Answered step by step

Verified Expert Solution

Question

1 Approved Answer

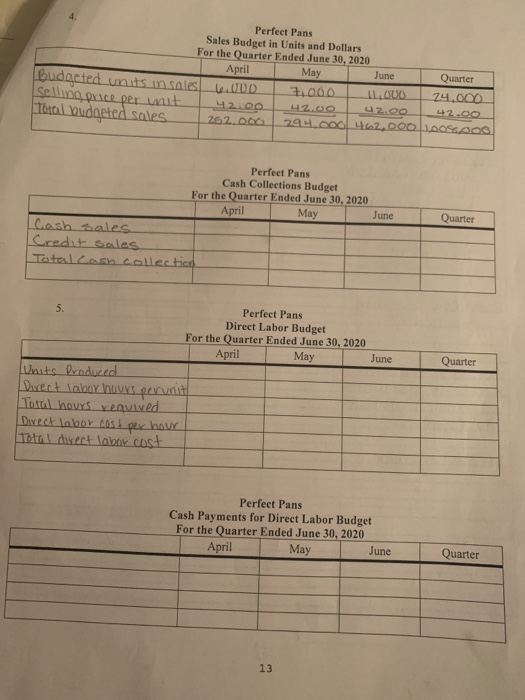

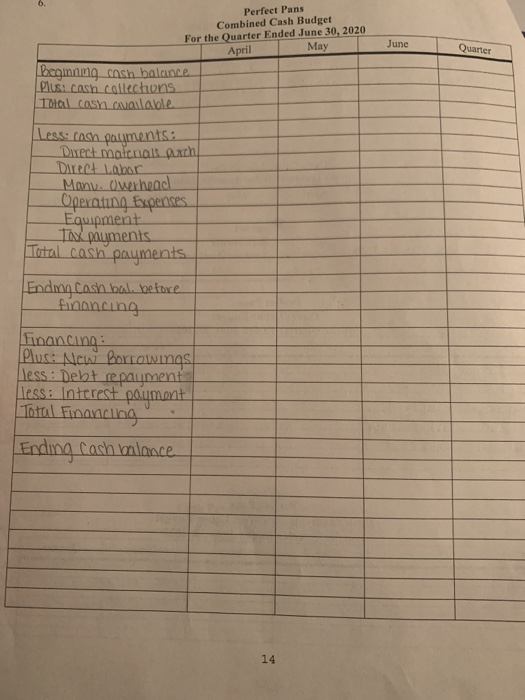

im stuck i require help on cash payments for direct labor and the combined cash budget Objective The obiective of Problem 3 is to reinforce

