Image #1

Using the information above, Compute the Following:

1)

2)

3)

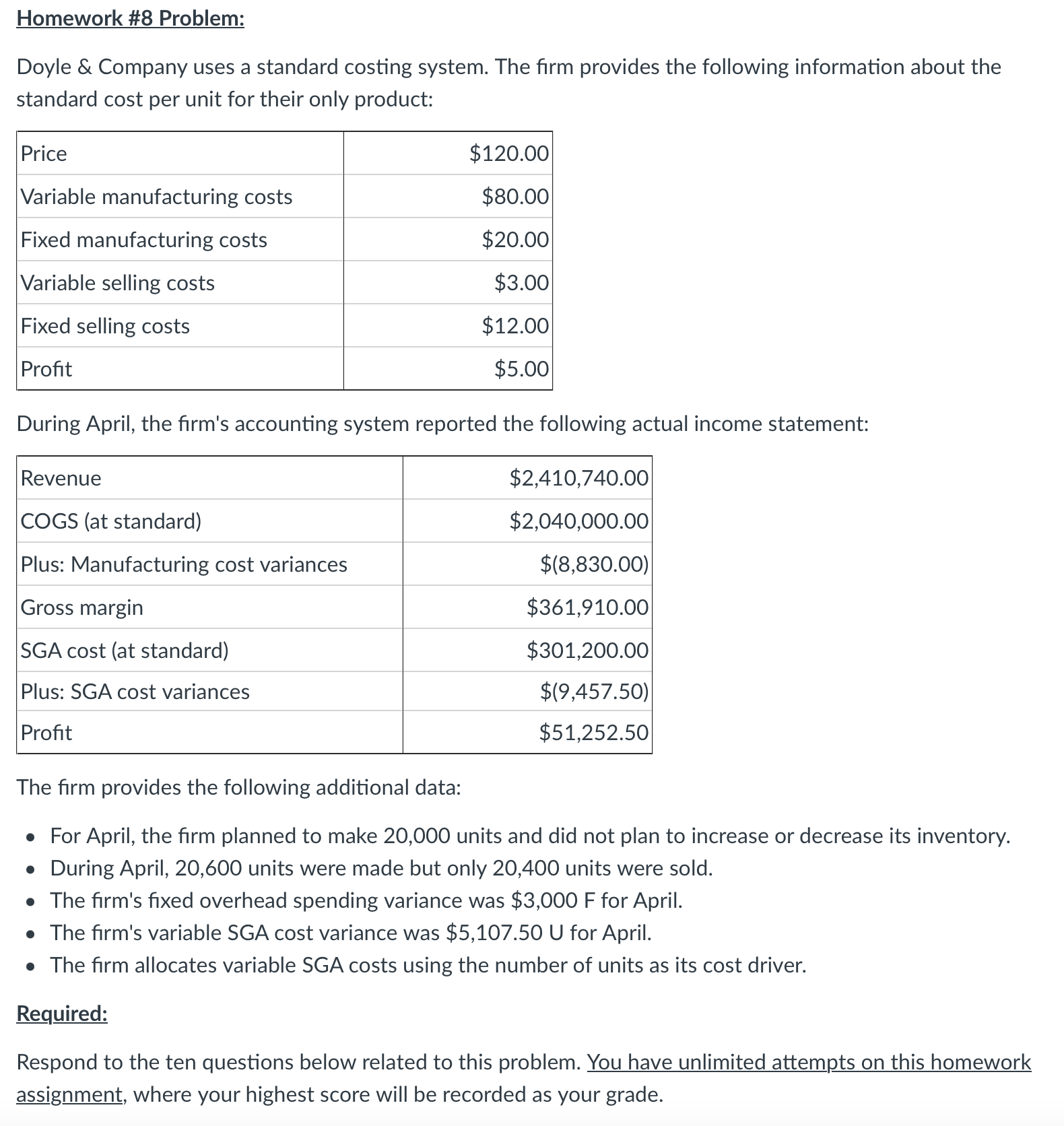

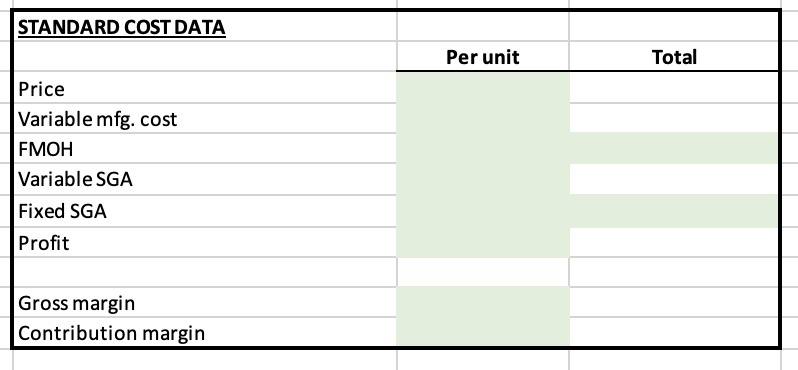

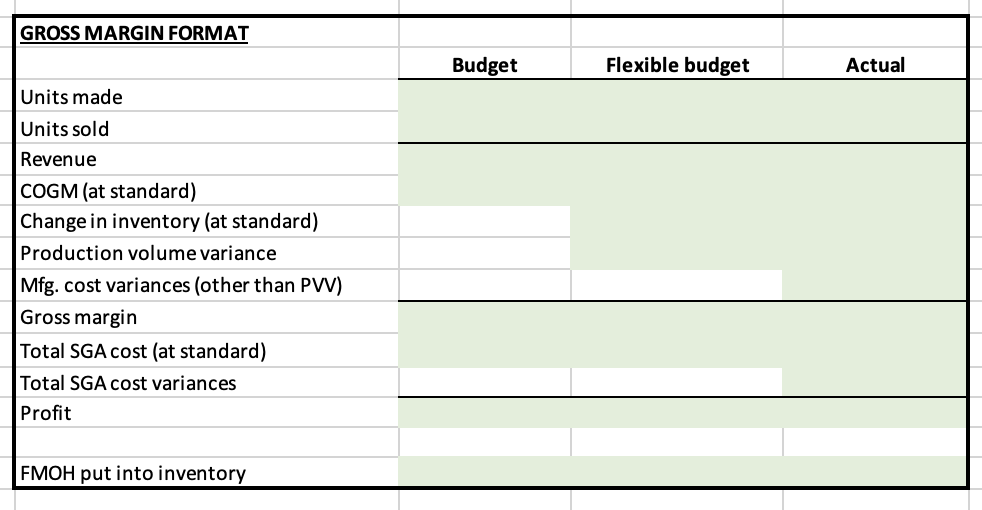

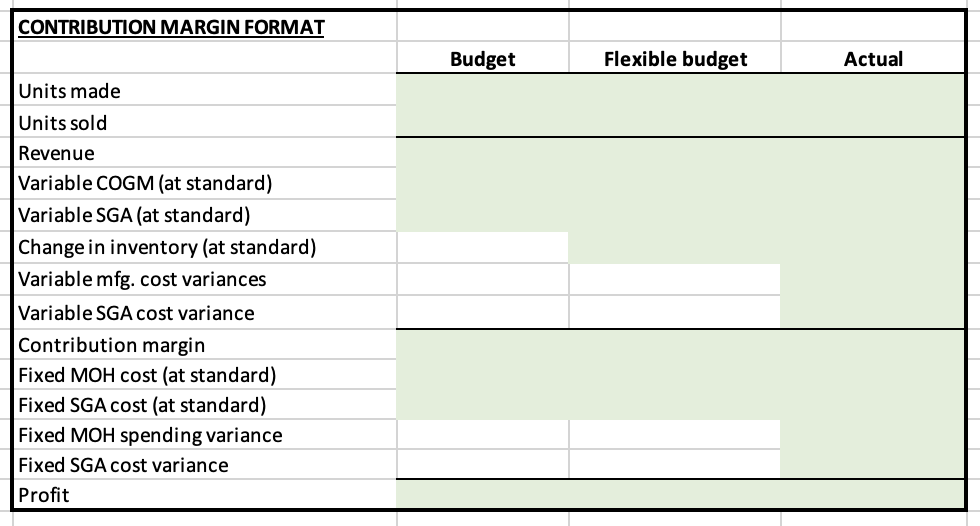

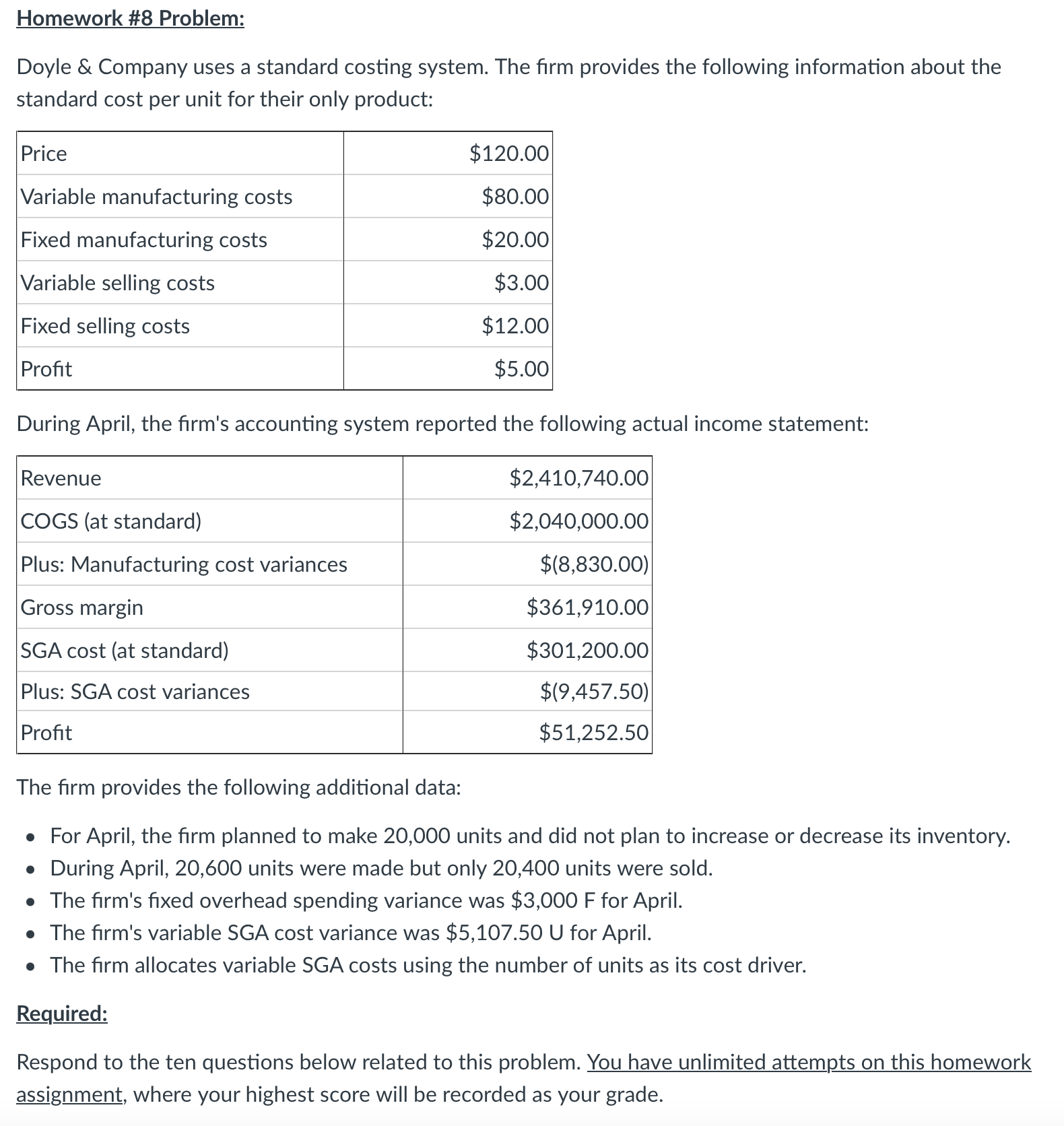

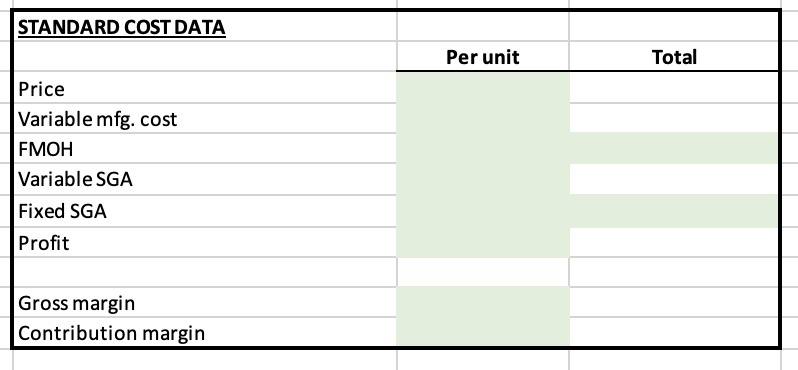

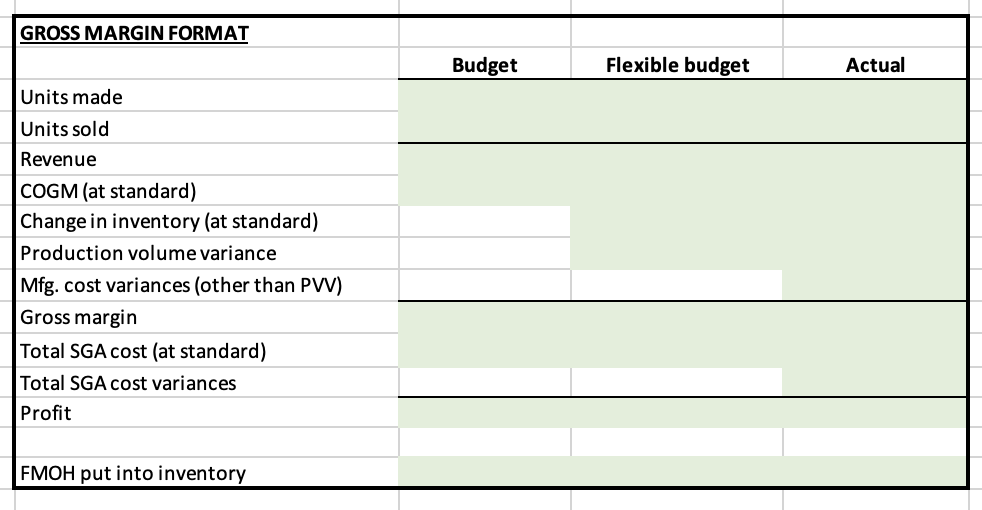

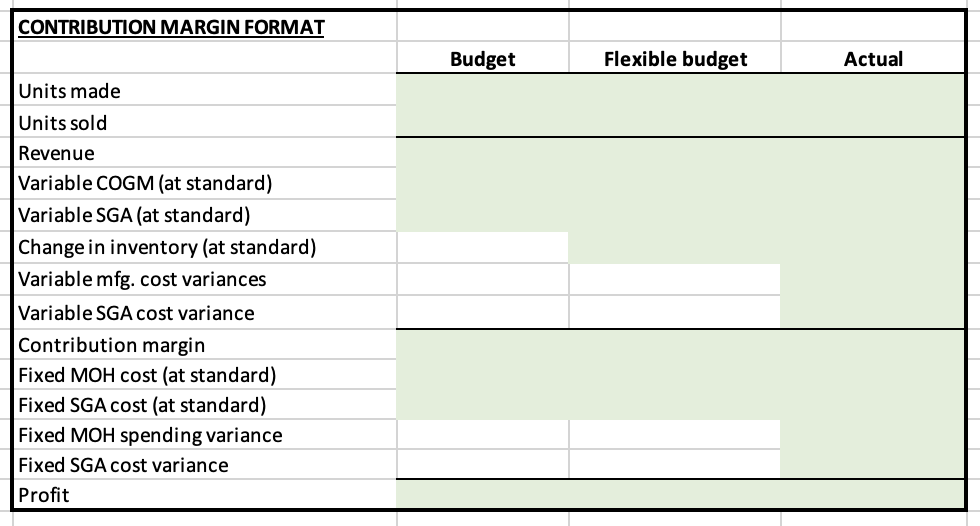

Homework \#8 Problem: Doyle \& Company uses a standard costing system. The firm provides the following information about the standard cost per unit for their only product: During April, the firm's accounting system reported the following actual income statement: The firm provides