Answered step by step

Verified Expert Solution

Question

1 Approved Answer

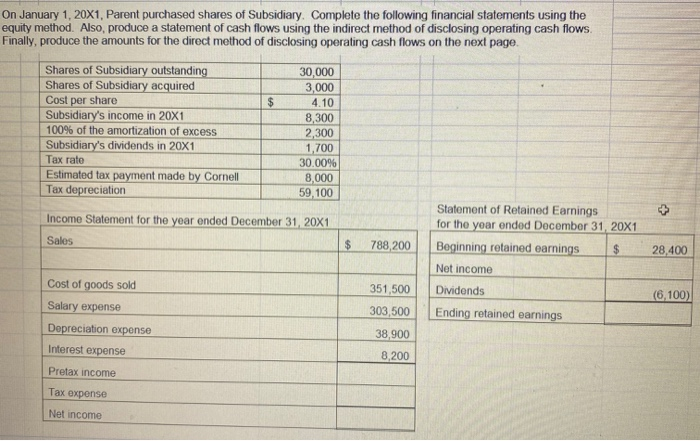

I'm trying to find the total operating, investing, and financing cash flows. On January 1, 20X1. Parent purchased shares of Subsidiary. Complete the following financial

I'm trying to find the total operating, investing, and financing cash flows.

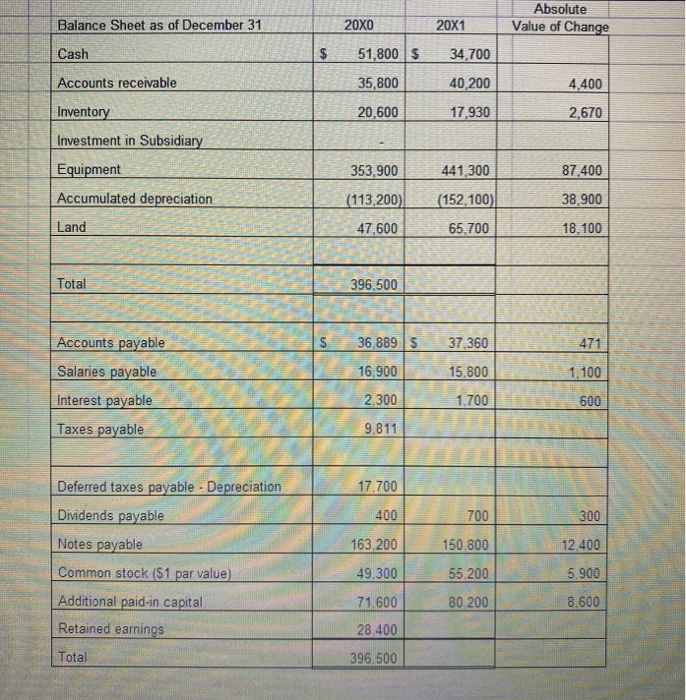

On January 1, 20X1. Parent purchased shares of Subsidiary. Complete the following financial statements using the equity method. Also, produce a statement of cash flows using the indirect method of disclosing operating cash flows Finally, produce the amounts for the direct method of disclosing operating cash flows on the next page Shares of Subsidiary outstanding 30,000 Shares of Subsidiary acquired 3,000 Cost per share $ 4.10 Subsidiary's income in 20X1 8,300 100% of the amortization of excess 2,300 Subsidiary's dividends in 20X1 1,700 Tax rate 30.00% Estimated tax payment made by Cornell 8,000 Tax depreciation 59,100 Statement of Retained Earnings Income Statement for the year ended December 31, 20X1 for the year ended December 31, 20X1 Sales $ 788 200 Beginning retained earnings $ 28,400 Net income Cost of goods sold Salary expense Depreciation expense 351,500 303,500 (6,100) Dividends Ending retained earnings 38,900 Interest expense 8,200 Pretax income Tax expense Net income Balance Sheet as of December 31 20x0 Absolute Value of Change 20X1 Cash $ 51,800 $ 34,700 Accounts receivable 35,800 40,200 4,400 2,670 20,600 17,930 Inventory Investment in Subsidiary 353,900 441,300 87.400 Equipment Accumulated depreciation (113,200) 38,900 (152, 100) 65,700 Land 47,600 18,100 Total 396,500 Accounts payable $ 36.889S 37-360 471 16.900 15.800 1,100 Salaries payable Interest payable 2.300 1.700 600 Taxes payable 9.811 17,700 400 700 300 163,200 150.800 12.400 Deferred taxes payable - Depreciation Dividends payable Notes payable Common stock (S1 par value) Additional paid-in capital Retained earnings 49.300 55,200 5.900 71,600 80.200 8,600 28.400 Total 396,500 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started