im stuck

i require help on cash payments for direct labor and the combined cash budget

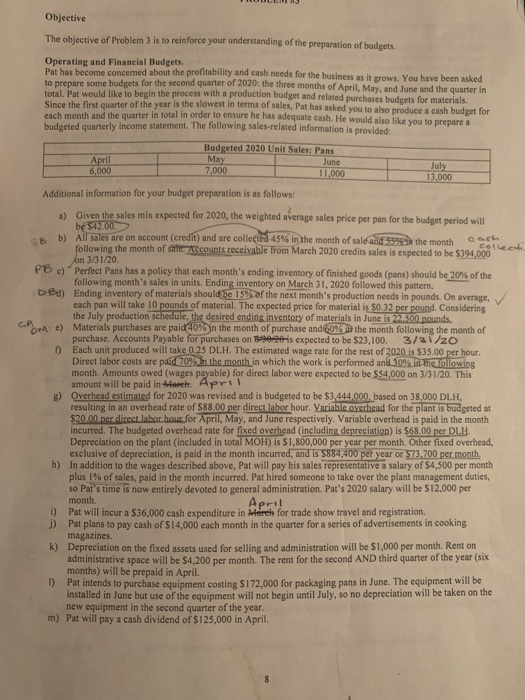

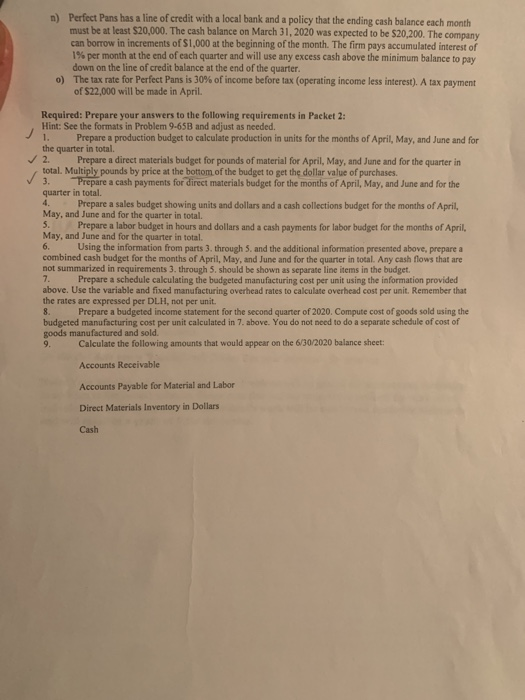

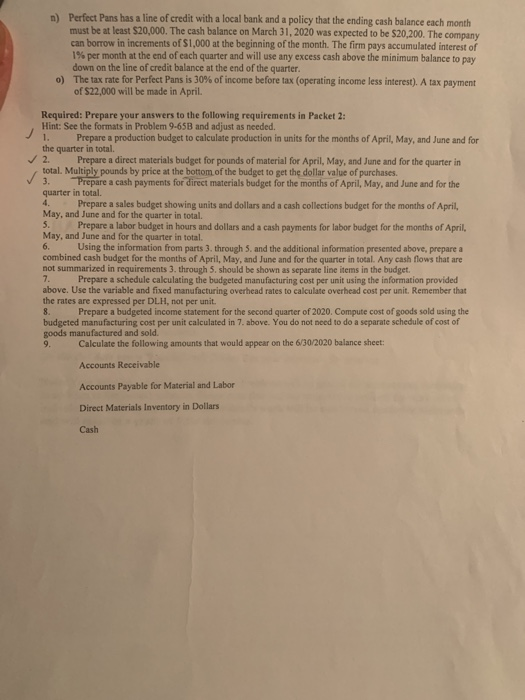

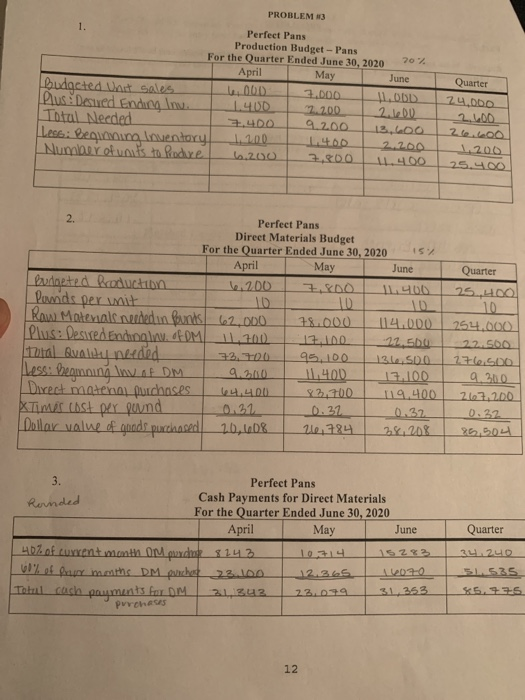

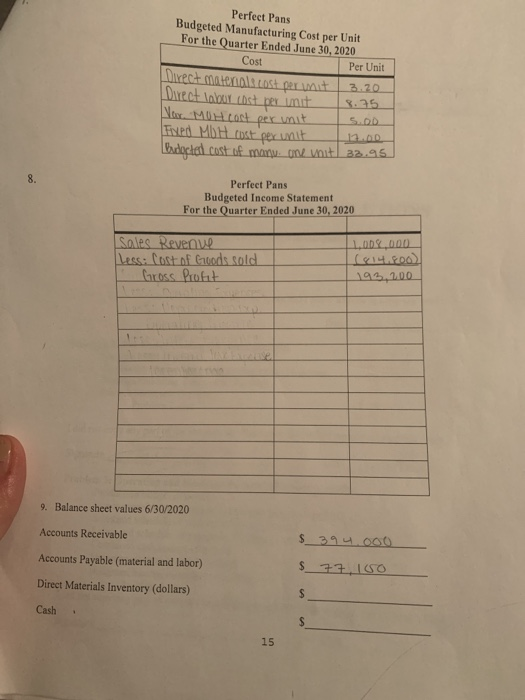

Objective The obiective of Problem 3 is to reinforce your understanding of the preparation of budgets. Operating and Financial Budgets. Pat has become concemed about the profitability and cash needs for the business as it grows. You have been asked to prepare some budgets for the second quarter of 2020: the three months of April. May and June and the quarter in total. Pat would like to begin the process with a production budget and related purchases budgets for materials. Since the first quarter of the year is the slowest in terms of sales, Pat has asked you to also produce a cash budget for each month and the quarter in total in order to ensure he has adequate cash. He would also like you to prepare a budgeted quarterly income statement. The following sales-related information is provided April 6,000 Budgeted 2020 Unit Sales: Pans May June 7,000 July 11,000 13,000 Additional information for your budget preparation is as follows: a) Given the sales mix expected for 2020, the weighted average sales price per pan for the budget period will be 542200 b) All sales are on account (credit) and are collected 45% in the month of sale and 55th the month och following the month of Se counts receivable from March 2020 credits sales is expected to be $394,000 Cote on 3/31/20 PB c) Perfect Pans has a policy that each month's ending inventory of finished goods (pans) should be 20% of the following month's sales in units. Ending inventory on March 31, 2020 followed this pattern. Deu Ending inventory of materials should be 15% of the next month's production needs in pounds. On average. each pan will take 10 pounds of material. The expected price for material is $0.32 per pound. Considering the July production schedule, the desired ending inventory of materials in June is 22.500 pounds. Chee) Materials purchases are paid 20% in the month of purchase and 60% the month following the month of purchase. Accounts Payable for purchases on is expected to be $23,100. 3/31/20 Each unit produced will take 0.25 DLH. The estimated wage rate for the rest of 2020 is $35.00 per hour. Direct labor costs are paid 70%In the month in which the work is performed and 30% in the following month. Amounts owed (wages payable) for direct labor were expected to be $54,000 on 3/31/20. This amount will be paid in March April B) Overhead estimated for 2020 was revised and is budgeted to be $3,444,000, based on 38,000 DLH. resulting in an overhead rate of $88.00 per direct labor hour. Variable overhead for the plant is budgeted at $20.00 per direct labor hour for April, May, and June respectively. Variable overhead is paid in the month incurred. The budgeted overhead rate for fixed overhead (including depreciation) is $68.00 per DLH. Depreciation on the plant (included in total MOH) is $1,800,000 per year per month. Other fixed overhead, exclusive of depreciation, is paid in the month incurred, and is $884,400 per year or $73,700 per month h) In addition to the wages described above, Pat will pay his sales representative a salary of $4,500 per month plus 1% of sales, paid in the month incurred. Pat hired someone to take over the plant management duties, so Pat's time is now entirely devoted to general administration. Pat's 2020 salary will be $12,000 per month. April Pat will incur a $36.000 cash expenditure in Merch for trade show travel and registration, J) Pat plans to pay cash of $14,000 each month in the quarter for a series of advertisements in cooking magazines k) Depreciation on the fixed assets used for selling and administration will be $1,000 per month. Rent on administrative space will be $4,200 per month. The rent for the second AND third quarter of the year (six months) will be prepaid in April. 