Fixed Expenses Ricket Money Subscription Chegg Subscription Gopuff Subscription Lacrosse weekly payment Gym Membership Savings Fraternity rent Car Insurance Total Fixed expenses The rule of thumb is that you need to save 25 times your annual expenses to retire, so by doing this I'm going to first multiply my annual fixed expenses by 25 which will come out to $804,444. It's really tough calculate my variabel expense but I'm going to say it will be around $20,000 a years so times that by 25 it will 25 years. This is a total approxiamte could be more, could be less. Actual Variable Expense (Will update throughout the month) Variable Expenses Gas Dining Out Food Delivery Rev Shopping Credit Card B Groceries Hobbies (Video Games, Golfing etc) Personal Care Total Variable Expenses Total Expenses $118.80 $95.88 $160.0 $840.0 $9,034.68 $12,800.00 $2,000.04 $804,444.00 $1,304,444.00 Fire Number $39,133.32 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $32,177.76 Book1 Share v 32 Tot Sheet1 Ready ? Accessibility: Good to go

Home Insert Draw Page Layout Formulas Data Review View Automate @ Tell me Expenses Fixed Expenses Ricket Money Subscription Chegg Subscription Gopuff Subscription Lacrosse weekly payment Gym Membership Savings Fraternity rent Car Insurance Total Fixed expenses The rule of thumb is that you need to save 25 times your annual expenses to retire, so by doing this I'm going to first multiply my annual fixed expenses by 25 which will come out to $804,444. It's really tough calculate my variabel expense but I'm going to say it will be around $20,000 a years so times that by 25 it will 25 years. This is a total approxiamte could be more, could be less. Actual Variable Expense (Will update throughout the month) Variable Expenses Gas Dining Out Food Delivery Rev Shopping Credit Card B Groceries Hobbies (Video Games, Golfing etc) Personal Care Total Variable Expenses Total Expenses $118.80 $95.88 $160.0 $840.0 $9,034.68 $12,800.00 $2,000.04 $804,444.00 $1,304,444.00 Fire Number $39,133.32 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $32,177.76 Book1 Share v 32 Tot Sheet1 Ready ? Accessibility: Good to go Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started