Answered step by step

Verified Expert Solution

Question

1 Approved Answer

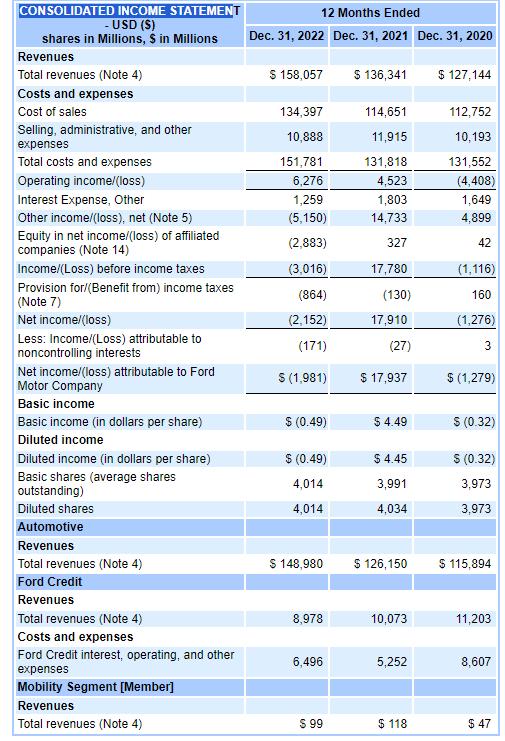

Determine if the income statement is presented in a multi-step format or a single-step format. If your company is presented in a single-step format,

- • Determine if the income statement is presented in a multi-step format or a single-step format.

- • If your company is presented in a single-step format, calculate the gross profit for each year and include that calculation in your post.

- • Calculate the gross profit margin and net profit margin for your assigned company for the three years provided on the income statement.

- • Include a table in your post that shows the inputs for each calculation and the ratio.

- • Explain the trends in gross profit and net profit over the three-year period.

- • Explain if the inventory is recorded using a Last in First Out (LIFO) or First in First Out (FIFO) basis.

- • Explain how property, plant and equipment is depreciated, including the method and estimated life of each asset category.

- • Pose one question about income statements, income statement accounting policies, or a concern about the income statement for your assigned company.

CONSOLIDATED INCOME STATEMENT -USD (S) shares in Millions, $ in Millions Revenues Total revenues (Note 4) 12 Months Ended Dec. 31, 2022 Dec. 31, 2021 Dec. 31, 2020 $ 158,057 $ 136,341 $ 127,144 Costs and expenses Cost of sales 134,397 114,651 112,752 Selling, administrative, and other 10,888 11,915 10,193 expenses Total costs and expenses 151,781 131,818 131,552 Operating income/(loss) 6,276 4,523 (4,408) Interest Expense, Other 1,259 1,803 1,649 Other income/(loss), net (Note 5) (5,150) 14,733 4,899 Equity in net income/(loss) of affiliated (2,883) 327 42 companies (Note 14) Income/(Loss) before income taxes (3,016) 17,780 (1,116) Provision for/(Benefit from) income taxes (864) (130) 160 (Note 7) Net income/(loss) (2,152) 17,910 (1,276) Less: Income/(Loss) attributable to noncontrolling interests (171) (27) 3 Net income/(loss) attributable to Ford $ (1,981) $ 17,937 $ (1,279) Motor Company Basic income Basic income (in dollars per share) $ (0.49) $ 4.49 $ (0.32) Diluted income Diluted income (in dollars per share) $ (0.49) $ 4.45 $ (0.32) Basic shares (average shares 4,014 3,991 3,973 outstanding) Diluted shares 4,014 4,034 3,973 Automotive Revenues Total revenues (Note 4) $ 148,980 $ 126,150 $ 115,894 Ford Credit Revenues Total revenues (Note 4) 8,978 10,073 11,203 Costs and expenses Ford Credit interest, operating, and other expenses 6,496 5,252 8,607 Mobility Segment [Member] Revenues Total revenues (Note 4) $ 99 $ 118 $ 47

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started