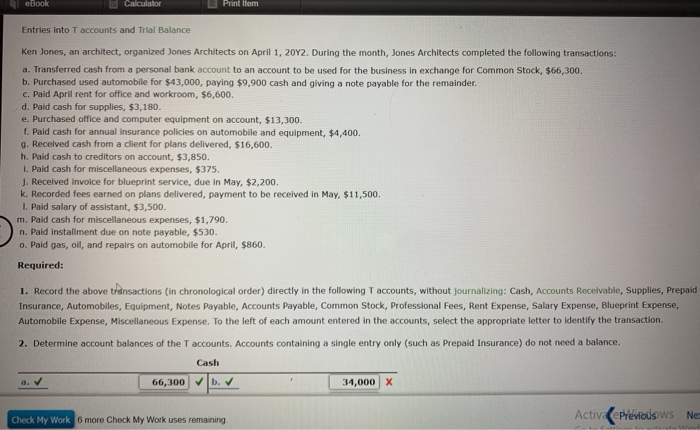

Im really struggling with my homework. my textbook hasnt came in yet so im not sure how to do any of this. I need help with everything that is blank or marked as an x

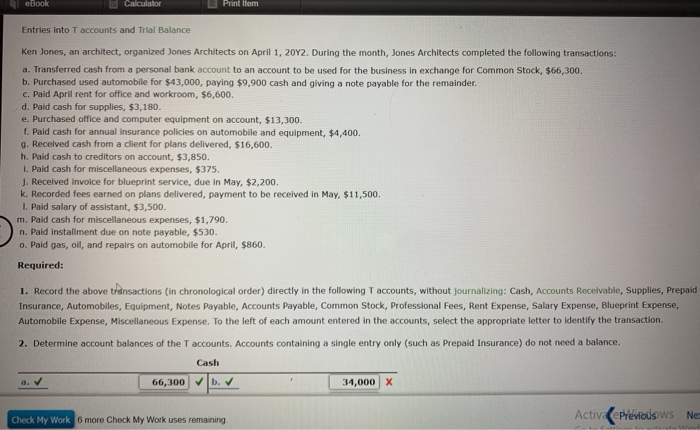

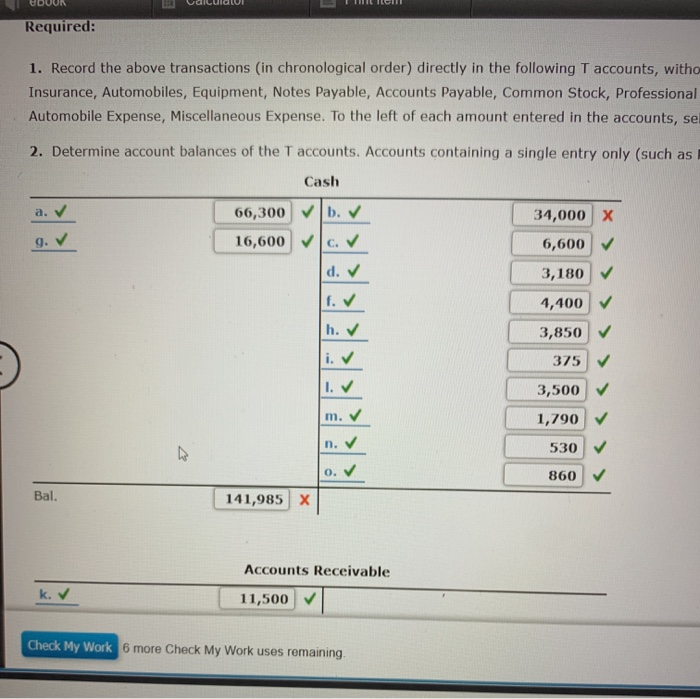

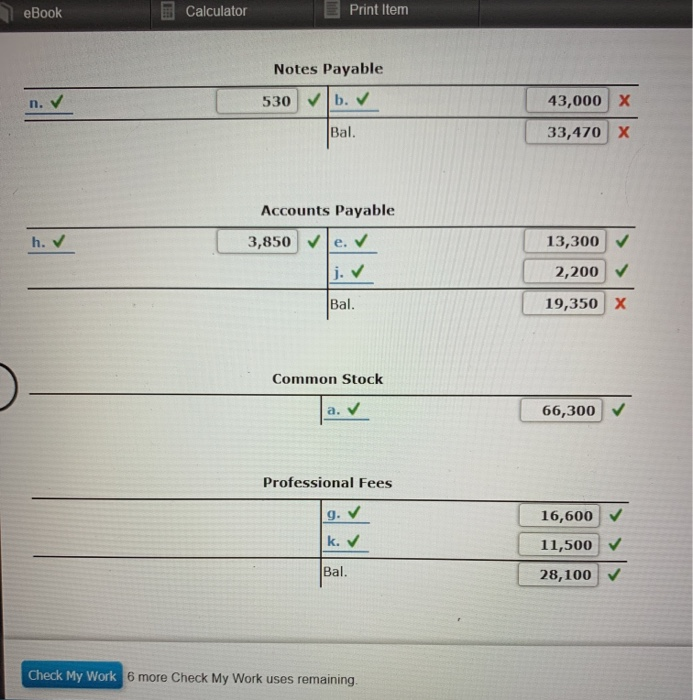

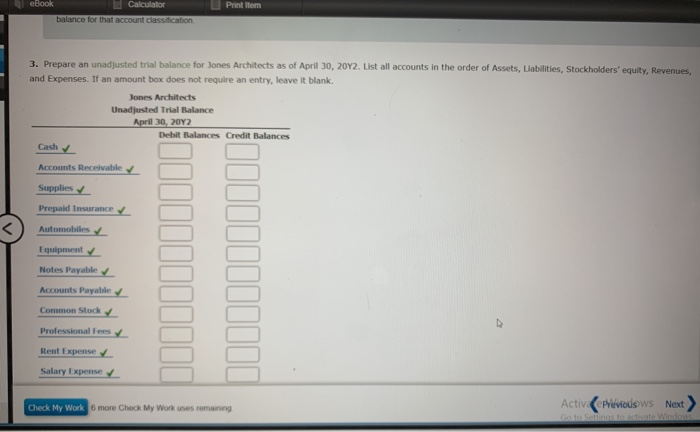

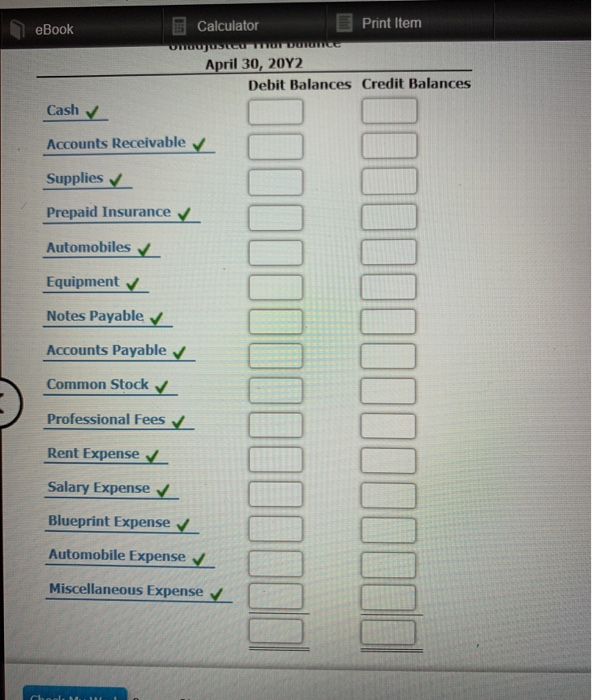

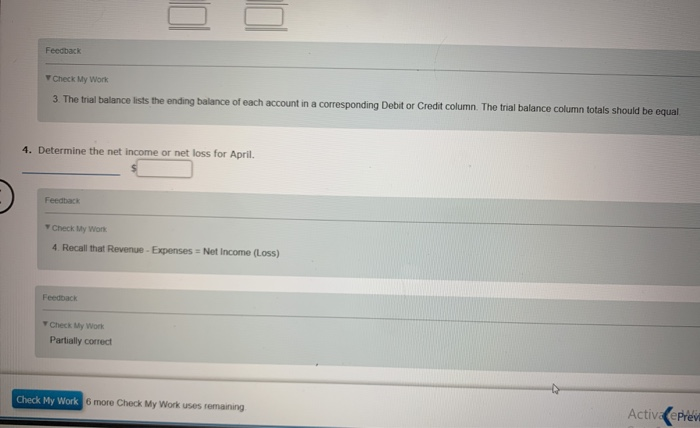

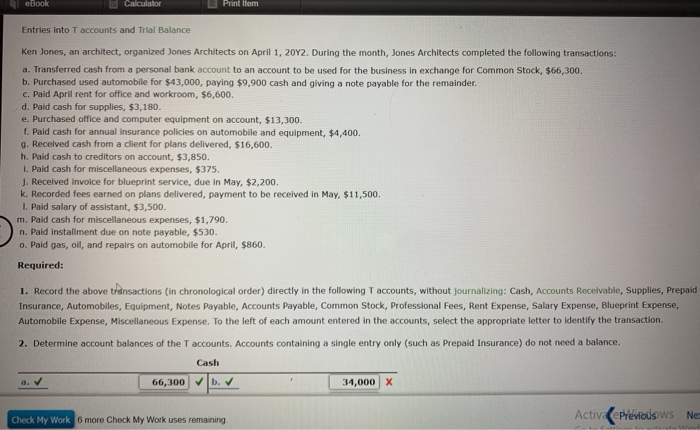

eBook Calculator Print Item Entries into T accounts and Trial Balance Ken Jones, an architect, organized Jones Architects on April 1, 2012. During the month, Jones Architects completed the following transactions a. Transferred cash from a personal bank account to an account to be used for the business in exchange for Common Stock, $66,300. b. Purchased used automobile for $43,000, paying $9.900 cash and giving a note payable for the remainder. c. Paid April rent for office and workroom, $6,600. d. Pald cash for supplies, $3,180. e. Purchased office and computer equipment on account, $13,300. f. Pald cash for annual Insurance policies on automobile and equipment, $4,400. 9. Received cash from a client for plans delivered, $16,600. h. Paid cash to creditors on account, $3,850. 1. Pald cash for miscellaneous expenses, $375. J. Received invoice for blueprint service, due in May, $2,200. k. Recorded fees earned on plans delivered, payment to be received in May, $11,500. 