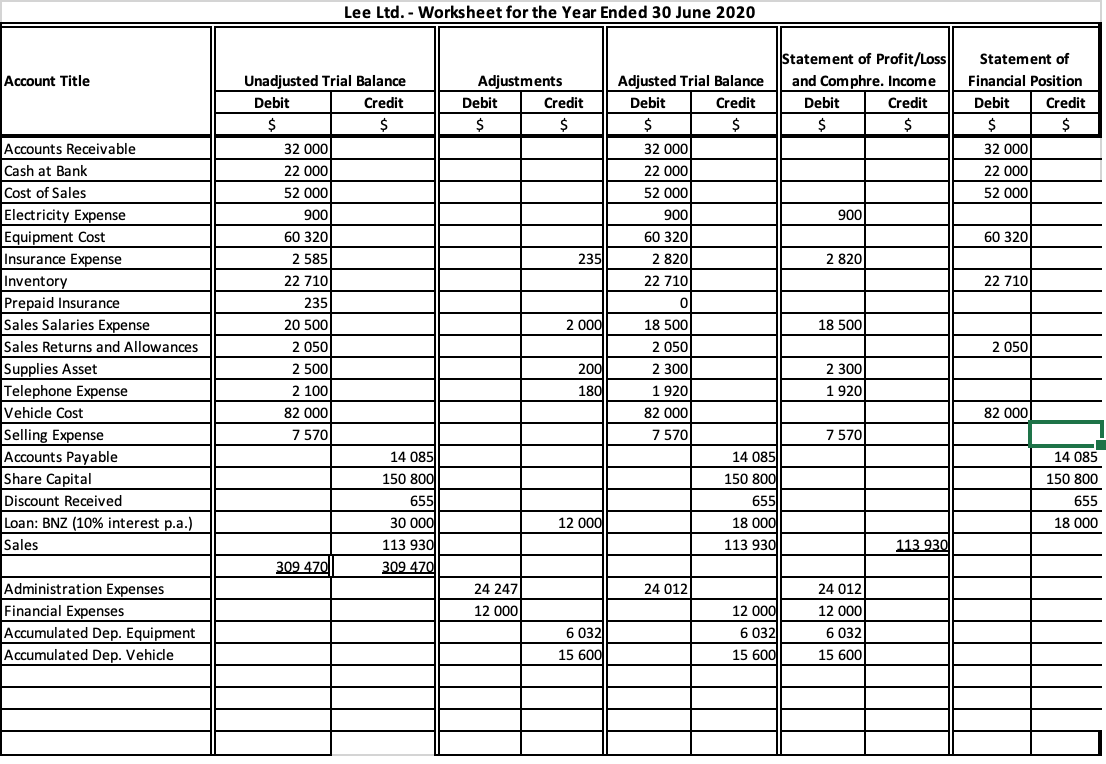

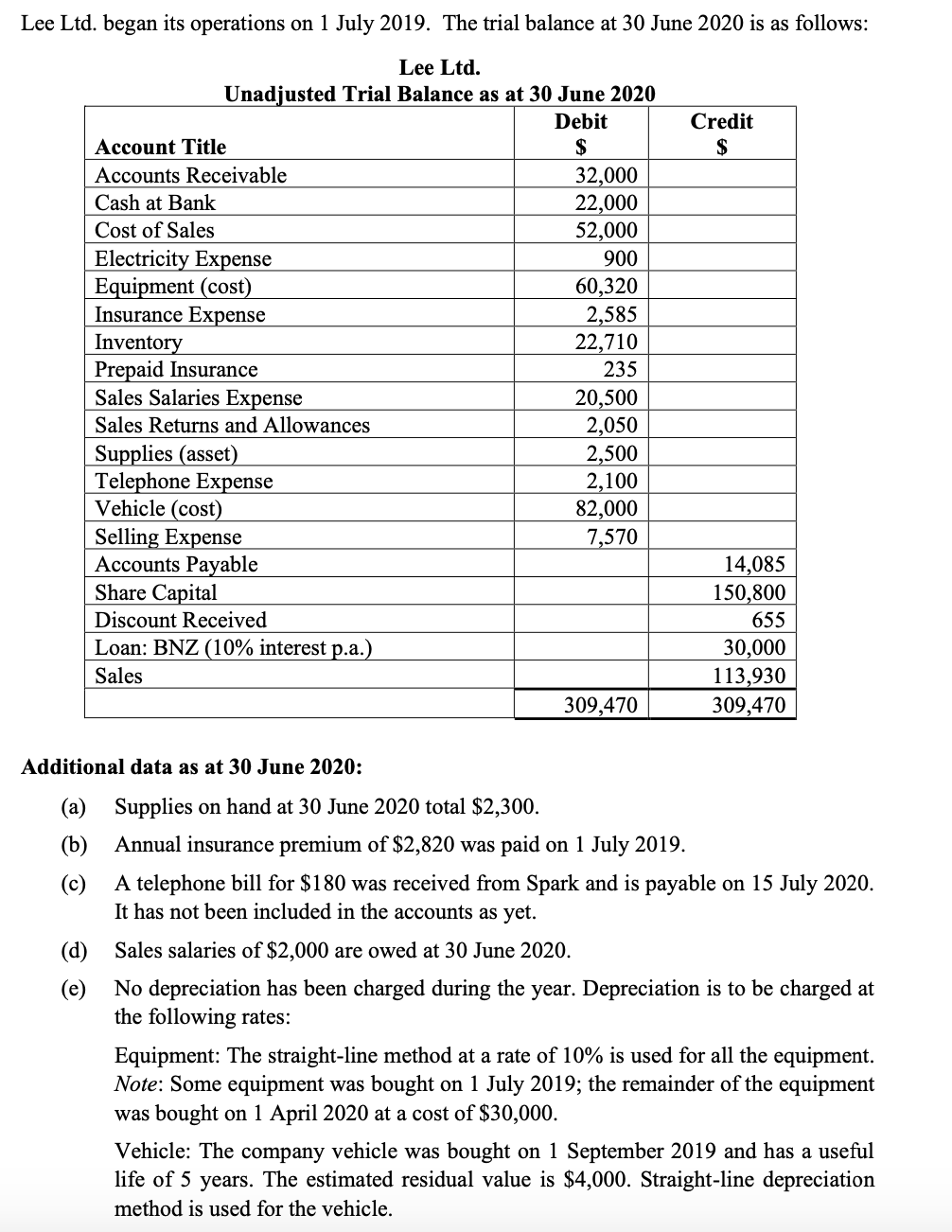

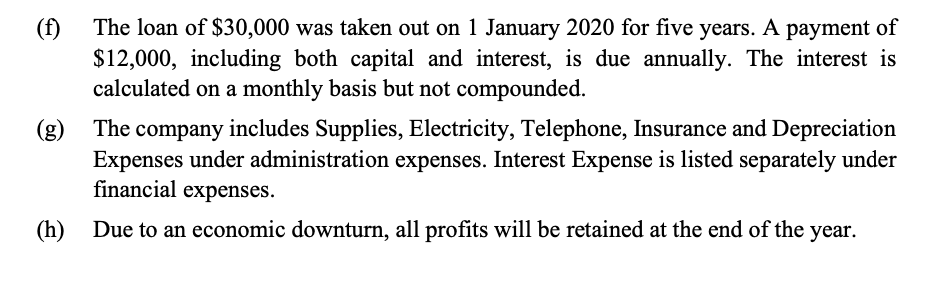

- Images 1/2 provide a trial balance for