Answered step by step

Verified Expert Solution

Question

1 Approved Answer

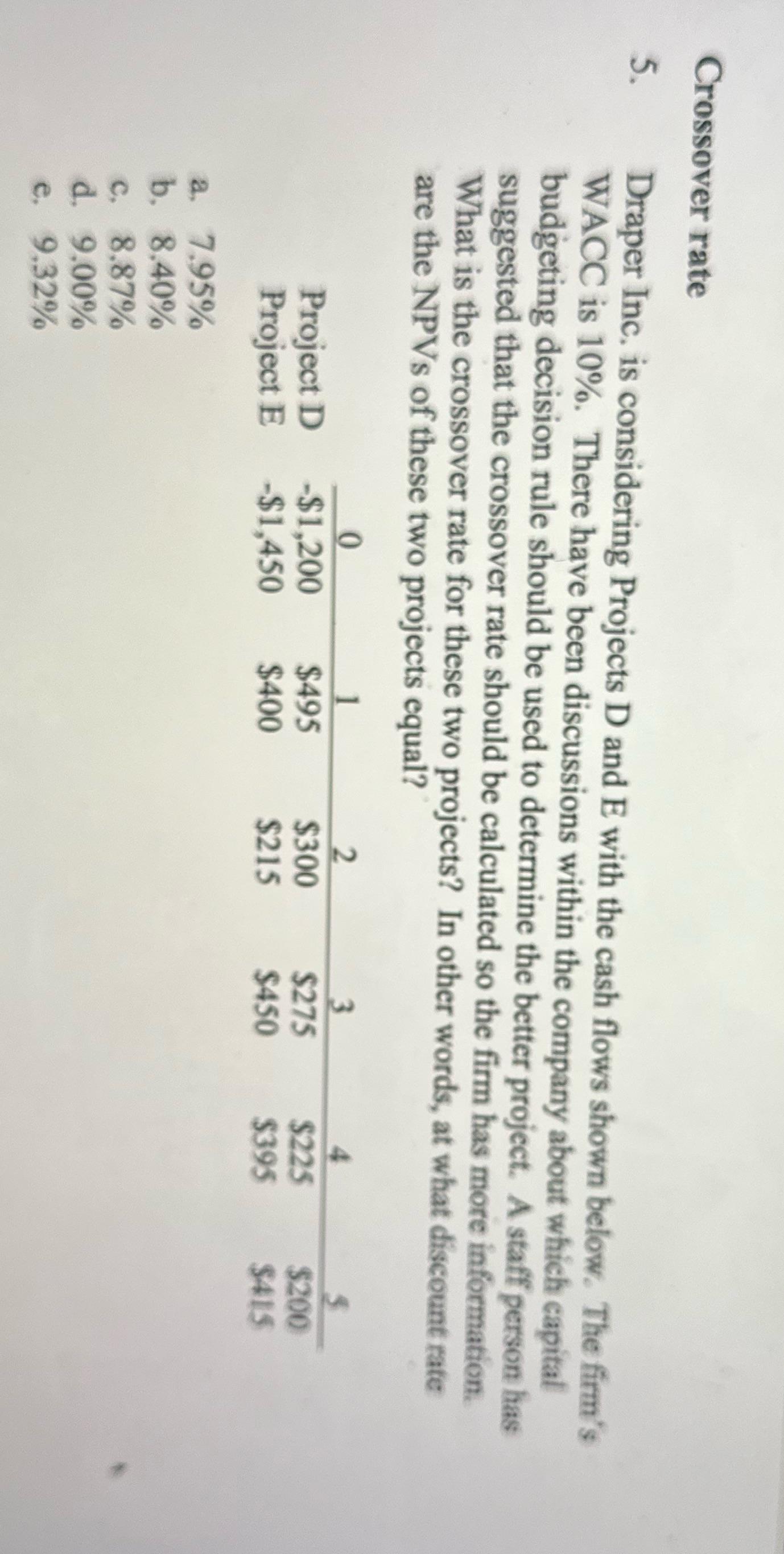

Crossover rate 5. Draper Inc. is considering Projects D and E with the cash flows shown below. The firm's WACC is 10%. There have

Crossover rate 5. Draper Inc. is considering Projects D and E with the cash flows shown below. The firm's WACC is 10%. There have been discussions within the company about which capital budgeting decision rule should be used to determine the better project. A staff person has suggested that the crossover rate should be calculated so the firm has more information. What is the crossover rate for these two projects? In other words, at what discount rate are the NPVs of these two projects equal? 0 1 2 3 4 Project D -$1,200 $495 $300 $275 $225 $200 Project E -$1,450 $400 $215 $450 $395 $415 a. 7.95% b. 8.40% c. 8.87% d. 9.00% e. 9.32%

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the crossover rate we need to find the discount rate at which ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started