Imagine it is August 1999 and you are part of a team that is advising PepsiCo on a potential acquisition of Quaker Oats (the two companies eventually merge in August 2001). You have been asked to prepare a cost of capital estimate for valuing Quaker Oats. In particular, you must determine the companys weighted average cost of capital (WACC) in August of 1999.

Here is the whole question as below:

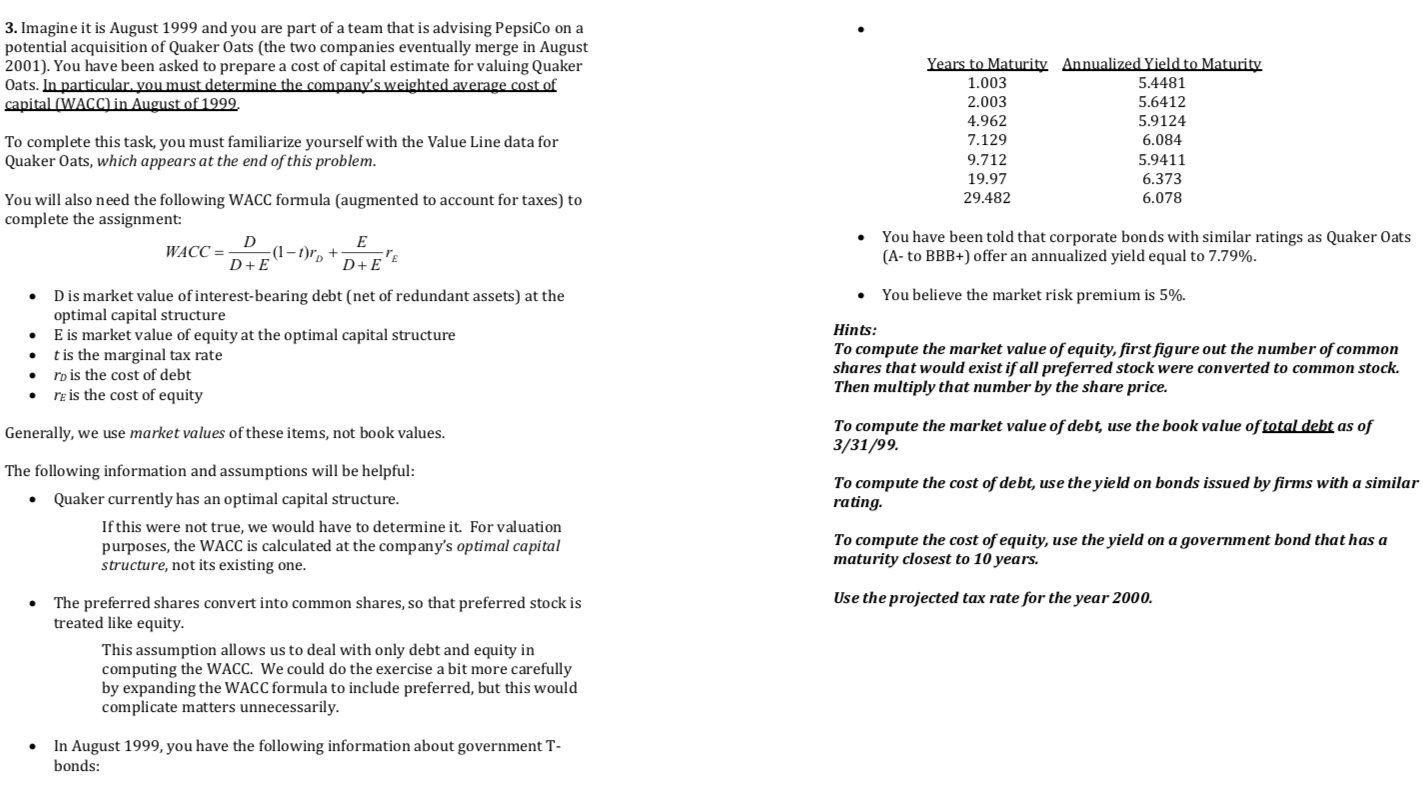

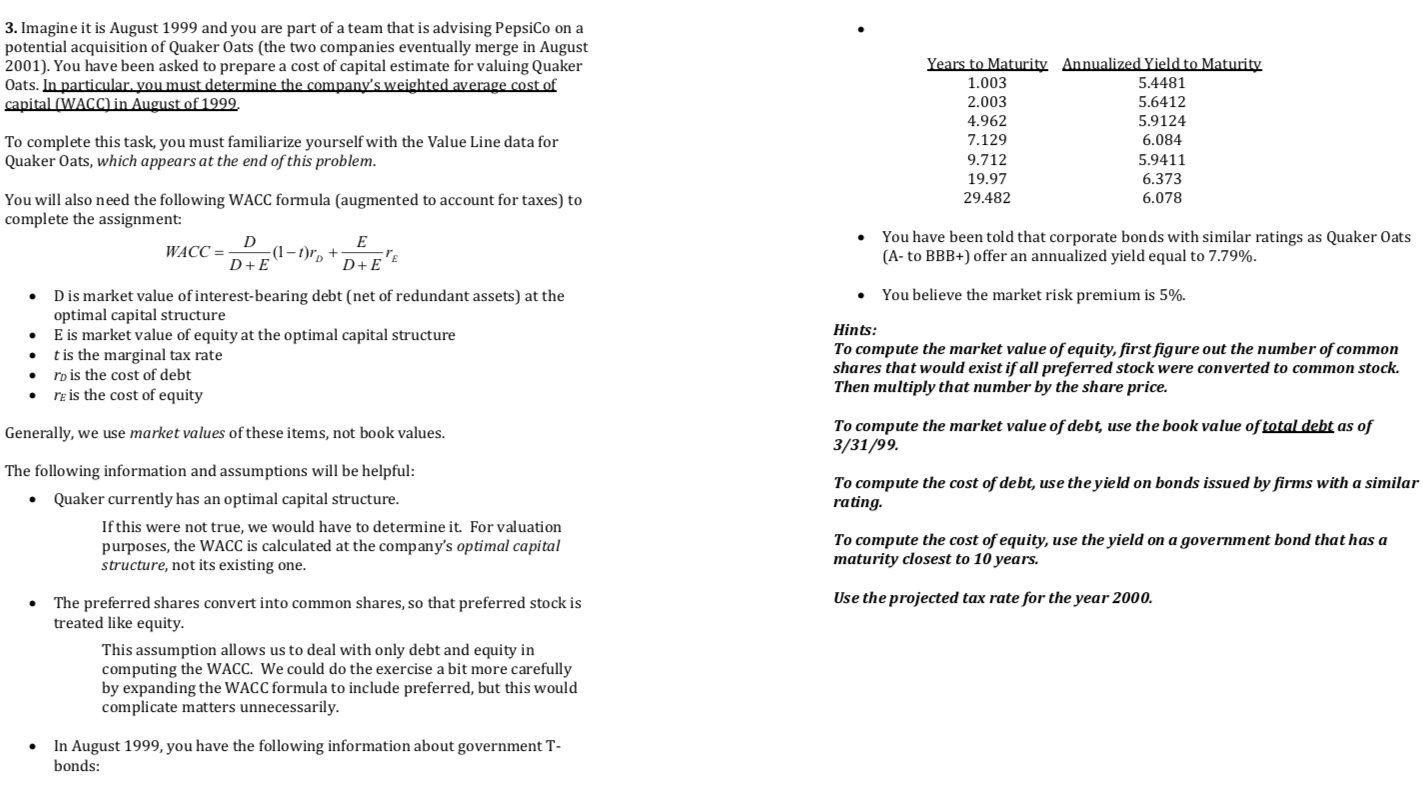

3. Imagine it is August 1999 and you are part of a team that is advising PepsiCo on a potential acquisition of Quaker Oats (the two companies eventually merge in August 2001). You have been asked to prepare a cost of capital estimate for valuing Quaker Oats. In particular. you must determine the company's weighted average cost of capital (WACC) in August of 1999. To complete this task, you must familiarize yourself with the Value Line data for Quaker Oats, which appears at the end of this problem. Years to Maturity Annualized Yield to Maturity 1.003 5.4481 2.003 5.6412 4.962 5.9124 7.129 6.084 9.712 5.9411 19.97 6.373 29.482 6.078 You have been told that corporate bonds with similar ratings as Quaker Oats (A-to BBB+) offer an annualized yield equal to 7.79%. D+EPE You will also need the following WACC formula (augmented to account for taxes) to complete the assignment: D E WACC = (1-1), + D+E Dis market value of interest-bearing debt (net of redundant assets) at the optimal capital structure E is market value of equity at the optimal capital structure t is the marginal tax rate ro is the cost of debt re is the cost of equity You believe the market risk premium is 5%. Hints: To compute the market value of equity, first figure out the number of common shares that would exist if all preferred stock were