Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'm specifically looking to understand the calculations for the invested capital portion (especially prepayments) in the ROIC tree Paul Downs Cabinetmakers Paul Downs started making

I'm specifically looking to understand the calculations for the invested capital portion (especially prepayments) in the ROIC tree

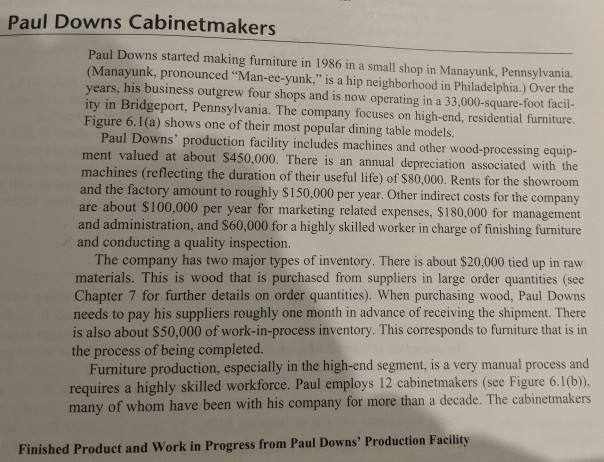

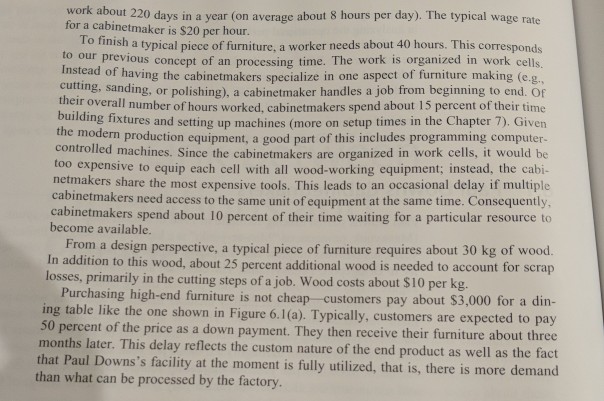

Paul Downs Cabinetmakers Paul Downs started making furniture in 1986 in a small shop in Manayunk, Pennsylvania. (Manayunk, pronounced "Man-ee-yunk," is a hip neighborhood in Philadelphia.) Over the years, his business outgrew four shops and is now operating in a 33,000-square-foot facil- ity in Bridgeport, Pennsylvania. The company focuses on high-end, residential furniture. Figure 6.1(a) shows one of their most popular dining table models. Paul Downs' production facility includes machines and other wood-processing equip ment valued at about $450,000. There is an annual depreciation associated with the machines (reflecting the duration of their useful life) of $80,000. Rents for the showroom and the factory amount to roughly $150,000 per year. Other indirect costs for the compa are about $100,000 per year for marketing related expenses, $180,000 for management and administration, and S60,000 for a highly skilled worker in charge of finishing furniture and conducting a quality inspection. The company has two major types of inventory. There is about $20,000 tied up in raw materials. This is wood that is purchased from suppliers in large order quantities (see Chapter 7 for further details on order quantities). When purchasing wood, Paul Downs needs to pay his suppliers roughly one month in advance of receiving the shipment. There is also about $50,000 of work-in-process inventory. This corresponds to furniture that is in e process of being completed. Furniture production, especially in the high-end segment, is a very manual process and requires a highly skilled workforce. Paul employs 12 cabinetmakers (see Figure 6.1(b) many of whom have been with his company for more than a decade. The cabinetmakers Finished Product and Work in Progress from Paul Downs' Production Facility Paul Downs Cabinetmakers Paul Downs started making furniture in 1986 in a small shop in Manayunk, Pennsylvania. (Manayunk, pronounced "Man-ee-yunk," is a hip neighborhood in Philadelphia.) Over the years, his business outgrew four shops and is now operating in a 33,000-square-foot facil- ity in Bridgeport, Pennsylvania. The company focuses on high-end, residential furniture. Figure 6.1(a) shows one of their most popular dining table models. Paul Downs' production facility includes machines and other wood-processing equip ment valued at about $450,000. There is an annual depreciation associated with the machines (reflecting the duration of their useful life) of $80,000. Rents for the showroom and the factory amount to roughly $150,000 per year. Other indirect costs for the compa are about $100,000 per year for marketing related expenses, $180,000 for management and administration, and S60,000 for a highly skilled worker in charge of finishing furniture and conducting a quality inspection. The company has two major types of inventory. There is about $20,000 tied up in raw materials. This is wood that is purchased from suppliers in large order quantities (see Chapter 7 for further details on order quantities). When purchasing wood, Paul Downs needs to pay his suppliers roughly one month in advance of receiving the shipment. There is also about $50,000 of work-in-process inventory. This corresponds to furniture that is in e process of being completed. Furniture production, especially in the high-end segment, is a very manual process and requires a highly skilled workforce. Paul employs 12 cabinetmakers (see Figure 6.1(b) many of whom have been with his company for more than a decade. The cabinetmakers Finished Product and Work in Progress from Paul Downs' Production FacilityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started