Answered step by step

Verified Expert Solution

Question

1 Approved Answer

IMA EDUCATIONAL Case Journal Case The Association of ima Accountants and Financial Professionals Study in Business ISSN 1940-204X EcoBags, Inc.: Production Planning in a

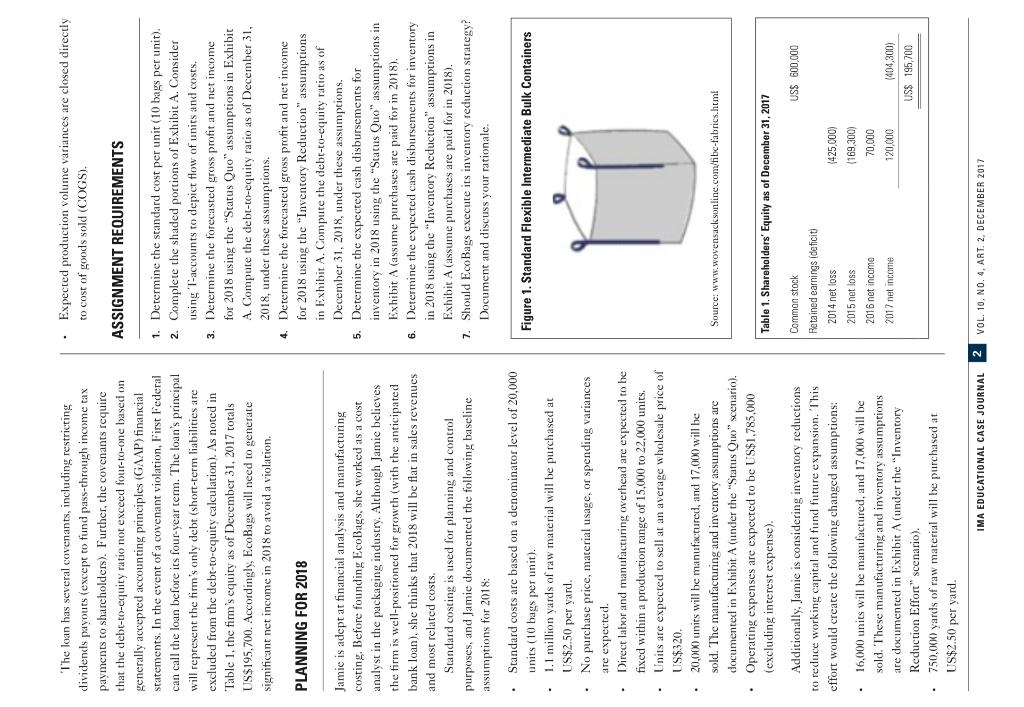

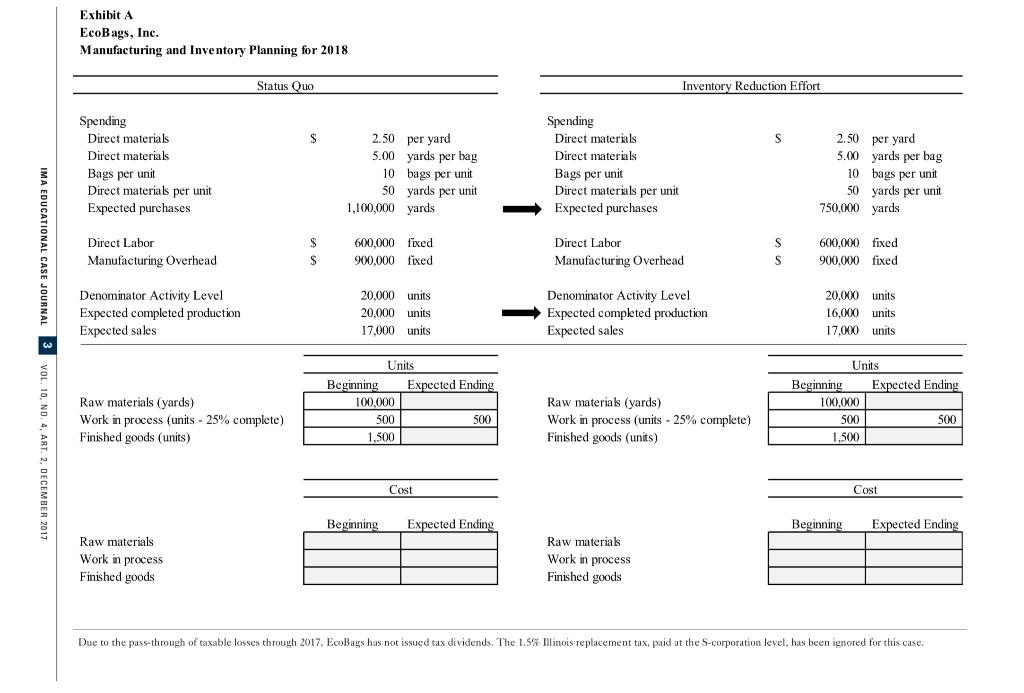

IMA EDUCATIONAL Case Journal Case The Association of ima Accountants and Financial Professionals Study in Business ISSN 1940-204X EcoBags, Inc.: Production Planning in a Standard Cost Environment David L. Gray North Central College Naperville, II. INTRODUCTION Jamie founded the business with a personal investment of US$100,000. Additionally, she secured funding from Horizon Capital Partners, a private equity firm that invests in startups focused on sustainable products. Horizon contributed US$500,000 in exchange for a 20% equity stake in EcoBags. Jamie Matthews couldn't believe it had been four years since she founded EcoBags, Inc. The firm manufactures industrial bags called flexible intermediate bulk containers (FIBCS) in a rented facility in the Chicago suburb of Woodlawn and operates as an Illinois S-corporation. It was March 2018, and CURRENT SITUATION EcoBags recently wrapped up its fiscal year-end reporting for the 2017 calendar year. Management was finalizing financial and manufacturing plans for 2018. Through cautious and steady growth, the business has expanded to approximately US$5 million in revenues for the year ended December 31, 2017. EcoBags has financed operations using the initial equity investments and cash PRODUCT AND COMPANY BACKGROUND from operations. After two years of initial losses, EcoBags FIBCS have become a popular means for shipping and storing generated net income in 2016 and 2017. Jamie believed the firm was ready for faster growth and considered expanding the firm's product line and geographic industrial products over the past 20 years. The standard FIBC is 35" x 35" x 40" with handles so that the bags can be moved by forklifts. Figure 1 depicts the standard FIBC. footprint. However, the firm needed additional equipment The bags' popularity and simple construction have led to to achieve this growth. Horizon has expressed a willingness for an additional equity investment; however, Jamie would significant market competition. Recently, firms have developed FIBCS from woven polypropylene plastic. The polypropylene prefer not to dilute her ownership interest. Accordingly, she bags have a longer useful life and are easier to clean than approached several banks about providing debt to finance the traditional cloth bags. Further, the plastic weave allows capital investments. materials to be washed and drained in place-an attractive DEBT FINANCING feature for many of the bags' applications. While polypropylene bags have become the industry standard, other manufacturers Jamie received proposals from several banks, but First Federal Bank seems to be the best option based on EcoBags needs. require virgin plastic to make their bags. Five years ago, however, Jamie developed a