Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BEAM047-Exam Paper_BEAM047R-AUG22 (1).pdf - Adobe Acrobat Reader DC (64-bit) File Edit View Sign Window Help Home Tools BEAM047-Exam_Pa... x 26C Sunny 3 / 4

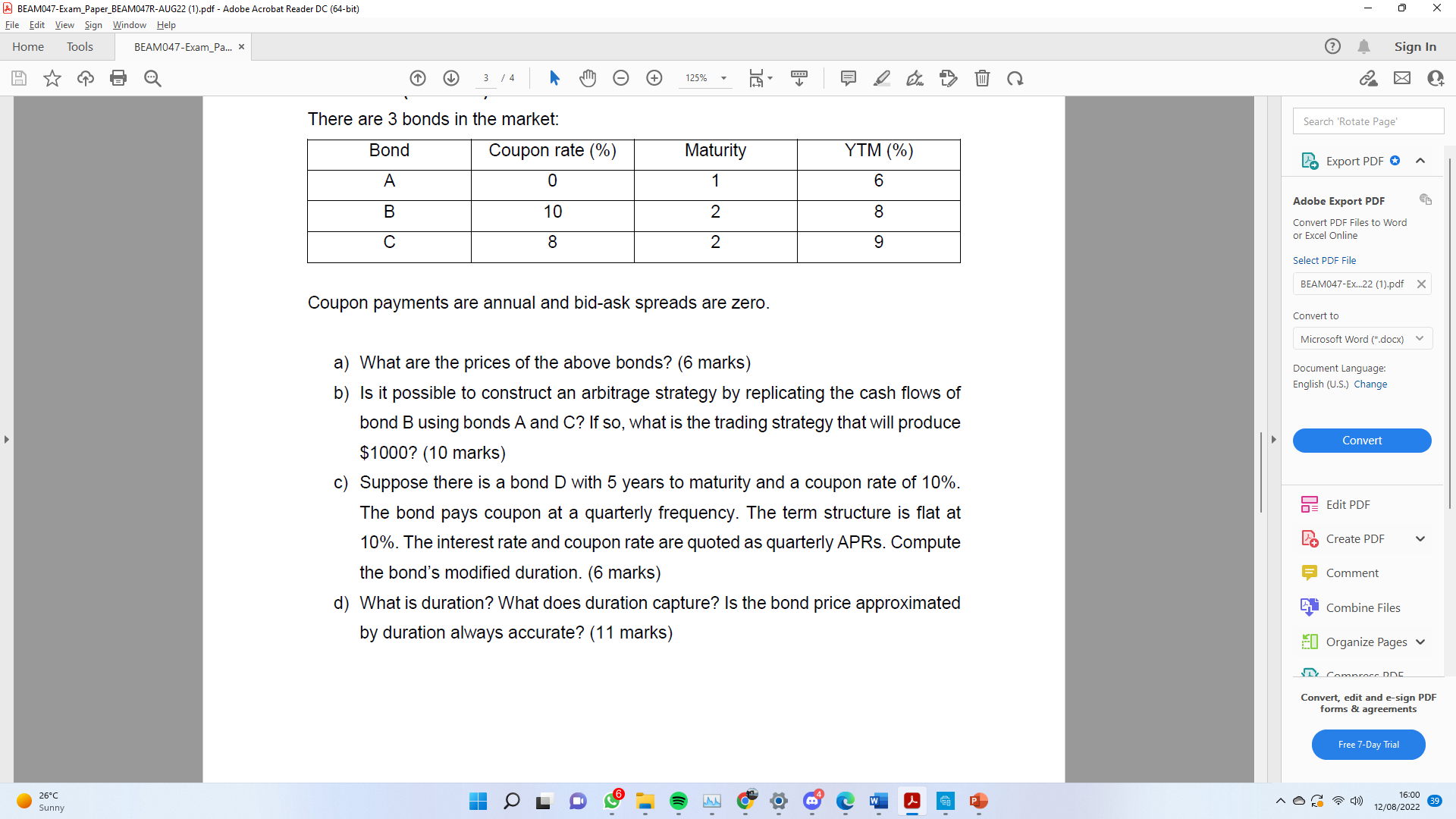

BEAM047-Exam Paper_BEAM047R-AUG22 (1).pdf - Adobe Acrobat Reader DC (64-bit) File Edit View Sign Window Help Home Tools BEAM047-Exam_Pa... x 26C Sunny 3 / 4 125% 0 Sign In There are 3 bonds in the market: Bond A B C Coupon rate (%) 0 Maturity YTM (%) 1 6 10 8 2 2 8 9 Coupon payments are annual and bid-ask spreads are zero. a) What are the prices of the above bonds? (6 marks) b) Is it possible to construct an arbitrage strategy by replicating the cash flows of bond B using bonds A and C? If so, what is the trading strategy that will produce $1000? (10 marks) c) Suppose there is a bond D with 5 years to maturity and a coupon rate of 10%. The bond pays coupon at a quarterly frequency. The term structure is flat at 10%. The interest rate and coupon rate are quoted as quarterly APRs. Compute the bond's modified duration. (6 marks) d) What is duration? What does duration capture? Is the bond price approximated by duration always accurate? (11 marks) Search 'Rotate Page' Export PDF Adobe Export PDF Convert PDF Files to Word or Excel Online Select PDF File BEAM047-Ex...22 (1).pdf x Convert to Microsoft Word (*.docx) Document Language: English (U.S.) Change Convert Edit PDF Create PDF Comment Combine Files Organize Pages Comprocs DDC Convert, edit and e-sign PDF forms & agreements Free 7-Day Trial Q 16:00 12/08/2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the prices of the bonds we use the formula for the present value of a bonds cash flow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started