Answered step by step

Verified Expert Solution

Question

1 Approved Answer

;; I'm very appreciative the expert help me to solve these questions! Wu Equipment Company manufactures and distributes industrial air compressors. The following data are

;;

;;

I'm very appreciative the expert help me to solve these questions!

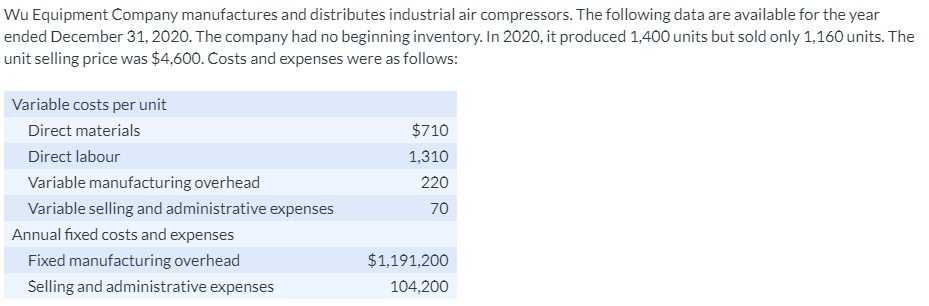

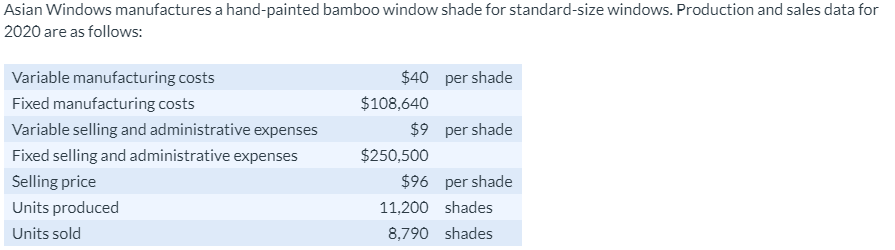

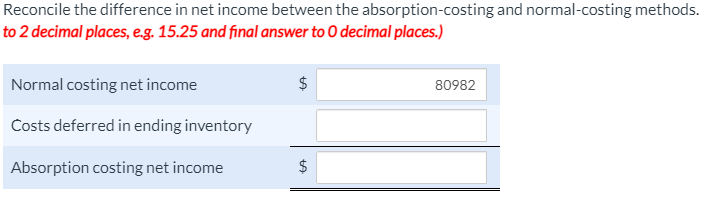

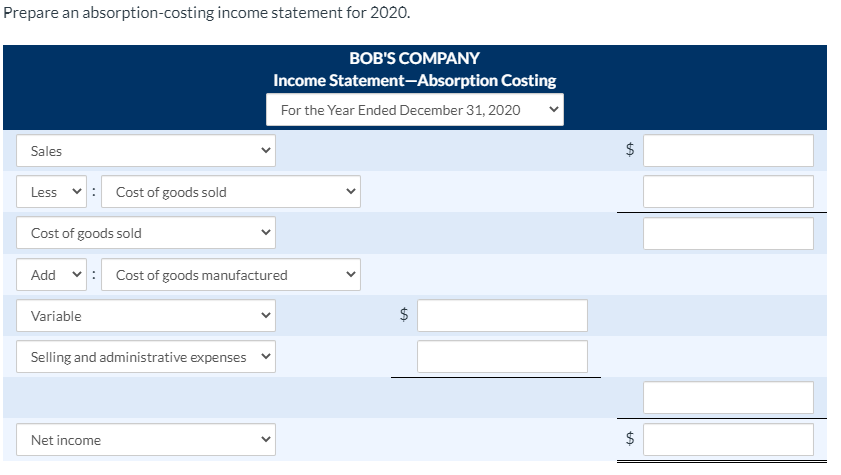

Wu Equipment Company manufactures and distributes industrial air compressors. The following data are available for the year ended December 31, 2020. The company had no beginning inventory. In 2020, it produced 1,400 units but sold only 1,160 units. The unit selling price was $4,600. Costs and expenses were as follows: Variable costs per unit Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative expenses Annual fixed costs and expenses Fixed manufacturing overhead Selling and administrative expenses $710 1,310 220 70 $1,191,200 104,200 Prepare a 2020 income statement for Wu Company using throughput costing. WU EQUIPMENT COMPANY Income Statement For the Year Ended December 31, 2020 Throughput Costing Sales $ 5336000 Less Cost of goods sold 823600 i Throughput contribution margin 4512400 Less : Operating expenses Direct labour costs $ 1519600 > Variable manufacturing overhead 255200 Fixed manufacturing overhead 1191200 i Variable selling and administrative expenses 81200 i Fixed selling and administrative expenses 104200 i Total operating expenses 3151400 Net income $ $ 1361000 Asian Windows manufactures a hand-painted bamboo window shade for standard-size windows. Production and sales data for 2020 are as follows: Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative expenses Fixed selling and administrative expenses Selling price Units produced Units sold $40 per shade $108,640 $9 per shade $250,500 $96 per shade 11,200 shades 8,790 shades Reconcile the difference in net income between the absorption-costing and normal-costing methods. to 2 decimal places, e.g. 15.25 and final answer to 0 decimal places.) Normal costing net income $ 80982 Costs deferred in ending inventory Absorption costing net income $ Bob's Company builds custom fishing lures for sporting goods stores. In its first year of operations, 2020, the company incurred the following costs: Variable cost per unit Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative expenses Fixed costs for year Fixed manufacturing overhead Fixed selling and administrative expenses $6.60 2.80 5.90 3.85 $316,140 241,000 Bob's Company sells the fishing lures for $26. During 2020, the company sold 70.000 lures and produced 95.800 lures. Prepare an absorption-costing income statement for 2020. BOB'S COMPANY Income Statement-Absorption Costing For the Year Ended December 31, 2020 Sales $ $ Less: Cost of goods sold Cost of goods sold Add : Cost of goods manufactured Variable $ Selling and administrative expenses Net income $ $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started