proprietary and patented process to fuse recycled polypropylene sheets into FIBCS. While the bags The proposed loan is for US$1.5 million over four years at a 7% are slightly more expensive than other plastic FIBCS, they have annual rate. The requires monthly interest payments, but become popular because of their environmental sustainability. the principal is not repaid until the end of the four-year term. The loan is expected to commence on July 1, 2018. IMA EDUCATIONAL CASE JOURNAL VOL. 10, NO. 4, ART. 2, DECEMBER 2017 2017 IMA The loan has several covenants, including restricting Expected production volume variances are closed directly to cost of goods sold (COGS). dividends payouts (except to fund pass-through income tax payments to shareholders). Further, the covenants require that the debt-to-equity ratio not exceed four-to-one based on ASSIGNMENT REQUIREMENTS generally accepted accounting principles (GAAP) financial statements. In the event of a covenant violation, First Federal 1. Determine the standard cost per unit (10 bags per unit). 2. Complete the shaded portions of Exhibit A. Consider using T-accounts to depict flow of units and costs, 3. Determine the forecasted gross profit and net income for 2018 using the "Status Quo" assumptions in Exhibit A. Compute the debt-to-equity ratio as of December 31, 2018, under these assumptions. 4. Determine the forecasted gross profit and net income for 2018 using the "Inventory Reduction" assumptions in Exhibit A. Compute the debt-to-equity ratio as of can call the loan before its four-year term. The loan's principal will represent the firm's only debt (short-term liabilities are excluded from the debt-to-cquity calculation). As noted in Table 1, the fim's equity as of December 31, 2017 totals US$195,700. Accordingly, EcoBags will need to generate significant net income in 2018 to avoid a violation. PLANNING FOR 2018 December 31, 2018, under these assumptions. Jamie is adept at financial analysis and manufacturing costing. Before founding EcoBags, she worked as a cost 5. Determine the expected cash disbursements for analyst in the packaging industry. Although Jamie believes inventory in 2018 using the "Status Quo" assumptions in the firm is well-positioned for growth (with the anticipated Exhibit A (assume purchases are paid for in 2018). 6. Determine the expected cash disbursements for inventory in 2018 using the "Inventory Reduction" assumptions in Exhibit A (assume purchases are paid for in 2018). 7. Should EcoBags execute its inventory reduction strategy? Document and discuss your rationale. bank loan), she thinks that 2018 will be flat in sales revenues and most related costs. Standard costing is used for planning and control purposes, and Jamie documented the following baseline assumptions for 2018: Standard costs are based on a denominator level of 20,000 Figure 1. Standard Flexible Intermediate Bulk Containers (10 bags per unit). 