converted to common stock. Then multiply that number by the share price. Generally, we use market values of these items, not book values. To compute the market value of debt use the book value of total debt as of 3/31/99. To compute the cost of debt, use the yield on bonds issued by firms with a similar rating The following information and assumptions will be helpful: Quaker currently has an optimal capital structure. If this were not true, we would have to determine it. For valuation purposes, the WACC is calculated at the company's optimal capital structure, not its existing one. To compute the cost of equity, use the yield on a government bond that has a maturity closest to 10 years. Use the projected tax rate for the year 2000. The preferred shares convert into common shares, so that preferred stock is treated like equity. This assumption allows us to deal with only debt and equity in computing the WACC. We could do the exercise a bit more carefully by expanding the WACC formula to include preferred, but this would complicate matters unnecessarily. . In August 1999, you have the following information about government T- bonds: 3. Imagine it is August 1999 and you are part of a team that is advising PepsiCo on a potential acquisition of Quaker Oats (the two companies eventually merge in August 2001). You have been asked to prepare a cost of capital estimate for valuing Quaker Oats. In particular. you must determine the company's weighted average cost of capital (WACC) in August of 1999. To complete this task, you must familiarize yourself with the Value Line data for Quaker Oats, which appears at the end of this problem. Years to Maturity Annualized Yield to Maturity 1.003 5.4481 2.003 5.6412 4.962 5.9124 7.129 6.084 9.712 5.9411 19.97 6.373 29.482 6.078 You have been told that