Answered step by step

Verified Expert Solution

Question

1 Approved Answer

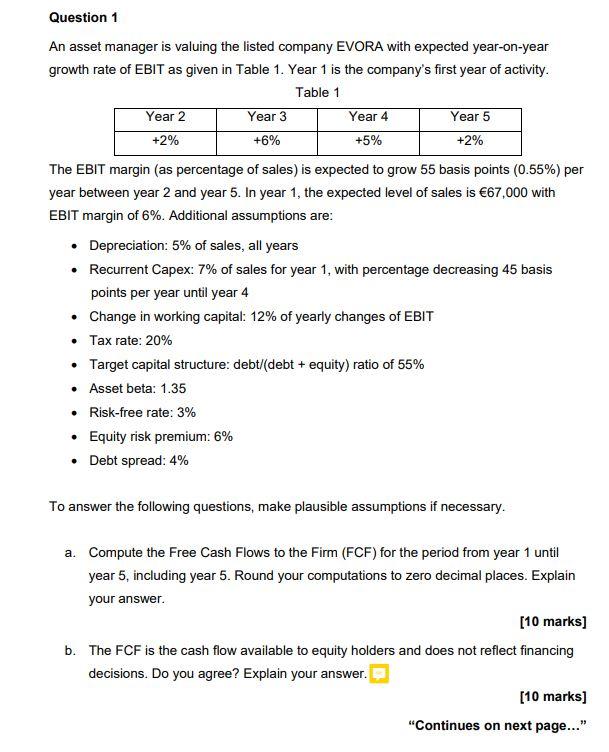

Question 1 An asset manager is valuing the listed company EVORA with expected year-on-year growth rate of EBIT as given in Table 1. Year

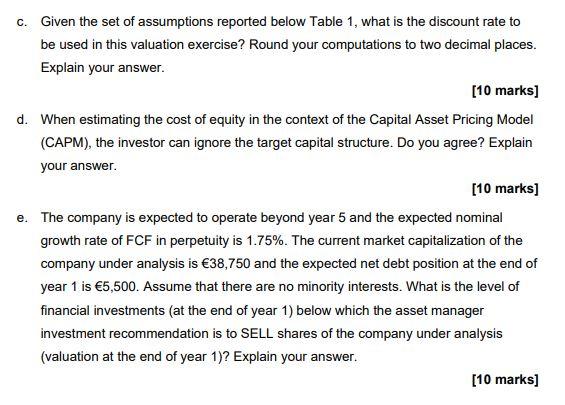

Question 1 An asset manager is valuing the listed company EVORA with expected year-on-year growth rate of EBIT as given in Table 1. Year 1 is the company's first year of activity. Table 1 Year 2 +2% Year 3 +6% Year 4 Year 5 +5% +2% The EBIT margin (as percentage of sales) is expected to grow 55 basis points (0.55%) per year between year 2 and year 5. In year 1, the expected level of sales is 67,000 with EBIT margin of 6%. Additional assumptions are: Depreciation: 5% of sales, all years Recurrent Capex: 7% of sales for year 1, with percentage decreasing 45 basis points per year until year 4 Change in working capital: 12% of yearly changes of EBIT Tax rate: 20% Target capital structure: debt/(debt + equity) ratio of 55% Asset beta: 1.35 Risk-free rate: 3% Equity risk premium: 6% Debt spread: 4% To answer the following questions, make plausible assumptions if necessary. a. Compute the Free Cash Flows to the Firm (FCF) for the period from year 1 until year 5, including year 5. Round your computations to zero decimal places. Explain your answer. [10 marks] b. The FCF is the cash flow available to equity holders and does not reflect financing decisions. Do you agree? Explain your answer. [10 marks] "Continues on next page..." c. Given the set of assumptions reported below Table 1, what is the discount rate to be used in this valuation exercise? Round your computations to two decimal places. Explain your answer. [10 marks] d. When estimating the cost of equity in the context of the Capital Asset Pricing Model (CAPM), the investor can ignore the target capital structure. Do you agree? Explain your answer. [10 marks] e. The company is expected to operate beyond year 5 and the expected nominal growth rate of FCF in perpetuity is 1.75%. The current market capitalization of the company under analysis is 38,750 and the expected net debt position at the end of year 1 is 5,500. Assume that there are no minority interests. What is the level of financial investments (at the end of year 1) below which the asset manager investment recommendation is to SELL shares of the company under analysis (valuation at the end of year 1)? Explain your an answer. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answers a Compute the Free Cash Flows to the Firm FCF for the period from year 1 until year 5 including year 5 FCF Year1 EBIT Year1 x 1 Tax Rate Depreciation Year1 Recurrent Capex Year1 Change In Work...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started