Lee Ltd with additional data to be journalised

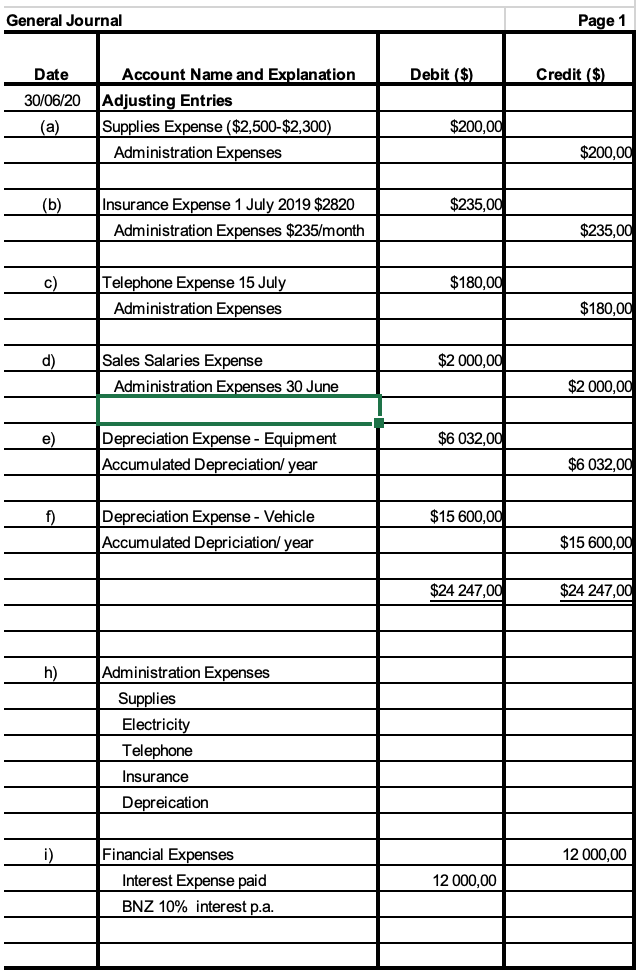

- Images 3/4: (My work) Journalising the adjusting entries on 30 June 2020.