corporate bonds with similar ratings as Quaker Oats (A-to BBB+) offer an annualized yield equal to 7.79%. D+EPE You will also need the following WACC formula (augmented to account for taxes) to complete the assignment: D E WACC = (1-1), + D+E Dis market value of interest-bearing debt (net of redundant assets) at the optimal capital structure E is market value of equity at the optimal capital structure t is the marginal tax rate ro is the cost of debt re is the cost of equity You believe the market risk premium is 5%. Hints: To compute the market value of equity, first figure out the number of common shares that would exist if all preferred stock were converted to common stock. Then multiply that number by the share price. Generally, we use market values of these items, not book values. To compute the market value of debt use the book value of total debt as of 3/31/99. To compute the cost of debt, use the yield on bonds issued by firms with a similar rating The following information and assumptions will be helpful: Quaker currently has an optimal capital structure. If this were not true, we would have to determine it. For valuation purposes, the WACC is calculated at the company's optimal capital structure, not its existing one. To compute the cost of equity, use the yield on a government bond that has a maturity closest to 10 years. Use the projected tax rate for the year 2000. The preferred shares convert into common shares, so that preferred stock is treated like equity. This assumption allows us to deal with only debt and equity in computing the WACC. We could do the exercise a bit more carefully by expanding the WACC formula to include preferred, but this would complicate matters unnecessarily. . In August 1999, you have the following information about government T- bonds