Answered step by step

Verified Expert Solution

Question

1 Approved Answer

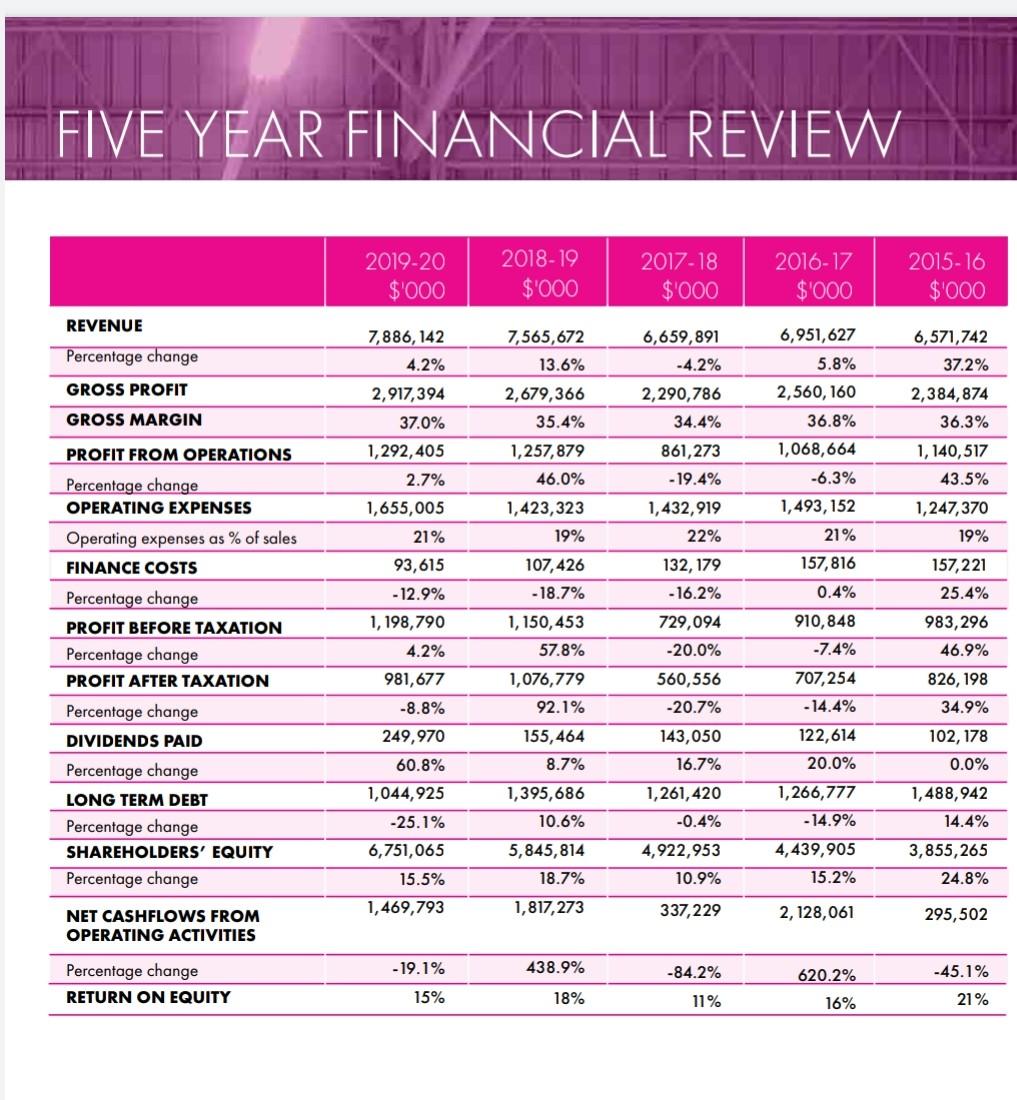

I'm using lasco manufacturing limited financial statement FIVE YEAR FINANCIAL REVIEW 2019-20 $'000 2018-19 $'000 2017-18 $'000 2016-17 $'000 2015-16 $'000 REVENUE Percentage change 7,886,

