Question

1. For each of the two scenarios below, please answer the following questions: (50 points, 25 points for scenario; see details for each question).

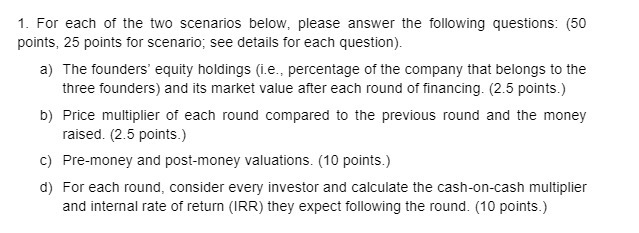

1. For each of the two scenarios below, please answer the following questions: (50 points, 25 points for scenario; see details for each question). a) The founders' equity holdings (i.e., percentage of the company that belongs to the three founders) and its market value after each round of financing. (2.5 points.) b) Price multiplier of each round compared to the previous round and the money raised. (2.5 points.) c) Pre-money and post-money valuations. (10 points.) d) For each round, consider every investor and calculate the cash-on-cash multiplier and internal rate of return (IRR) they expect following the round. (10 points.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainly Here are the details for scenario A Financing Rounds Round 1 Seed funding Round 2 Series A ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Management Accounting And Control

Authors: Don R. Hansen, Maryanne M. Mowen, Liming Guan

6th Edition

324559674, 978-0324559675

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App