1. Pald salary of assistant, $3,500. m. Pald cash for miscellaneous expenses, $1,790. n. Paid installment due on note payable, $530. o. Pald gas, oil, and repairs on automobile for April, $860. Required: 1. Record the above transactions (in chronological order) directly in the following T accounts, without journalizing: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Automobiles, Equipment, Notes Payable, Accounts Payable, Common Stock, Professional Fees, Rent Expense, Salary Expense, Blueprint Expense, Automobile Expense, Miscellaneous Expense. To the left of each amount entered in the accounts, select the appropriate letter to identify the transaction. 2. Determine account balances of the Taccounts. Accounts containing a single entry only (such as Prepaid Insurance) do not need a balance Cash a. 66,300 b. 34,000 x Check My Work 6 more Check My Work uses remaining. Active previousws Ne DDUUN Calculdul Hillclll Required: 1. Record the above transactions (in chronological order) directly in the following T accounts, witho Insurance, Automobiles, Equipment, Notes Payable, Accounts Payable, Common Stock, Professional Automobile Expense, Miscellaneous Expense. To the left of each amount entered in the accounts, se 2. Determine account balances of the T accounts. Accounts containing a single entry only (such as Cash 66,300 b. 34,000 16,600 / 6,600 3,180 4,400 3,850 375 3,500 1,790 530 860 Bal. 141,985 Accounts Receivable 11,500 k. v Check My Work 6 more Check My Work uses remaining eBook Calculator E Print Item Notes Payable 530 b. 43,000 X Bal. 33,470 x Accounts Payable 3,850 13,300 2,200 19,350 X Bal. Common Stock 66,300 Professional Fees 0 . 