I'm using lasco manufacturing limited financial statement

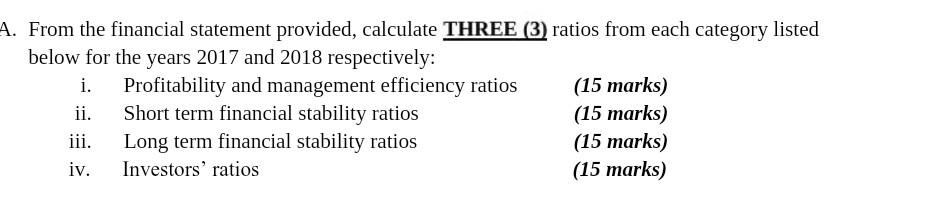

FIVE YEAR FINANCIAL REVIEW 2019-20 $'000 2018-19 $'000 2017-18 $'000 2016-17 $'000 2015-16 $'000 REVENUE Percentage change 7,886, 142 4.2% 7,565,672 13.6% GROSS PROFIT GROSS MARGIN PROFIT FROM OPERATIONS 6,659,891 -4.2% 2,290,786 34.4% 861,273 - 19.4% 1,432,919 22% 132,179 2,917,394 37.0% 1,292,405 2.7% 1,655,005 21% 93,615 - 12.9% 1,198,790 4.2% 6,951,627 5.8% 2,560, 160 36.8% 1,068,664 -6.3% 1,493, 152 21% 157,816 0.4% 6,571,742 37.2% 2,384,874 36.3% 1, 140,517 43.5% 1,247,370 19% Percentage change OPERATING EXPENSES Operating expenses as % of sales FINANCE COSTS 157,221 25.4% Percentage change PROFIT BEFORE TAXATION Percentage change PROFIT AFTER TAXATION Percentage change DIVIDENDS PAID 2,679,366 35.4% 1,257,879 46.0% 1,423,323 19% 107,426 - 18.7% 1,150,453 57.8% 1,076,779 92.1% 155,464 8.7% 1,395,686 10.6% - 16.2% 729,094 -20.0% 560,556 -20.7% 143,050 16.7% 1,261,420 -0.4% 4,922,953 10.9% 910,848 -7.4% 707,254 - 14.4% 122,614 20.0% 981, 677 -8.8% 249,970 60.8% 1,044,925 -25.1% 6,751,065 15.5% 1,469,793 983,296 46.9% 826, 198 34.9% 102,178 0.0% 1,488,942 14.4% 3,855,265 24.8% Percentage change LONG TERM DEBT Percentage change SHAREHOLDERS' EQUITY Percentage change 1,266,777 - 14.9% 4,439,905 15.2% 5,845,814 18.7% 1,817,273 337,229 2, 128,061 295,502 NET CASHFLOWS FROM OPERATING ACTIVITIES 438.9% -84.2% Percentage change RETURN ON EQUITY - 19.1% 15% 620.2% -45.1% 21% 18% 11% 16% A. From the financial statement provided, calculate THREE (3) ratios from each category listed below for the years 2017 and 2018 respectively: i. Profitability and management efficiency ratios (15 marks) ii. Short term financial stability ratios (15 marks) iii. Long term financial stability ratios (15 marks) iv. Investors' ratios (15 marks) 1. Each group must select the annual report for ONE (1) of three companies listed on the Jamaica Stock Exchange that belongs to the same industry (No two groups should be investigating the same company). The companies to choose from are: i. Salada Foods Jamaica Limited ii. Seprod Jamaica Ltd iii. Lasco Manufacturing Limited Please review the financial statements for the years 2017 and 2018 and perform the tasks below. A. From the financial statement provided, calculate THREE (3) ratios from each category listed below for the years 2017 and 2018 respectively: i. Profitability and management efficiency ratios (15 marks) ii. Short term financial stability ratios (15 marks) iii. Long term financial stability ratios (15 marks) iv. Investors' ratios (15 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started