1) Pat intends to purchase equipment Costine S172.000 for packaging pans in June. The equipment will be installed in June but use of the equipment will not begin until July, so no depreciation will be taken on the new equipment in the second quarter of the year. m) Pat will pay a cash dividend of $125,000 in April. n Perfect Pans has a line of credit with a local bank and a policy that the ending cash balance each month must be at least 520,000. The cash balance on March 31, 2020 was expected to be $20,200. The company can borrow in increments of $1,000 at the beginning of the month. The firm pays accumulated interest of 1% per month at the end of each quarter and will use any excess cash above the minimum balance to pay down on the line of credit balance at the end of the quarter. The tax rate for Perfect Pans is 30% of income before tax (operating income less interest). A tax payment of 522,000 will be made in April. o) V Required: Prepare your answers to the following requirements in Packet 2: Hint: See the formats in Problem 9-65B and adjust as needed. 1. Prepare a production budget to calculate production in units for the months of April, May, and June and for the quarter in total 2. Prepare a direct materials budget for pounds of material for April, May, and June and for the quarter in total. Multiply pounds by price at the bottom of the budget to get the dollar value of purchases 3. Prepare a cash payments for direct materials budget for the months of April, May, and June and for the quarter in total. 4. Prepare a sales budget showing units and dollars and a cash collections budget for the months of April, May, and June and for the quarter in total 5. Prepare a labor budget in hours and dollars and a cash payments for labor budget for the months of April. May, and June and for the quarter in total 6. Using the information from parts 3. through 5. and the additional information presented above, prepare a combined cash budget for the months of April, May, and June and for the quarter in total. Any cash flows that are not summarized in requirements 3. through 5. should be shown as separate line items in the budget. 7. Prepare a schedule calculating the budgeted manufacturing cost per unit using the information provided above. Use the variable and fixed manufacturing overhead rates to calculate overhead cost per unit. Remember that the rates are expressed per DLH, not per unit. 8. Prepare a budgeted income statement for the second quarter of 2020. Compute cost of goods sold using the budgeted manufacturing cost per unit calculated in 7. above. You do not need to do a separate schedule of cost of goods manufactured and sold. Calculate the following amounts that would appear on the 6/30/2020 balance sheet: Accounts Receivable Accounts Payable for Material and Labor Direct Materials Inventory in Dollars Cash PROBLEM N3 Perfect Pans Production Budget -Pans For the Quarter Ended June 30, 2020 70% April May June budgeted Unct Sales 7.000 11.00 Pus Desued Endir in 1.400 2.200 2.600 Total Needed 7,400 9.2.00 13,600 Lee: Beginning Inventory 1,400 2.200 Number of units to prodre 6.200 7.300 1.400 Quarter 24.000 2.400 1 26.600 1.200 25.400 Perfect Pans Direet Materials Budget For the Quarter Ended June 30, 2020 15% April May June Puedoetz Broducten 200 7 .XD0 | 1.400 Panids per mit 1010 10 Raw Material nunded in funds 62.000 78.000 114.000 Plus: Desired Enchengl. of OM 11.700 17100 12.500 Total Quality needed 73, 700 95.00 131.500 Less: Beginning invof DM 9.2100 11.400 13.100 Direct matenal purchases 64,400 3.700 119.400 Timas last per pund 0.31 0.32 0.32 Dollar value of