Question

Dr. X is opening a new dental clinic and attempting to estimate his anticipated cash collections. The top line of the schedule below lists the

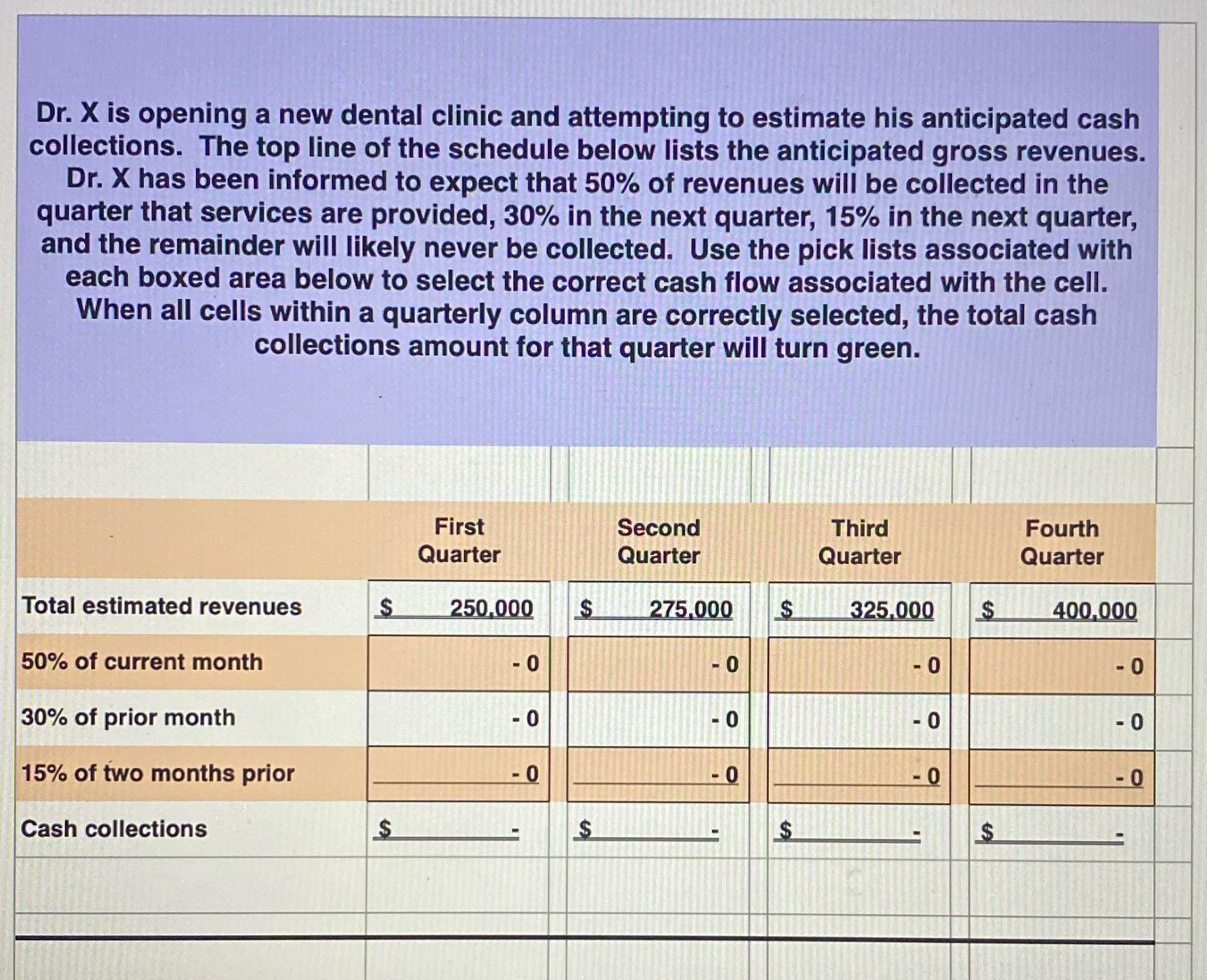

Dr. X is opening a new dental clinic and attempting to estimate his anticipated cash collections. The top line of the schedule below lists the anticipated gross revenues. l Dr. x has been informed to expect that 50% of revenues will be collected in the 1 quarter that services are provided. 30% In the next quarter, 15% in the next quarter, 1 and the remainder wlll likely never be collected. Use the plck lists associated with ' each boxed area below to select the correct cash ?ow associated with the cell. 1 When all cells within a quarterly column are correctly selected, the total cash collections amount for that quarter will turn green. First Quarter Fourth Total estimated revenues 50% of current month 30% of prior month - 15% of two months prior Cash collections §?-

Dr. X is opening a new dental clinic and attempting to estimate his anticipated cash collections. The top line of the schedule below lists the anticipated gross revenues. Dr. X has been informed to expect that 50% of revenues will be collected in the quarter that services are provided, 30% in the next quarter, 15% in the next quarter, and the remainder will likely never be collected. Use the pick lists associated with each boxed area below to select the correct cash flow associated with the cell. When all cells within a quarterly column are correctly selected, the total cash collections amount for that quarter will turn green. First Second Third Fourth Quarter Quarter Quarter Quarter Total estimated revenues $ 250,000 S 275,000 $ 325,000 $ 400,000 50% of current month - 0 - 0 - 0 -0 30% of prior month - 0 0 - 0 - 0 15% of two months prior -0 -0 - 0 -0 Cash collections S $ S SA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

First Quarter ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started