the following additional data: - For April, the firm planned to make 20,000 units and did not plan to increase or decrease its inventory. - During April, 20,600 units were made but only 20,400 units were sold. - The firm's fixed overhead spending variance was $3,000F for April. - The firm's variable SGA cost variance was $5,107.50 U for April. - The firm allocates variable SGA costs using the number of units as its cost driver. Required: Respond to the ten questions below related to this problem. You have unlimited attempts on this homework assignment, where your highest score will be recorded as your grade. \begin{tabular}{|c|c|c|} \hline \multirow[t]{2}{*}{ STANDARD COST DATA } & & \\ \hline & Per unit & Total \\ \hline \multicolumn{3}{|l|}{ Price } \\ \hline \multicolumn{3}{|l|}{ Variable mfg. cost } \\ \hline \multicolumn{3}{|l|}{FMOH} \\ \hline \multicolumn{3}{|l|}{ Variable SGA } \\ \hline \multicolumn{3}{|l|}{ Fixed SGA } \\ \hline \multicolumn{3}{|l|}{ Profit } \\ \hline \multicolumn{3}{|l|}{ Gross margin } \\ \hline Contribution margin & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|l|}{ CONTRIBUTION MARGIN FORMAT } \\ \hline & Budget & Flexible budget & Actual \\ \hline \multicolumn{4}{|l|}{ Units made } \\ \hline \multicolumn{4}{|l|}{ Units sold } \\ \hline \multicolumn{4}{|l|}{ Revenue } \\ \hline \multicolumn{4}{|l|}{ Variable COGM (at