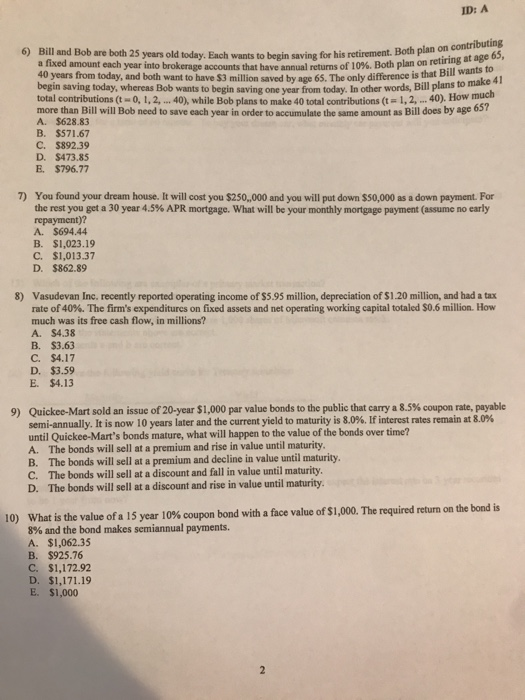

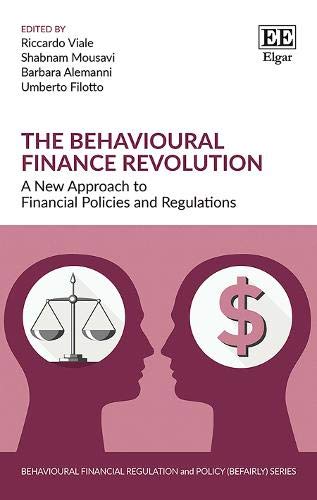

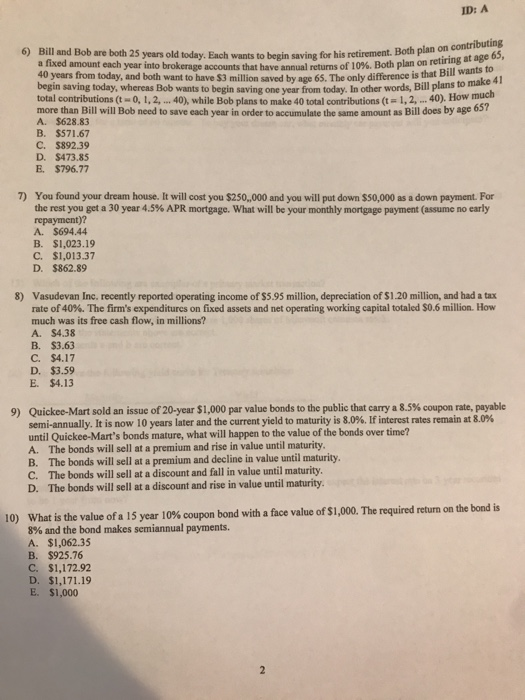

Im very confused by these and would appreciate any help and explanations

ID: A 6) Bill and Bob are both 25 years old today. Each wants to begin saving for his retirement. Both plan on contributing a fixed amount each year into brokerage accounts that have annual returns of 10%. Both plan on retiring at age 65, 40 years from today, and both want to have $3 million saved by age 65. The only difference is that Bill wants to begin saving today, whereasBob wants to begin saving one year from today. In other words, Bill plans to make 41 total contributions (t0, 1, 2, 40), while Bob plans to make 40 total comtributions (t= 1, 2,.. 40). How much more than Bill will Bob need to save each year in order to accumulate the same amount as Bill does by age 657 A. $628.83 B. $571.67 C. $892.39 D. $473.85 E. $796.77 7) You found your dream house. It will cost you $250,000 and you will put down $50,000 as a down payment. For the rest you get a 30 year 4.5% APR mortgage. What will be your monthly mortgage payment (assume no early repayment)? A. $694 B. $1,023.19 C. $1,013.37 D. $862.89 8) Vasudevan Inc. recently reported operating income of $5.95 million, depreciation of $1.20 million, and had a tax rate of 40%. The firm's expenditures on fixed assets and net operating working capital totaled $0.6 million. How much was its free cash flow, in millions? A. $4.38 $3.63 B. $4.17 D. $3.59 E. $4.13 C. 9) Quickee-Mart sold an issue of 20-year $1,000 par value bonds to the public that carry a 8.5 % coupon rate, payable semi-annually. It is now 10 years later and the current yield to maturity is 8.0 %. If interest rates remain at 8.0 % until Quickee-Mart's bonds mature, what will happen to the value of the bonds over time? A. The bonds will sell at a premium and rise in value until maturity. B. The bonds will sell at a premium and decline in value until maturity. C. The bonds will sell at a discount and fall in value until maturity. D. The bonds will sell at a discount and rise in value until maturity 10) What is the value of a 15 year 10% coupon bond with a face value of $1,000. The required return on the bond is 8% and the bond makes semiannual payments. A. $1,062.35 B. $925.76 C. $1,172.92 D. $1,171.19 E. $1,000 2