16,600 11,500 Bal. 28,100 Check My Work 6 more Check My Work uses remaining. Print Item eBook Calculator balance for that account classification 3. Prepare an unadjusted trial balance for Jones Architects as of April 30, 2012. List all accounts in the order of Assets, Liabilities, Stockholders' equity, Revenues and Expenses. If an amount box does not require an entry, leave it blank. Jones Architects Unadjusted Trial Balance April 30, 2012 Debit Falances Credit Balances Cash Accounts Receivable Supplies Prepaid Insurance Automobiles Equipment Notes Payable Accounts Payable Common Stock Professional fees Rent Expense Salary Expense Check My Work 6 more Check My Work uses remaining ActivPreviodows Next > eBook Calculator E Print Item muuten warence April 30, 20Y2 Debit Balances Credit Balances Cash Accounts Receivable Supplies Prepaid Insurance Automobiles Equipment Notes Payable Accounts Payable Common Stock Professional Fees Rent Expense Salary Expense Blueprint Expense Automobile Expense Miscellaneous Expense Feedback Check My Work 3 The trial balance lists the ending balance of each account in a corresponding Debitor Credit column. The trial balance column totals should be equal 4. Determine the net income or net loss for April. Feedback Check My Work 4. Recall that Revenue - Expenses = Net Income (Loss) Feedback Check My Work Partially correct Check My Work 6 more Check My Work uses remaining ActivePrevi