Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BEAM047-Exam Paper_BEAM047R-AUG22 (1).pdf - Adobe Acrobat Reader DC (64-bit) File Edit View Sign Window Help Home Tools 26C Sunny BEAM047-Exam_Pa... x 2 / 4

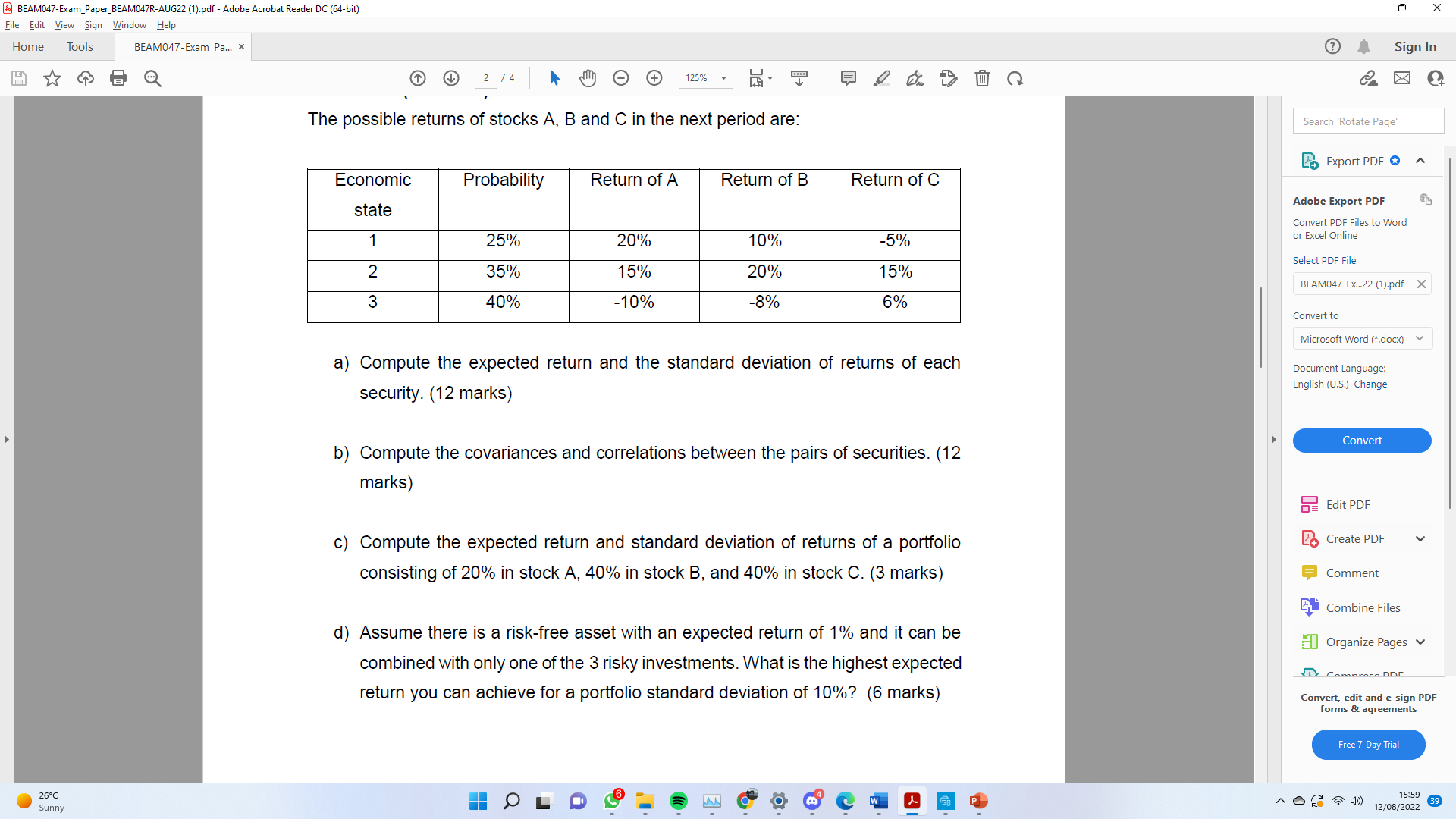

BEAM047-Exam Paper_BEAM047R-AUG22 (1).pdf - Adobe Acrobat Reader DC (64-bit) File Edit View Sign Window Help Home Tools 26C Sunny BEAM047-Exam_Pa... x 2 / 4 125% wwww The possible returns of stocks A, B and C in the next period are: Economic Probability Return of A Return of B Return of C state 1 25% 20% 10% -5% 2 35% 15% 20% 15% 3 40% -10% -8% 6% 0 Sign In Search 'Rotate Page' Export PDF Adobe Export PDF Convert PDF Files to Word or Excel Online Select PDF File BEAM047-Ex...22 (1).pdf x Convert to Microsoft Word (*.docx) a) Compute the expected return and the standard deviation of returns of each security. (12 marks) b) Compute the covariances and correlations between the pairs of securities. (12 marks) c) Compute the expected return and standard deviation of returns of a portfolio consisting of 20% in stock A, 40% in stock B, and 40% in stock C. (3 marks) d) Assume there is a risk-free asset with an expected return of 1% and it can be combined with only one of the 3 risky investments. What is the highest expected return you can achieve for a portfolio standard deviation of 10%? (6 marks) Document Language: English (U.S.) Change Convert Edit PDF Create PDF Comment Combine Files Organize Pages Comprocs DDC Convert, edit and e-sign PDF forms & agreements Free 7-Day Trial 15:59 12/08/2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate each part step by step a Expected return and standard deviation for each security For stock A ERA 025020 035015 040010 005 text or 5 sigmaA sqrt025020 0052 035015 0052 040010 0052 sigma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started