goods purchased 26,408 26,784 28,208 Quarter 25.00 10 254.000 22.500 176500 9.300 267,200 0.32 86,504 Rounded Quarter Perfect Pans Cash Payments for Direct Materials For the Quarter Ended June 30, 2020 April May June 40% of current month Om uwch_$1.4.3 1021415283 % of a menthe DM parchet 23.100 12.2.65 A 2070 Totul cash powments for DM31 zuz 23.079 31, 353 purchases 34.240 51.535 Perfect Pans Sales Budget in Units and Dollars For the Quarter Ended June 30, 2020 April May June Quarter budacted units in sales 1.000 1.000 1.000 24.00 42.00 42.00 42.00 Total budgeted sales 262.000 29.cod 42.000 DOLARA June Quarter Perfect Pans Cash Collections Budget For the Quarter Ended June 30, 2020 April May Cash sales Credit sales Tatal.cash collection June Quarter Perfect Pans Direct Labor Budget For the Quarter Ended June 30, 2020 April May Units Produced Direct Tabor Set Total noves required Direct labor cost per hour Total direct laboy cost Perfect Pans Cash Payments for Direct Labor Budget For the Quarter Ended June 30, 2020 April May June Quarter Perfect Pans Combined Cash Budget For the Quarter Ended June 30, 2020 April May June Quarter Beginng cash balance Plus: cash collections Total con cavalade Less: cash payments: Direct mainals Axch Direct Labor Monu. Overhead Operating Expenses Equipment This pauments Total cosh payments Endmo cash bal. before financing financing: Plus: New Borrowings less: Debt repaumenta less: Interest poumont Total Financing Ending Cash balance Per Unit Perfect Pans Budgeted Manufacturing Cost per Unit For the Quarter Ended June 30, 2020 Cost Alemak cost per unit 3.70 Direct lobo est per unit Nor Mohon per unit Fixed MDH tot per unit Erectal cost of manu. an unita2.95 3.25 12.00 Perfect Pans Budgeted Income Statement For the Quarter Ended June 30, 2020 Sales Revenue Less: Cost of Goods sold - Gross Profit 1.00 8.000 (8144. 193,200 9. Balance sheet values 6/30/2020 Accounts Receivable Accounts Payable (material and labor) $_394.000 $_77.150 Direct Materials Inventory (dollars) Cash Objective The obiective of Problem 3 is to reinforce your understanding of the preparation of budgets. Operating and Financial Budgets. Pat has become concemed about the profitability and cash needs for the business as it grows. You have been asked to prepare some budgets for the second quarter of 2020: the three months of April. May and June and the quarter in total. Pat would like to begin the process with a production budget and related purchases budgets for materials. Since the first quarter of the year is the slowest in terms of sales, Pat has asked you to also produce a cash budget for each month and the quarter in total in order to ensure he has adequate cash. He would also like you to prepare a budgeted quarterly income statement. The following sales-related information is provided April 6,000 Budgeted 2020 Unit Sales: Pans May June 7,000 July 11,000 13,000 Additional information for your budget preparation is as follows: a) Given the sales mix expected for 2020, the weighted average sales price per pan for the budget period will be 542200 b) All sales are on account (credit) and are collected 45% in the month of sale and 55th the month och following the month of Se counts receivable from March 2020 credits sales is expected to be $394,000 Cote on 3/31/20 PB c) Perfect Pans has a policy that each month's ending inventory of finished goods (pans) should be 20% of the following month's sales in units. Ending inventory on March 31, 2020 followed this pattern. Deu Ending inventory of materials should be 15% of the next month's production needs in pounds. On average. each pan will take 10 pounds of material. The expected price for material is $0.32 per pound. Considering the July production schedule, the desired ending inventory of materials in June is 22.500 pounds. Chee) Materials purchases are paid 20% in the month of purchase and 60% the month following the month of purchase. Accounts Payable for purchases on is expected to be $23,100. 