- Completing the Worksheet for the year ended 30 June 2020.

How I can I improve my Journal and Worksheet?

Lee Ltd. - Worksheet for the Year Ended 30 June 2020 Statement of Profit/Loss Statement of Account Title Unadjusted Trial Balance Adjustments Adjusted Trial Balance and Comphre. Income Financial Position Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit $ $ $ S $ $ Accounts Receivable 32 000 32 000 32 000 Cash at Bank 22 000 22 000 22 000 Cost of Sales 52 000 52 000 52 000 Electricity Expense 900 900 900 Equipment Cos 60 320 60 320 60 320 Insurance Expense 2 585 235 2 820 2 820 Inventory 22 710 22 710 22 710 Prepaid Insurance 235 0 Sales Salaries Expense 20 500 2 000 18 500 18 500 Sales Returns and Allowances 2 050 2 050 2 050 Supplies Asset 2 500 200 2 300 2 300 Telephone Expense 2 100 180 1 920 1 920 Vehicle Cost 82 000 82 000 82 000 Selling Expense 7 570 7 570 7 570 Accounts Payable 14 085 14 085 14 085 Share Capital 150 800 150 800 150 80 Discount Received 655 655 655 Loan: BNZ (10% interest p.a.) 30 000 12 000 18 000 18 00 Sales 113 930 113 930 309 470 309 470 Administration Expenses 24 247 24 012 24 012 Financial Expenses 12 000 12 000 12 000 Accumulated Dep. Equipment 6 032 6 0321 6 032 Accumulated Dep. Vehicle 15 600 15 600 15 600General Journal Page 1 Date Account Name and Explanation Debit ($) Credit ($) 30/06/20 Adjusting Entries a) Supplies Expense ($2,500-$2,300) $200,00 Administration Expenses $200,00 (b) Insurance Expense 1 July 2019 $2820 $235,00 Administration Expenses $235/month $235,00 c ) Telephone Expense 15 July $180,00 Administration Expenses $180,00 d) Sales Salaries Expense $2 000,00 Administration Expenses 30 June $2 000,00 e) Depreciation Expense - Equipment $6 032,00 Accumulated Depreciation/ year $6 032,00 f) Depreciation Expense - Vehicle $15 600,00 Accumulated Depriciation/ year $15 600,00 $24 247,00 $24 247,00 h) Administration Expenses Supplies Electricity Telephone Insurance Depreication i) Financial Expenses 12 000,00 Interest Expense paid 12 000,00 BNZ 10% interest p.a.Lee Ltd. began its operations on 1 July 2019. The trial balance at 30 June 2020 is as follows: Lee Ltd. Unadjusted Trial Balance as at 30 June 2020 Debit Credit Account Title $ S Accounts Receivable 32,000 Cash at Bank 22,000 Cost of Sales 52,000 Electricity Expense 900 Equipment (cost) 60,320 Insurance Expense 2,585 Inventory 22,710 Prepaid Insurance 235 Sales Salaries Expense 20,500 Sales Returns and Allowances 2,050 Supplies (asset) 2,500 Telephone Expense 2,100 Vehicle (cost 32,000 Selling Expense 7,570 Accounts Payable 14,085 Share Capital 150,800 Discount Received 655 Loan: BNZ (10% interest p.a.) 30,000 Sales 113,930 309,470 309,470 Additional data as at 30 June 2020: a) Supplies on hand at 30 June 2020 total $2,300. (b) Annual insurance premium of $2,820 was paid on 1 July 2019. (c) A telephone bill for $180 was received from Spark and is payable on 15 July 2020. It has not been included in the accounts as yet. (d) Sales salaries of $2,000 are owed at 30 June 2020. (e) No depreciation has been charged during the year. Depreciation is to be charged at the following rates: Equipment: The straight-line method at a rate of 10% is used for all the equipment. Note: Some equipment was bought on 1 July 2019; the remainder of the equipment was bought on 1 April 2020 at a cost of $30,000. Vehicle: The company vehicle was bought on 1 September 2019 and has a useful life of 5 years. The estimated residual value is $4,000. Straight-line depreciation method is used for the vehicle.(f) (s) (h) The loan of $30,000 was taken out on 1 January 2020 for ve years. A payment of $12,000, including both capital and interest, is due annually. The interest is calculated on a monthly basis but not compounded. The company includes Supplies, Electricity, Telephone, Insurance and Depreciation Expenses under administration expenses. Interest Expense is listed separately under nancial expenses. Due to an economic downturn, all prots will be retained at the end of the year