Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In to Assume that you have just turned 29 years old and recently secured your first job. order celebrate this accomplishment, you decide to

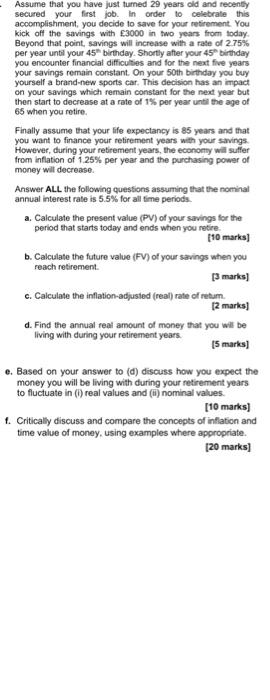

In to Assume that you have just turned 29 years old and recently secured your first job. order celebrate this accomplishment, you decide to save for your retirement. You kick off the savings with 3000 in two years from today. Beyond that point, savings will increase with a rate of 2.75% per year until your 45 birthday. Shortly after your 45 birthday you encounter financial difficulties and for the next five years your savings remain constant. On your 50th birthday you buy yourself a brand-new sports car. This decision has an impact on your savings which remain constant for the next year but then start to decrease at a rate of 1% per year until the age of 65 when you retire. Finally assume that your life expectancy is 85 years and that you want to finance your retirement years with your savings. However, during your retirement years, the economy will suffer from inflation of 1.25% per year and the purchasing power of money will decrease. Answer ALL the following questions assuming that the nominal annual interest rate is 5.5% for all time periods. a. Calculate the present value (PV) of your savings for the period that starts today and ends when you retire. [10 marks] when you [3 marks] b. Calculate the future value (FV) of your savings reach retirement. c. Calculate the inflation-adjusted (real) rate of retum. [2 marks] d. Find the annual real amount of money that you will be living with during your retirement years. [5 marks] e. Based on your answer to (d) discuss how you expect the money you will be living with during your retirement years to fluctuate in (i) real values and (ii) nominal values. [10 marks] f. Critically discuss and compare the concepts of inflation and time value of money, using examples where appropriate. [20 marks]

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To calculate the present value of savings for the period that starts today and ends when you retire we can use the present value formula PV FV 1 rn where PV is the present value of savings ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started