standard) } \\ \hline \multicolumn{4}{|l|}{ Variable SGA (at standard) } \\ \hline \multicolumn{4}{|l|}{ Change in inventory (at standard) } \\ \hline \multicolumn{4}{|l|}{ Variable mfg. cost variances } \\ \hline \multicolumn{4}{|l|}{ Variable SGA cost variance } \\ \hline \multicolumn{4}{|l|}{ Contribution margin } \\ \hline \multicolumn{4}{|l|}{ Fixed MOH cost (at standard) } \\ \hline \multicolumn{4}{|l|}{ Fixed SGA cost (at standard) } \\ \hline \multicolumn{4}{|l|}{ Fixed MOH spending variance } \\ \hline \multicolumn{4}{|l|}{ Fixed SGA cost variance } \\ \hline Profit & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multirow[t]{2}{*}{ GROSS MARGIN FORMAT } & & & \\ \hline & Budget & Flexible budget & Actual \\ \hline \multicolumn{4}{|l|}{ Units made } \\ \hline \multicolumn{4}{|l|}{ Units sold } \\ \hline \multicolumn{4}{|l|}{ Revenue } \\ \hline \multicolumn{4}{|l|}{ COGM (at standard) } \\ \hline \multicolumn{4}{|l|}{ Change in inventory (at standard) } \\ \hline \multicolumn{4}{|l|}{ Production volume variance } \\ \hline \multicolumn{4}{|l|}{ Mfg. cost variances (other than PVV) } \\ \hline \multicolumn{4}{|l|}{ Gross margin } \\ \hline \multicolumn{4}{|l|}{ Total SGA cost (at standard) } \\ \hline \multicolumn{4}{|l|}{ Total SGA cost variances } \\ \hline \multicolumn{4}{|l|}{ Profit } \\ \hline FMOH put into inventory & & & \\ \hline \end{tabular}