Question

Imagine that it is January 2021, and you have just accepted the chief financial officer (CFO) position at Hays County Integrated Delivery System (IDS), hereafter

Imagine that it is January 2021, and you have just accepted the chief financial officer (CFO) position at Hays County Integrated Delivery System (IDS), hereafter referred to as County. You will be reporting to Mr. Salter, Countys chief executive officer, a retired schoolteacher who was hired last year. When announcing your appointment, Mr. Salter stated that your primary objective in the coming year would be to reverse the ominous financial trend that began in 2019 with an operating loss and continued in 2020. Previous operating losses were funded with investment income. However, your board recently passed a resolution discontinuing that practice and restricting investment income to capital expenditures in 2021.

County is a non-for-profit, county-owned urban hospital and includes an acute care hospital, a skilled nursing facility (SNF), a rehab facility, a home health care agency, and an outpatient clinic. The hospital, Hays County Hospital (HCH), is one of two hospitals in the county (population is 175,000) and the only hospital in San Marcos, Texas, with a population of 50,000. St. Teresas, a not-for-profit Catholic-owned hospital, is the only other hospital in Hays County. St. Teresas is about 25 miles from Hays County IDS.

To acquire background information on the primary challenges and opportunities facing County, you meet with Mr. Salter, who states:

I just dont understand why we are losing money. I spent a considerable amount of time recruiting new doctors while keeping the existing doctors happy. Everyone seems happyeveryone except Mr. Finance Myway, whom youll be replacing. He and I both started in January 2019 and he seemed increasingly frustrated with the way I do things herehe just didnt fit in. I tried to accommodate him by implementing some of his recommendations, even though they were against my better judgement. And when I announced that I was bringing in more business to the hospital by entering into a two-year capitated managed care agreement with the city (it expires this month)we get $425 per month per family for taking care of the 300 city employees and their families, whether theyre sick or notMr. Myway threw a fit at an executive team meeting. He claimed that my decisions were driving County deeper into the red, and as a result, I had to show Mr. Myway the highway for insubordination. That happened last month.

Mr. Salter has asked you to do the following:

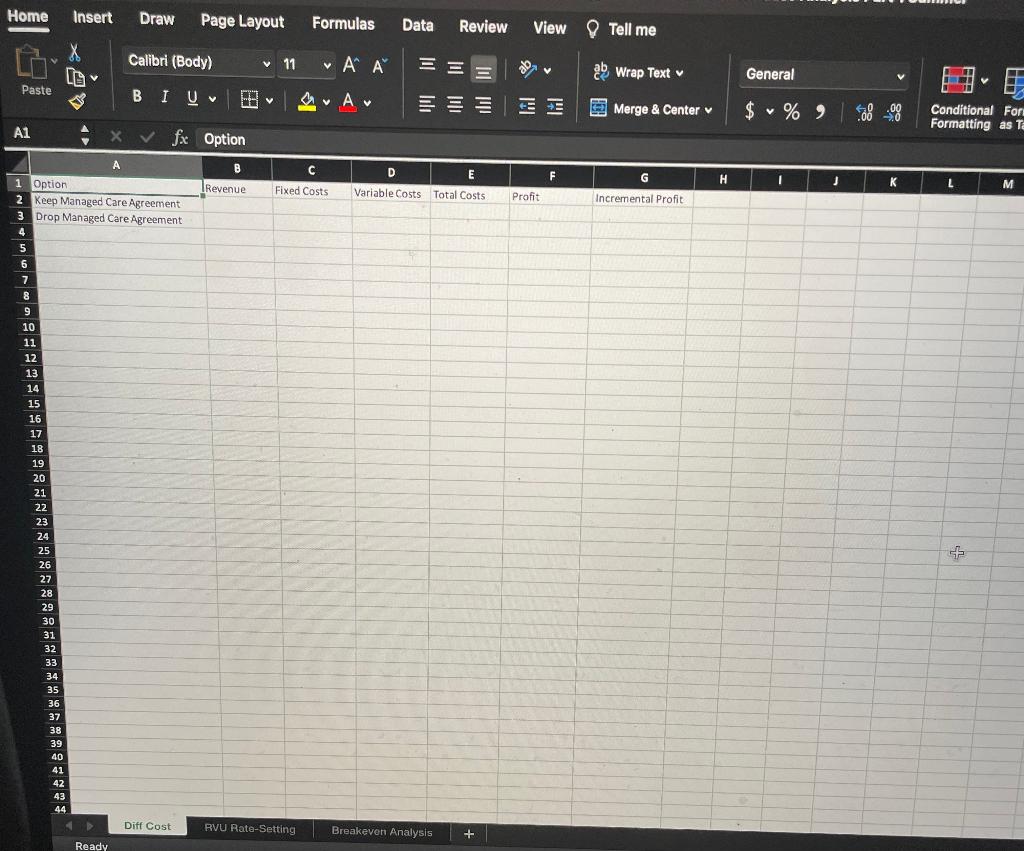

(1). Analyze the capitated managed care agreement with the city using differential cost analysis. You already have the information to determine the annual revenue from the agreement. The total annual variable costs associated with treating patients from the member pool is $730,600. The annual fixed costs allocated to treating this group is $1,100,653. These fixed costs would remain even if the program were dropped. Use the sheet entitled Diff Cost.

(a). Your first task to determine the net profit or loss from the agreement.

(b). Next, calculate the monthly reimbursement rate from the managed care organization that would enable County to breakeven on the treatment of the agreements members. You will need to make some changes to the spreadsheet to carry out this step (Hint: How much would each of the 300 members have to be charged each month to cover the average monthly costs?).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started