1.1 million yards of raw material will be purchased at US$2.50 per yard. No purchase price, material usage, or spending variances are expected. Direct labor and manufacturing overhead are expected to be fixed within a production range of 15,000 to 22,000 units. Units are expected to sell at an average wholesale price of US$320. 20,000 units will be manufactured, and 17,000 will be sold. The manufacturing and inventory assumptions are Source: www.wovensacksonline.com/fibc-fabrics.html documented in Exhibit A (under the "Status QuKo" scenario). Operating expenses are expected to be US$1,.785,000 (excluding interest expense). Table 1. Shareholders' Equity as of December 31, 2017 Additionally, Jamie is considering inventory reductions Common stock 000'009 $sn Retained earnings (deficit) to reduce working capital and fund future expansion. This effort would crecate the following changed assumptions: 2014 net loss (D00'SZb) 2015 net loss (169,300) 16,000 units will be manufactured, and 17,000 will be 2016 net income sold. These manufacturing and inventory assumptions 000'0L 2017 net income (404,300) are documented in Exhibit A (under the "Inventory 000'0ZL US$ 195,700 Reduction Effort" scenario). 750,000 yards of raw material will be purchased at US$2.50 per yard. IMA EDUCATIONAL CASE JOURNAL VOL. 10, NO. 4, ART. 2, DECEMBER 2017 Exhibit A EcoBags, Inc. Manufacturing and Inventory Planning for 2018 Status Quo Inventory Reduction Effort Spending Direct materials Spending 2.50 per yard 5.00 yards per bag 10 bags per unit 50 yards per unit 2.50 per yard 5.00 yards per bag 10 bags per unit 50 yards per unit 750,000 yards Direct materials Direct materias Bags per unit Direct materials per unit Direct materials Bags per unit Direct materials per unit Expected purchases 1,100,000 yards Expected purchases Direct Labor 600,000 fixed Direct Labor 600,000 fixed Manufacturing Overhead %2$ 900,000 fixed Manufacturing Overhead S 900,000 fixed Denominator Activity Level 20,000 units Denominator Activity Level Expected completed production Expected sales 20,000 units Expected completed production Expected sales 20,000 units 16,000 units 17,000 units 17,000 units Units Units Expected Ending Expected Ending Beginning 100,000 Beginning 100,000 Raw materials (yards) Work in process (units - 25% complete) Finished goods (units) Raw materiaks (yards) Work in process (units - 25% complete) Finished goods (units) 500 500 500 500 1,500 1,500 Cost Cost Beginning Expected Ending Beginning Expected Ending Raw materials Raw materiak Work in process Finished goods Work in process Finished goods Due to the pass-through of taxable losses through 2017, EcoBags has not issued tax dividends. The 1.5% Illinois replacement tax, paid at the S-corporation level, has been ignored for this case. IMA EDUCATIONAL CASE JOURNAL 3 VOL. 10, NO. 4, ART. 2, DECEMBER 201

Step by Step Solution

★★★★★

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Status Quo Units Beginning Expected Ending Raw materials yards 100000 200000 Work in process units 25 complete 500 500 Finished goods units 1500 4500 Cost Beginning Expected Ending Raw materials 25000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started