Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Im stuck on August 6th, 8th & 10th as well as the last two questions. Nicole's Getaway Spa (NGS) has been so successful that Nicole

Im stuck on August 6th, 8th & 10th as well as the last two questions.

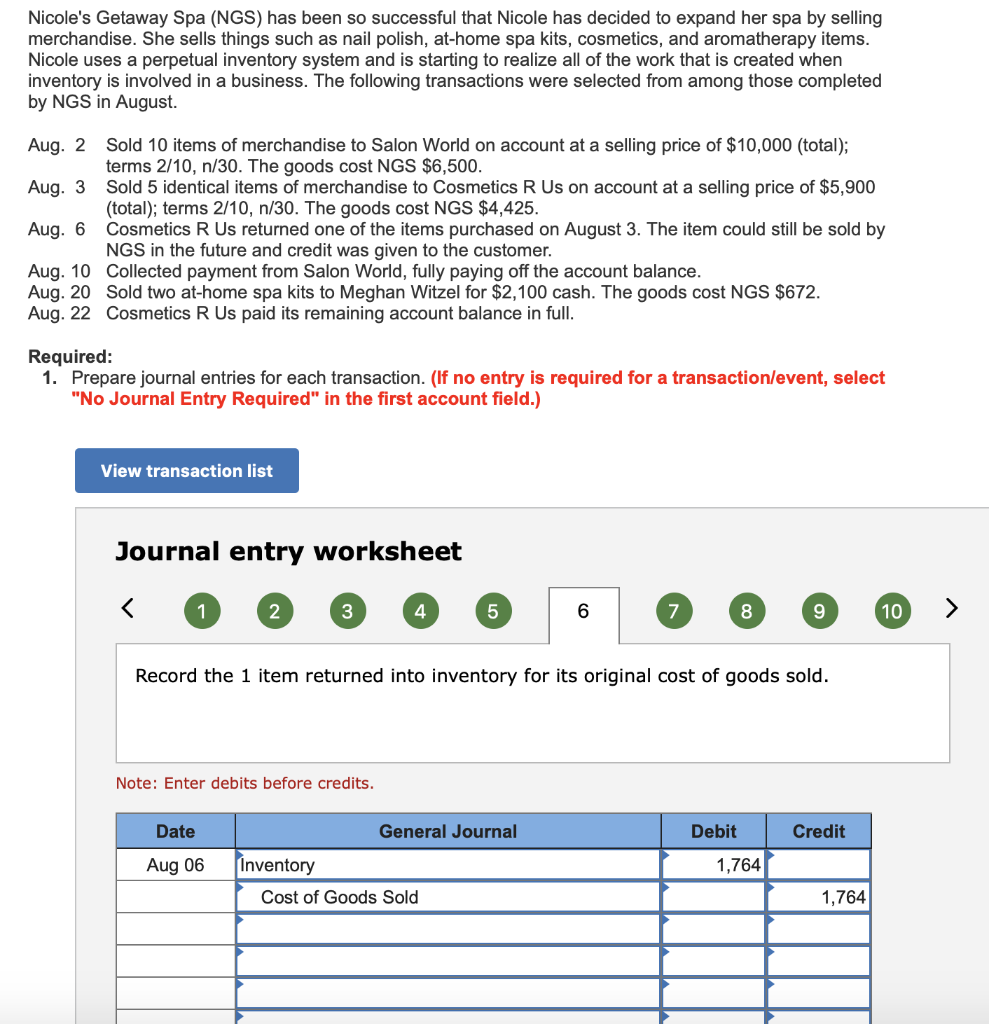

Nicole's Getaway Spa (NGS) has been so successful that Nicole has decided to expand her spa by selling merchandise. She sells things such as nail polish, at-home spa kits, cosmetics, and aromatherapy items. Nicole uses a perpetual inventory system and is starting to realize all of the work that is created when inventory is involved in a business. The following transactions were selected from among those completed by NGS in August. Aug. 2 Sold 10 items of merchandise to Salon World on account at a selling price of $10,000 (total); terms 2/10, n/30. The goods cost NGS $6,500. Aug. 3 Sold 5 identical items of merchandise to Cosmetics R Us on account at a selling price of $5,900 (total); terms 2/10, n/30. The goods cost NGS $4,425. Aug. 6 Cosmetics R Us returned one of the items purchased on August 3. The item could still be sold by NGS in the future and credit was given to the customer. Aug. 10 Collected payment from Salon World, fully paying off the account balance. Aug. 20 Sold two at-home spa kits to Meghan Witzel for $2,100 cash. The goods cost NGS $672. Aug. 22 Cosmetics R Us paid its remaining account balance in full. Required: 1. Prepare journal entries for each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet Ko @ @ @ 6 0 0 O O , Record the 1 item returned into inventory for its original cost of goods sold. Note: Enter debits before credits. Credit Date Aug 06 General Journal Inventory Cost of Goods Sold Debit 1,764 1,764Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started