Answered step by step

Verified Expert Solution

Question

1 Approved Answer

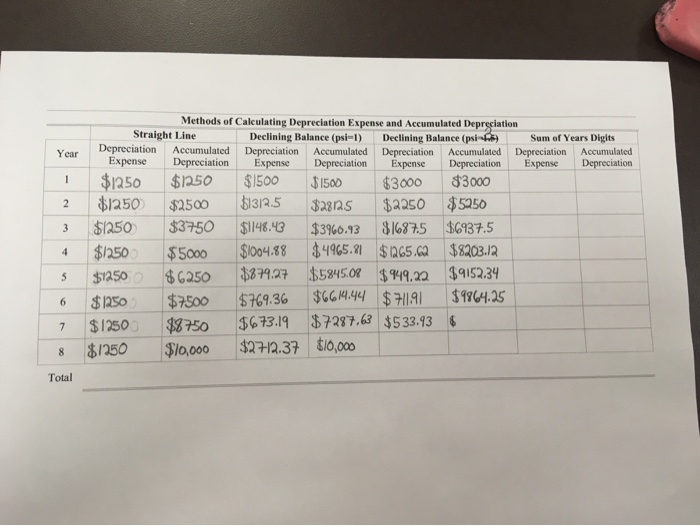

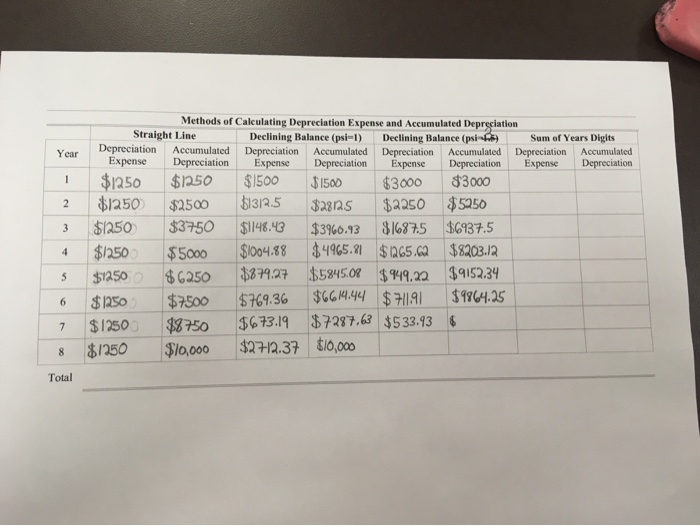

I'm struggling to get my psi=2 to work out and I'm unsure how to use the Sum of Digits method. AGEC 205: Agricultural Business Accounting

I'm struggling to get my psi=2 to work out and I'm unsure how to use the Sum of Digits method.

AGEC 205: Agricultural Business Accounting Homework X8 Snyder and Thompson purchased a tractor for $12,000 on January 1, 2018. They expect to utilize the tractor for 8 years and subsequently dispose it for $2,000. Using the table on the next page, calculate annual depreciation expense and accumulated depreciation using the straight-line method, the sum-of-years-digits method, and the declining-balance method, and the double- declining balance method. Methods of Calculating Depreciation Expense and Accumulated Depreciation Straight Line Declining Balance (psi- Declining Balance (psi-1) Depreciation Expense Sum of Years Digits Depreciation Expense Accumulated Accumulated Depreciation Depreciation cumulated Depreciation Expense Accumulated Depreciation Year Depreciation Depreciation Expense $1500 $1312.5 $1250 $1250 $1250 $1250 $1250 $3000 1 $1500 $3000 $2250 $5250 2 $28125 $2500 $3750 86875 $6937.5 $39%60.93 $4965.1 $65.ca $8203.12 $89.27$58450R$49.22 $9152.34 $66.4.44$H191 $146.43 3 $1004.88 $5000 6250 4 $1250 5 $1764.25 $769.36 $7500 $1250 6 $673.19 $7287.63 $533.93 $2H12.37 $10,000 $.2750 $12500 7 $1250 S10.,000 8 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started