Answered step by step

Verified Expert Solution

Question

1 Approved Answer

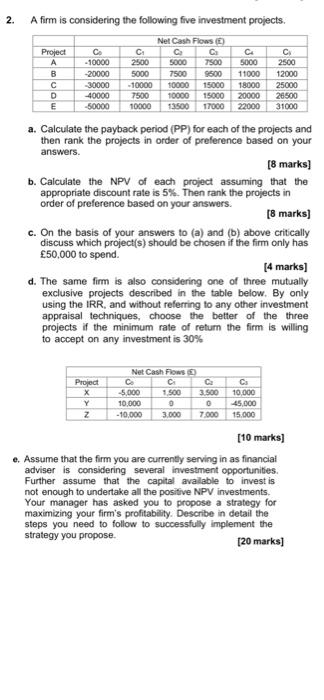

2. A firm is considering the following five investment projects. Net Cash Flows() C C 5000 7500 Project A B C D E Co

2. A firm is considering the following five investment projects. Net Cash Flows() C C 5000 7500 Project A B C D E Co -10000 -20000 -40000 -50000 C 2500 C 5000 9500 11000 12000 15000 18000 25000 10000 15000 20000 26500 10000 13500 17000 22000 31000 -30000 -10000 7500 5000 7500 10000 a. Calculate the payback period (PP) for each of the projects and then rank the projects in order of preference based on your answers. Project X Y z [8 marks] b. Calculate the NPV of each project assuming that the appropriate discount rate is 5%. Then rank the projects in order of preference based on your answers. [8 marks] c. On the basis of your answers to (a) and (b) above critically discuss which project(s) should be chosen if the firm only has 50,000 to spend. C 2500 [4 marks] d. The same firm is also considering one of three mutually exclusive projects described in the table below. By only using the IRR, and without referring to any other investment appraisal techniques, choose the better of the three projects if the minimum rate of return the firm is willing to accept on any investment is 30% Net Cash Flows) C 1,500 Co -5,000 10,000 C 3.500 0 7,000 0 -10,000 3.000 Ca 10,000 45,000 15.000 [10 marks] e. Assume that the firm you are currently serving in as financial adviser is considering several investment opportunities. Further assume that the capital available to invest is not enough to undertake all the positive NPV investments. Your manager has asked you to propose a strategy for maximizing your firm's profitability. Describe in detail the steps you need to follow to successfully implement the strategy you propose. [20 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started