3/31/20 Each unit produced will take 0.25 DLH. The estimated wage rate for the rest of 2020 is $35.00 per hour. Direct labor costs are paid 70%In the month in which the work is performed and 30% in the following month. Amounts owed (wages payable) for direct labor were expected to be $54,000 on 3/31/20. This amount will be paid in March April B) Overhead estimated for 2020 was revised and is budgeted to be $3,444,000, based on 38,000 DLH. resulting in an overhead rate of $88.00 per direct labor hour. Variable overhead for the plant is budgeted at $20.00 per direct labor hour for April, May, and June respectively. Variable overhead is paid in the month incurred. The budgeted overhead rate for fixed overhead (including depreciation) is $68.00 per DLH. Depreciation on the plant (included in total MOH) is $1,800,000 per year per month. Other fixed overhead, exclusive of depreciation, is paid in the month incurred, and is $884,400 per year or $73,700 per month h) In addition to the wages described above, Pat will pay his sales representative a salary of $4,500 per month plus 1% of sales, paid in the month incurred. Pat hired someone to take over the plant management duties, so Pat's time is now entirely devoted to general administration. Pat's 2020 salary will be $12,000 per month. April Pat will incur a $36.000 cash expenditure in Merch for trade show travel and registration, J) Pat plans to pay cash of $14,000 each month in the quarter for a series of advertisements in cooking magazines k) Depreciation on the fixed assets used for selling and administration will be $1,000 per month. Rent on administrative space will be $4,200 per month. The rent for the second AND third quarter of the year (six months) will be prepaid in April. 1) Pat intends to purchase equipment Costine S172.000 for packaging pans in June. The equipment will be installed in June but use of the equipment will not begin until July, so no depreciation will be taken on the new equipment in the second quarter of the year. m) Pat will pay a cash dividend of $125,000 in April. n Perfect Pans has a line of credit with a local bank and a policy that the ending cash balance each month must be at least 520,000. The cash balance on March 31, 2020 was expected to be $20,200. The company can borrow in increments of $1,000 at the beginning of the month. The firm pays accumulated interest of 1% per month at the end of each quarter and will use any excess cash above the minimum balance to pay down on the line of credit balance at the end of the quarter. The tax rate for Perfect Pans is 30% of income before tax (operating income less interest). A tax payment of 522,000 will be made in April. o) V Required: Prepare your answers to the following requirements in Packet 2: Hint: See the formats in Problem 9-65B and adjust as needed. 1. Prepare a production budget to calculate production in units for the months of April, May, and June and for the quarter in total 2. Prepare a direct materials budget for pounds of material for April, May, and June and for the quarter in total. Multiply pounds by price at the bottom of the budget to get the dollar value of purchases 3. Prepare a cash payments for direct materials budget for the months of April, May, and June and for the quarter in total. 4. Prepare a sales budget showing units and dollars and a cash collections budget for the months of April, May, and June and for the quarter in total 5. Prepare a labor budget in hours and dollars and a cash payments for labor budget for the months of April. May, and June and for the quarter in total 6. Using the information from parts 3. through 5. and the additional information presented above, prepare a combined cash budget for the months of April, May, and June and for the quarter in total. Any cash flows that are not summarized in requirements 3. through 5. should be shown as separate line items in the budget. 