Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AutoSave O OFF A A P . G ... AC PAINTERS_Ratio Calculations - Solvency v Q Home Insert Draw Page Layout Formulas Data Review View

Calculate the Solvency Ratios.

The first ratio (current ratio) has been calculated for you.

Complete the other solvency ratios, along with an explanation.

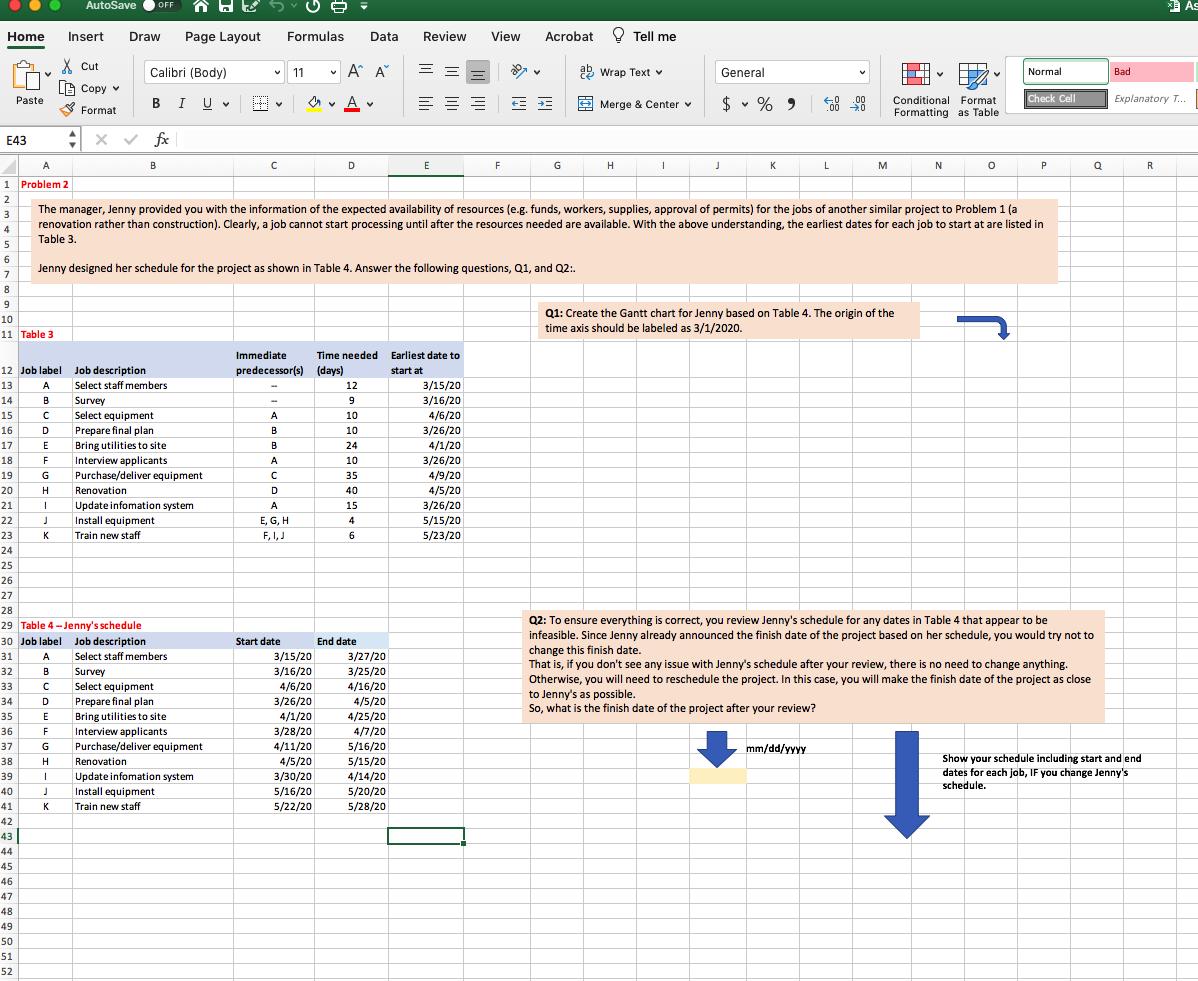

AutoSave OFF Home Insert Draw Page Layout Paste E43 A Cut Copy Format Calibri (Body) BIU B fx Formulas Data Review View Acrobat Tell me 11 A A ab Wrap Text General A Merge & Center $ % 9 .00 0+ Normal Bad Conditional Format Formatting as Table Check Cell Explanatory T... C D E F G H 1 J K L M N 1 Problem 2 2 3 4 5 The manager, Jenny provided you with the information of the expected availability of resources (e.g. funds, workers, supplies, approval of permits) for the jobs of another similar project to Problem 1 (a renovation rather than construction). Clearly, a job cannot start processing until after the resources needed are available. With the above understanding, the earliest dates for each job to start at are listed in Table 3. 6 7 Jenny designed her schedule for the project as shown in Table 4. Answer the following questions, Q1, and Q2:. 8 9 10 11 Table 3 Q1: Create the Gantt chart for Jenny based on Table 4. The origin of the time axis should be labeled as 3/1/2020. Immediatel Time needed 12 Job label Job description predecessor(s) (days) Earliest date to start at 13 A Select staff members 12 3/15/20 14 B Survey - 9 3/16/20 15 C Select equipment A 10 4/6/20 16 D Prepare final plan B 10 3/26/20 17 E Bring utilities to site B 24 4/1/20 18 F Interview applicants A 10 3/26/20 19 G Purchase/deliver equipment C 35 4/9/20 20 H Renovation D 40 4/5/20 21 1 Update infomation system A 15 3/26/20 22 J Install equipment E, G, H 4 23 K Train new staff F, I, J 6 5/15/20 5/23/20 24 25 26 27 28 29 Table 4-Jenny's schedule P Q R 3/27/20 Q2: To ensure everything is correct, you review Jenny's schedule for any dates in Table 4 that appear to be infeasible. Since Jenny already announced the finish date of the project based on her schedule, you would try not to change this finish date. That is, if you don't see any issue with Jenny's schedule after your review, there is no need to change anything. Otherwise, you will need to reschedule the project. In this case, you will make the finish date of the project as close to Jenny's as possible. So, what is the finish date of the project after your review? 30 Job label Job description Start date End date 31 A Select staff members 3/15/20 32 B Survey 3/16/20 3/25/20 33 C Select equipment 4/6/20 4/16/20 34 D Prepare final plan 3/26/201 4/5/20 35 E Bring utilities to site 4/1/20 4/25/20 36 F Interview applicants 3/28/20 4/7/201 37 G Purchase/deliver equipment 4/11/20 5/16/20 38 H Renovation 4/5/20 5/15/20 39 Update infomation system 3/30/20 4/14/20 40 J Install equipment 5/16/20 5/20/20 41 K Train new staff 5/22/20 5/28/20 42 43 44 45 46 47 48 49 50 51 52 mm/dd/yyyy Show your schedule including start and end dates for each job, IF you change Jenny's schedule. As

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started