Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine that in September, a U.S. company agrees to buy industrial equipment from a German manufacturer. Payment of 1 million euros is due upon

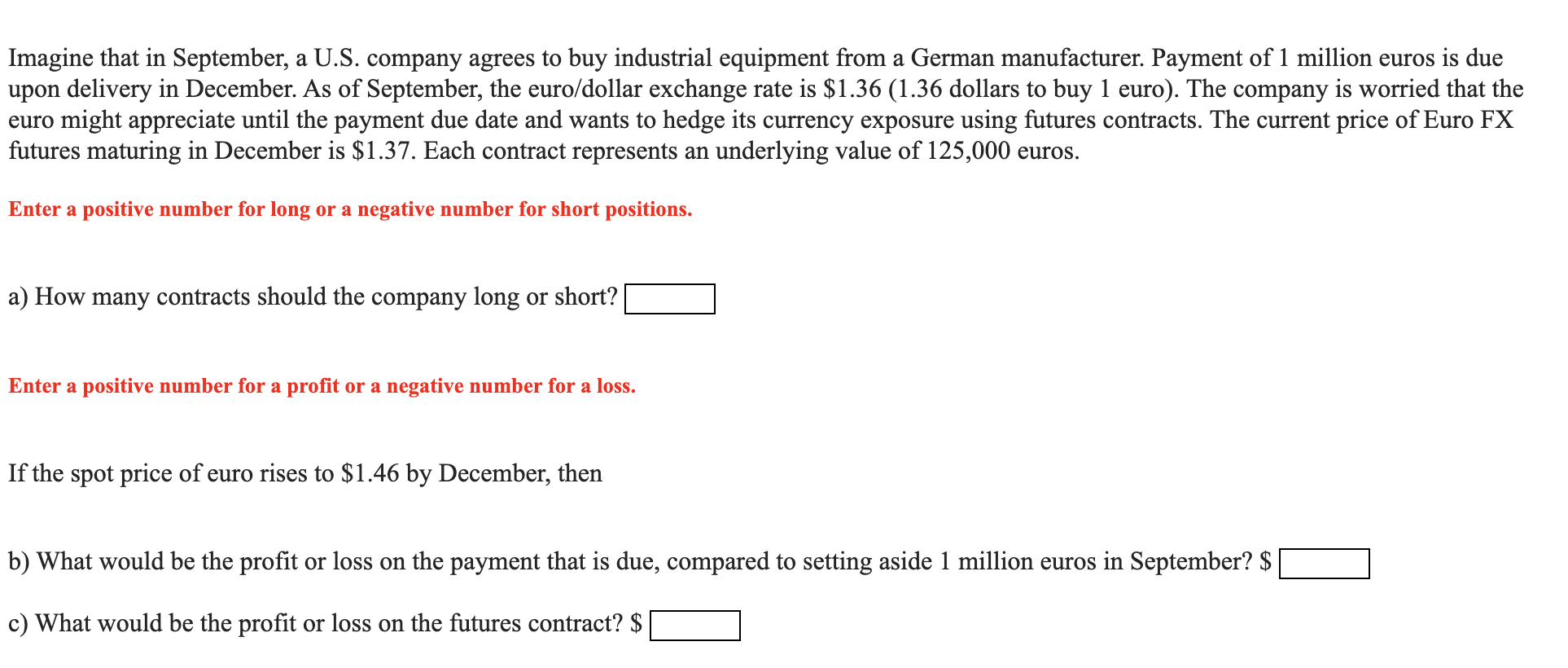

Imagine that in September, a U.S. company agrees to buy industrial equipment from a German manufacturer. Payment of 1 million euros is due upon delivery in December. As of September, the euro/dollar exchange rate is $1.36 (1.36 dollars to buy 1 euro). The company is worried that the euro might appreciate until the payment due date and wants to hedge its currency exposure using futures contracts. The current price of Euro FX futures maturing in December is $1.37. Each contract represents an underlying value of 125,000 euros. Enter a positive number for long or a negative number for short positions. a) How many contracts should the company long or short? | Enter a positive number for a profit or a negative number for a loss. If the spot price of euro rises to $1.46 by December, then b) What would be the profit or loss on the payment that is due, compared to setting aside 1 million euros in September? $ c) What would be the profit or loss on the futures contract? $

Step by Step Solution

★★★★★

3.47 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution a i Company agrees to buy industrial equipment from German in december at 1 million ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started