7. Prepare a schedule calculating the budgeted manufacturing cost per unit using the information provided above. Use the variable and fixed manufacturing overhead rates to calculate overhead cost per unit. Remember that the rates are expressed per DLH, not per unit. 8. Prepare a budgeted income statement for the second quarter of 2020. Compute cost of goods sold using the budgeted manufacturing cost per unit calculated in 7. above. You do not need to do a separate schedule of cost of goods manufactured and sold. Calculate the following amounts that would appear on the 6/30/2020 balance sheet: Accounts Receivable Accounts Payable for Material and Labor Direct Materials Inventory in Dollars Cash PROBLEM N3 Perfect Pans Production Budget -Pans For the Quarter Ended June 30, 2020 70% April May June budgeted Unct Sales 7.000 11.00 Pus Desued Endir in 1.400 2.200 2.600 Total Needed 7,400 9.2.00 13,600 Lee: Beginning Inventory 1,400 2.200 Number of units to prodre 6.200 7.300 1.400 Quarter 24.000 2.400 1 26.600 1.200 25.400 Perfect Pans Direet Materials Budget For the Quarter Ended June 30, 2020 15% April May June Puedoetz Broducten 200 7 .XD0 | 1.400 Panids per mit 1010 10 Raw Material nunded in funds 62.000 78.000 114.000 Plus: Desired Enchengl. of OM 11.700 17100 12.500 Total Quality needed 73, 700 95.00 131.500 Less: Beginning invof DM 9.2100 11.400 13.100 Direct matenal purchases 64,400 3.700 119.400 Timas last per pund 0.31 0.32 0.32 Dollar value of goods purchased 26,408 26,784 28,208 Quarter 25.00 10 254.000 22.500 176500 9.300 267,200 0.32 86,504 Rounded Quarter Perfect Pans Cash Payments for Direct Materials For the Quarter Ended June 30, 2020 April May June 40% of current month Om uwch_$1.4.3 1021415283 % of a menthe DM parchet 23.100 12.2.65 A 2070 Totul cash powments for DM31 zuz 23.079 31, 353 purchases 34.240 51.535 Perfect Pans Sales Budget in Units and Dollars For the Quarter Ended June 30, 2020 April May June Quarter budacted units in sales 1.000 1.000 1.000 24.00 42.00 42.00 42.00 Total budgeted sales 262.000 29.cod 42.000 DOLARA June Quarter Perfect Pans Cash Collections Budget For the Quarter Ended June 30, 2020 April May Cash sales Credit sales Tatal.cash collection June Quarter Perfect Pans Direct Labor Budget For the Quarter Ended June 30, 2020 April May Units Produced Direct Tabor Set Total noves required Direct labor cost per hour Total direct laboy cost Perfect Pans Cash Payments for Direct Labor Budget For the Quarter Ended June 30, 2020 April May June Quarter Perfect Pans Combined Cash Budget For the Quarter Ended June 30, 2020 April May June Quarter Beginng cash balance Plus: cash collections Total con cavalade Less: cash payments: Direct mainals Axch Direct Labor Monu. Overhead Operating Expenses Equipment This pauments Total cosh payments Endmo cash bal. before financing financing: Plus: New Borrowings less: Debt repaumenta less: Interest poumont Total Financing Ending Cash balance Per Unit Perfect Pans Budgeted Manufacturing Cost per Unit For the Quarter Ended June 30, 2020 Cost Alemak cost per unit 3.70 Direct lobo est per unit Nor Mohon per unit Fixed MDH tot per unit Erectal cost of manu. an unita2.95 3.25 12.00 Perfect Pans Budgeted Income Statement For the Quarter Ended June 30, 2020 Sales Revenue Less: Cost of Goods sold - Gross Profit 1.00 8.000 (8144. 193,200 9. Balance sheet values 6/30/2020 Accounts Receivable Accounts Payable (material and labor) $_394.000 $_77.150 Direct Materials Inventory (dollars) Cash Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started